How much wheat is leaving the Black Sea? Grain market daily

Tuesday, 31 May 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £308.25/t yesterday, down £6.50/t from Friday’s close. The May-23 contract closed at £324.25/t, dropping £5.75/t over the same period.

- News of establishing a potential grain corridor out of Ukraine is easing concern over global wheat supply. More on this below.

- Paris milling wheat futures (Dec-22) followed suit with a €7.75/t loss from Friday to settle at €400.00/t.

- An oil embargo on Russia to cut imports into the EU by 90% before the end of the year, has supported the price of crude oil. Nearby (Jul-22) brent crude oil prices closed at $121.67/barrel yesterday, gaining $2.24/barrel from Friday’s close.

- Paris rapeseed futures (Nov-22) were down €13.25/t from Friday’s close at €808.25/t yesterday.

How much wheat is leaving the Black Sea?

UN talks with Russia to resume Ukrainian grain shipments, by lifting blockades on ports, continue to pressure global grain prices. The market sees some glimmer of hope that more Ukrainian grain may be accessible onto the global market.

Yesterday, President Putin said that Russia is ready to facilitate Ukrainian exports of grain in coordination with Turkey, according to Refinitiv.

Though this remains talk and not yet confirmed, it’s something to watch as the week progresses. Issues with export infrastructure also remain a concern, given the bombing and conflict around ports.

Currently grain is leaving Ukraine. In April, reportedly 1.1Mt of wheat, barley, and maize was exported (Refinitiv). According to UkrAgroconsult, from 1 to 25 May, 481.1Kt of grain was exported via rail through 11 land border crossings (out of 13). Over this same period, 144.6Kt is understood to have been exported through ports. This is positive for railway logistics, but arguably a drop in the ocean of ‘normal’ Ukrainian exports.

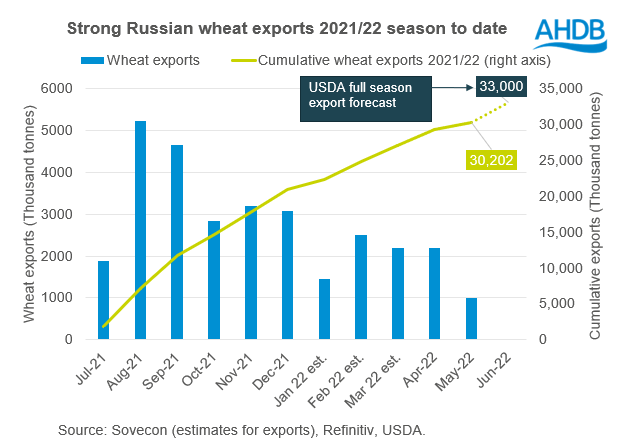

Russia still exporting high volumes

Russia remains to be exporting high volumes of grain with competitive pricing. According to SovEcon, April saw an estimated 2.7Mt of grain exports. Though the May estimate stands at 1.5Mt. Demand in recent days is understood to be weaker and with a depleting grain export quota to consider.

The quota for wheat is set at 8.0Mt (from 15 February) and remains until 30 June. 7.9Mt of wheat is estimated to have been exported from Russia between February and June. Whether Russian exports reach the USDA full season forecast of 33.0Mt is under question given these export quota numbers.

Though rumbles of large (2.0Mt) imports of Russian wheat from Pakistan are floating around, reportedly Russia are stealing grain from Ukraine to be exported too. Egypt was reported to turn away a boat from Russia of stolen Ukrainian wheat (according to Refinitiv).

What could this mean for global prices?

As we head towards the end of the season, a large percentage of wheat has been exported from Russia. Damage to ports and infrastructure in Ukraine will also prove to be difficult to navigate.

However, signs of positive progress in Ukrainian grain exports via ports will be a significant move for markets. If exports do start up again, we could see prices feel pressure as the market removes some risk factored into high prices.

Expect price volatility to continue as the market assesses the global availability of grains next year, with such finely balanced supply and demand.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.