How low can rapeseed go? Analyst insight

Thursday, 1 June 2023

Market commentary

- Pressure continues as UK feed wheat futures (Nov-23) closed yesterday at £180.90/t, down £4.50/t from Tuesday’s close. The Nov-24 contract closed at £189.40/t, down £2.00/t over the same period.

- Global wheat markets were mixed yesterday. New crop Paris wheat futures were down as US wheat crop conditions improved, adding to supply pressure. Further to that, economic worries hang over commodity prices. The Chicago wheat market gained on bargain buying and concerns over rains damaging China’s wheat crop. Currently parts of China’s wheat growing area are receiving excessive rains, which is not good as the crop is ready for harvest.

- Paris rapeseed futures (Nov-23) closed yesterday at €403.00/t, gaining €9.00/t on Tuesday’s close. This is despite a drop in Canadian canola, new-crop Chicago soyabean and crude oil futures.

How low can rapeseed go?

We’ve talked a lot recently about pressure in rapeseed markets, with a bearish outlook for the future. Last Friday delivered rapeseed prices (into Erith, Jun-23) were quoted at £351.00/t, the lowest point since September 2020.

Can prices keep dropping? Although I don’t have a crystal ball to forecast that, we can use previous times when the availability of rapeseed has been high to distinguish what the pricing relationship could be to other oilseeds.

Availability is high in Europe

The UK price is heavily influenced by what happens on the continent. The outlook for the EU is bearish, so this will filter into our domestic price. In Europe, 2023/24 rapeseed production is expected to grow on the year, plus it is forecast to have the highest beginning stocks since 2019/20. With consumption next season projected to grow only marginally, this will leave the EU with the highest ending stocks since 2014/15 (USDA).

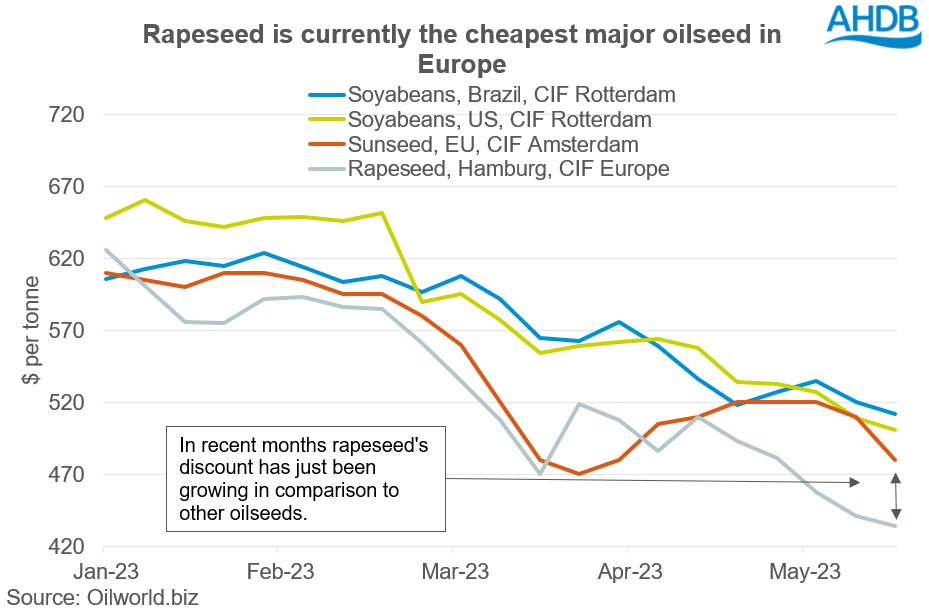

Also, the EU crops are faring well, which is just continuing to weigh on prices. Rapeseed is currently the cheapest major oilseed in Europe, as displayed in the graph below.

Last week, European rapeseed (CIF Hamburg) was at a $46.00/t discount to sunseed (CIF Amsterdam) and a £$67.00-$78.00/t discount to soyabeans (CIF Rotterdam, US & Brazil origin) (Oilworld.biz).

What could happen to prices going forward?

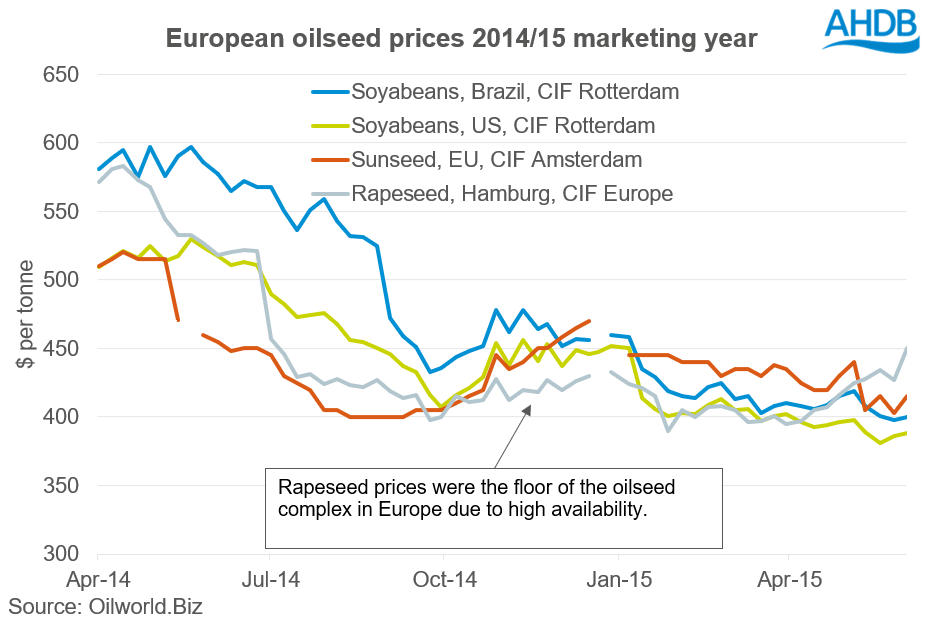

With the ending stocks in Europe estimated to be the highest since 2014/15, what happened to physical rapeseed prices back then relative to other oilseeds on the continent?

In the 2014/15 marketing year, EU rapeseed was the floor of the oilseed complex for a lot of the marketing year. Further to that, rapeseed at times was at a $55.00/t discount to sunseed and a $135.00/t discount to soyabeans (Brazilian origin). These are greater than rapeseed’s current discounts (see above).

Could this mean rapeseed might have not quite reached its discounted floor in comparison to other oilseeds?

Conclusion

The conclusion is that European rapeseed’s discount to other oilseeds has been greater in the past, such as 2014/15. This could mean rapeseed’s discount to other oilseeds could extend further. However, the rapeseed supply & demand balance will not be the only thing influencing the rapeseed’s discount, as other major oilseeds could influence this too.

What we do know is that rapeseed for the moment is probably going to stay around the floor of the oilseed complex in the short term, especially as the EU harvest approaches.

However, I do not believe that we are going to see rapeseed prices drop sharply in comparison to other oilseeds. This is due to the high input costs used to produce the 2023 crop, which alongside these lower prices could constrain farmer selling in the short-term. It could also impact the 2024 sown rapeseed area. Nonetheless, we could see further pressure though if there is large pressure on soyabean prices, which could possibly happen with the large US crop expected at the end of this year.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.