How will the UK be grain secure going into the 2020/21 marketing year? Grain Market Daily

Tuesday, 19 May 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £165.50/t, up £0.40/t on Friday’s close.

- Meanwhile, Paris wheat futures closed at €186.75/t, down €1.75/t on Friday’s close. Weakening sterling helped shelter the UK domestic price, closing yesterday at £1 = €1.1171.

- Paris maize futures (Nov-20) closed yesterday at €166.00/t, unchanged from Friday’s close, and represented a €23.00/t discount to Paris wheat. Until more significant demand for bio-ethanol restarts, maize futures will struggle to gather any substantial support.

How will the UK be grain secure going into the 2020/21 marketing year?

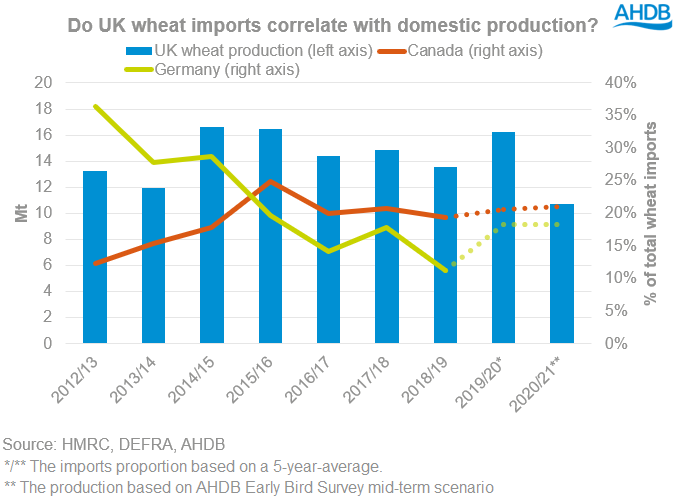

As is well documented, planting for the 2020 harvest suffered from the persistent rainfall throughout autumn and winter. Alex’s analysis on “taking a look at UK crop production 2020/21” in February calculated a mid-range scenario of 10.74Mt, which would be the lowest wheat production in the last 20 years by over 840kt.

As we progress towards the key growing months, and the point in crop development that affects the grain quality, the dial on the weather pendulum has swung. From having too much rain, many regions in the UK now require moisture to help kick-start some of the spring cropping.

With a reduced wheat crop and weather causing concerns for quality domestically, the UK is more than likely going to import a significant amount of medium grade wheat from the continent and continue to import similar amounts of high protein wheat from Canada. Given this, we will need to trade at import parity to continental prices and our milling premiums will depend on international milling premiums. For more information on this, be sure to read James’ analysis on “can milling premiums keep rising?”

Going from a wheat surplus to a wheat deficit

Canadian milling wheat

The UK imports a lot of premium milling wheat from Canada, as the grain they produce has a high protein that can be used milling processes to produce high quality bread flour.

For the past 8 years, our imports from Canada have been relatively level, averaging c340kt a year. This tonnage has remained largely static, regardless of UK production volumes. By calculating the 5-year average for the Canadian proportion of total UK imports, we can extrapolate that the UK could import around 353kt of wheat for the 2020/21 marketing year, based on an “average” year.

German milling wheat – or maybe Eastern European?

In contrast, imports from Germany have a correlation with UK domestic production. For example, imports from Germany were high in years of deficit such as 2012 and 2013. Since then, the UK has had successive years of large production, reducing the volume of German wheat imports.

The UK has also imported a significant amount of wheat from Eastern Europe over successive years too. However, poor planting conditions in much of Northern Europe, and prolonged spring dryness in Eastern Europe, has meant the soft wheat production for the EU has been revised down.

Going forward, growing conditions in possible import origins will be watched closely, as any inclement conditions could support prices domestically, and vice versa.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.