Can milling premiums keep rising? Grain Market Daily

Tuesday, 3 March 2020

Market Commentary

Uncertainty and volatility continue to be the predominant factors for grain and oilseed markets. Uncertainty around the impact of coronavirus had pressured markets, which in over the past two days have made a technical recovery.

May-20 UK wheat futures had moved to a point of weakness on a relative strength index, before reversing and gaining £1.90/t yesterday, to close at £150.95/t. Markets have continued to make gains this morning reaching £152.00/t, at time of writing.

Can milling premiums keep rising?

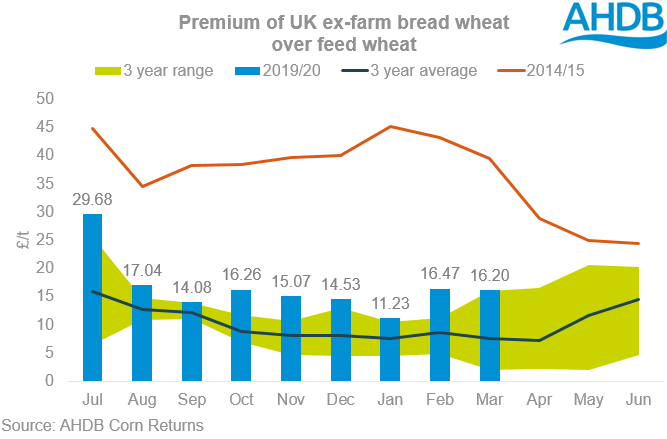

UK milling wheat premiums (ex-farm UK, spot) currently sit ahead of the three year average, and are at the highest point they have been since the 2014/15 season. The recent rise has been driven by uncertainty about the size and quality of the new crop. With a long time to go until yields and quality are fundamentally determined, there is scope for further uncertainty. However the ability of this to translate into increased milling premiums will be dependent on movements elsewhere in the world, with milling markets moving up towards import parity.

If we assume that quality and the split of nabim varieties is in line with the five-year average, we could be looking at a functional milling crop of just 2.7Mt, with a market that requires a crop of almost 5.0Mt. This would lead to the expectation that milling wheat premiums could continue to extend as uncertainty around the size and functionality of the crop grows. However, with such a small crop, the market will be increasingly focused on importing.

The ability of premiums to continue extending will be limited by the import parity of milling wheat. In the latest AHDB imported price survey, German A milling wheat was quoted at £186.00/t for March, below Thursday’s delivered milling wheat price for the North West, at £187.00/t (spot).

With import parity reached, domestic milling prices will be dependent on shifts in international milling premiums to make continued gains. Therefore, alongside the condition of the domestic crop, we need to pay particular attention to the development of EU milling wheat crops and to North American spring wheat crops.

EU milling crops are likely to replace the lack of domestic 13% protein milling wheat, while North American spring wheat crops are likely to be used to blend up the protein of lower quality domestic crops.

In its most recent report, Stratégie Grains estimates German Milling wheat production to increase by 5% year-on-year, although recent rainfall in the country is a definite watch point.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.