How might the second lockdown impact dairy markets?

Wednesday, 4 November 2020

By Patty Clayton

As of 5 November, England will join Scotland and Wales in re-introducing restrictions on movements in an attempt to stem the rising infection rate of COVID-19. The new measures will be in place until at least 2 December.

The restrictions are not as wide-ranging as they were in the spring. Although pubs, restaurants and cafes will be closed, take-away and delivery will continue to operate, and schools and universities will remain open.

So how will this new lockdown affect the markets, and what are the potential dangers for farmers?

Milk production

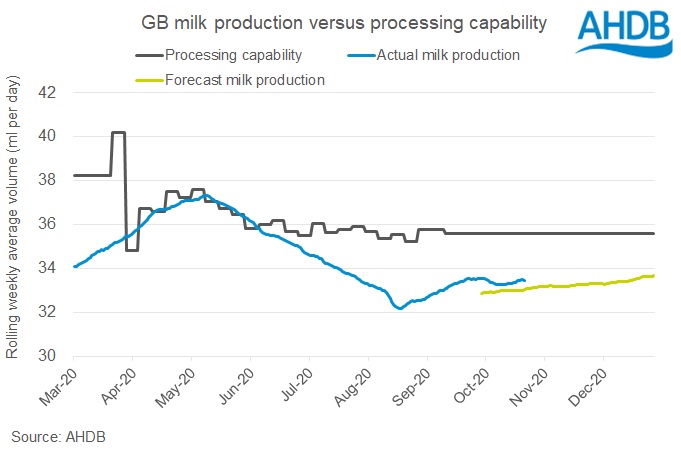

At the moment, production is seasonally low, meaning the volume of milk coming off farms is well within the industry’s ability to process* and store it.

In the first lockdown, production was rising and there were few, if any, options to repurpose the milk diverted from the foodservice sector. This created a glut of milk on spot markets, leading to a collapse in prices, and some disposals of milk.

Since then, processors have adjusted their product mix to match changes in consumer demand and where they are buying it. Prior to the first lockdown, 88% of liquid milk was purchased at retail, and foodservice sales accounted for around 8% (eating out and food delivery). With the shift towards retail, we estimate that the foodservice share of liquid milk sales has dropped to around 5%, predominantly due to lower sales in the eating out sector.

While milk production is currently running ahead of our milk forecast, we estimate there is still around 2 million litres per day of spare capacity in the industry. We should be mindful that this “spare capacity” is before we see the impact of the latest lockdown.

With lower volumes of milk coming off farm, and lower volumes of milk going to foodservice markets, we would expect less pressure on spot markets. How well they hold up will depend on the demand from processors of storable products, such as cheese and butter, and how long the lockdown remains in place.

Dairy demand

Demand will be held back further over the next month or so as restrictions on eating out affect a higher proportion of the GB population. Foodservice operators will still be able to offer take-away and delivery, but this is unlikely to compensate for the lost revenues from eating in sales. Helping to mitigate this is the expectation that retail sales are likely to grow through the lockdown period, although perhaps without such a high panic-buying induced spike.

Adding to the pressure on markets will be deflated holiday demand. The absence of group celebrations, and limits on the number of people who can meet up, even outside of the confines of the current lockdown, mean fewer and smaller occasions for dairy consumption. This will be particularly important for products such as potted creams and speciality cheeses which typically see higher sales over the holiday period.

Export opportunities to the continent may also be hampered due to lockdowns in many EU countries and the uncertainties around any UK-EU trade deal.

Farmgate milk prices

The impact on farmgate prices is, again, likely to differ for those supplying into foodservice markets and those supplying into retail or cheese markets, where demand is holding up well. Cash flow pressures and lower returns may well lead to some cuts to milk prices exposed to the hospitality industry.

With a time-limited lockdown, the impact on dairy markets should be short-lived. However, if restrictions are extended into the New Year, the added pressure of trade restrictions and rising milk volumes will add more pressure on markets.

Notes

*The industry’s ability to process is a combination of demand for short-shelf products and processing capacity for shelf-stable products. This gives us an indication of the overall processing capability of the country.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.