Why does my rapeseed price keep dropping? Grain market daily

Wednesday, 24 May 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £188.10/t, up £0.60/t from Monday’s close. The Nov-24 contract closed at £196.40/t, up £1.35/t over the same period.

- The domestic market followed both the Chicago and Paris wheat markets up yesterday. Markets gained on concerns that Ukrainian exports were being restricted, despite the renewal of the Black Sea Grain Initiative last week. There were reports that the Ukrainian port of Pivdennyi have halted operations because Russia is not allowing ships to enter, effectively cutting it out of the deal, which allows safe passage out of the Black Sea (Refinitiv).

- Paris rapeseed futures (Nov-23) closed yesterday at €403.75/t, marginally up (€1.00/t) from Monday’s close. There was pressure on Chicago soyabean prices from the progression of US soyabean plantings – read more on this below and how it could influence rapeseed prices going forward.

Why does my rapeseed price keep dropping?

Yesterday, Paris rapeseed futures (Nov-23) closed at £351.23/t, with the respective contract down 10.5% (in sterling terms) across the month so far. Prices continue to fall from the peak in April 2022. With harvest just around the corner, domestic rapeseed prices are going to be significantly lower at harvest, compared with when planting decisions were made last year, as shown in the AHDB delivered survey.

It’s well documented in our market reports the bearish outlook for the rapeseed market. Currently this market continues to be pressured from estimated large EU opening stocks for the 2023/24 marketing year, combined with a large EU production on the way.

There are other factors though that are now feeding into the bearish outlook for rapeseed, such as downward pressure on soyabean markets.

Until recently, nearby Chicago soyabean prices have remained strong, even after the Russia-Ukraine war volatility. This was from strong US demand for soya oil and to some extent the La Niña weather event in Argentina. However, over the last few weeks there has been pressure from the soyabean planting progression in the US, which has filtered into rapeseed prices.

US soyabean plantings

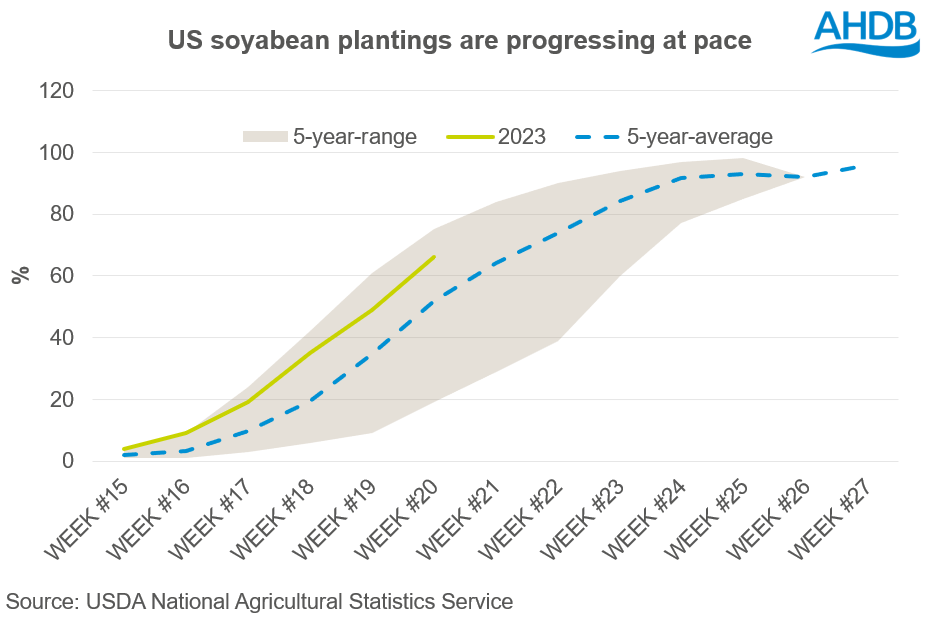

Weather to some extent has been benign in the US Midwest. Plantings started in the middle of April and progressed rapidly. As of 21 May 2023, 66% of soyabeans were planted, the second fastest based on the last five years (2018-2022). The only other fastest year was 2021 where plantings over this period were 75% complete.

Plantings are expected to be completed by the end of June, sooner if significant rains do not lead to any delays. Over the next seven days large parts of the US Midwest are not receiving any rain, which will allow plantings to progress further. To some extent this could continue to pressure the soyabean market which inherently will feed into the greater oilseed complex, including rapeseed prices.

As the US planting of soyabean continues the record crop estimated at 122.7Mt will come to a reality. This will have the potential to continue weighing on oilseed markets towards the end of 2023, which inherently will feed into rapeseed prices too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.