Arable Market Report - 22 May 2023

Monday, 22 May 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

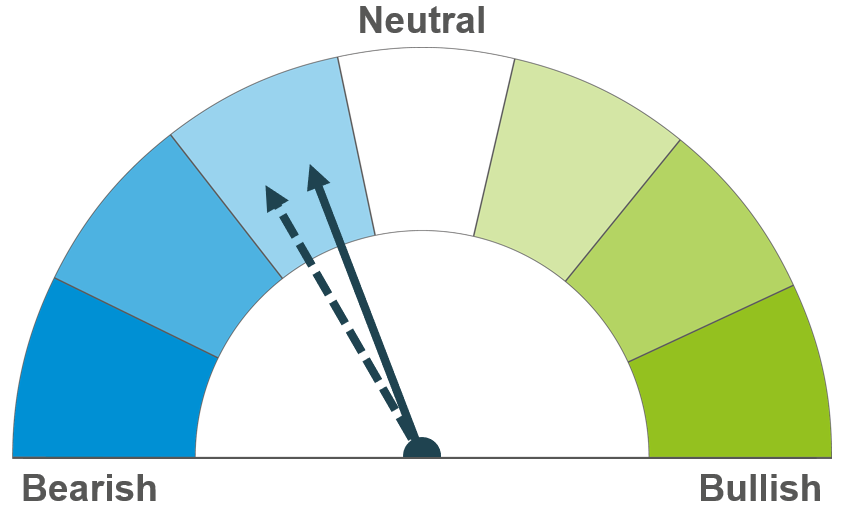

Wheat

Wheat is under pressure from the renewal of the Black Sea initiative as it means Ukrainian supplies are easier for the world to access. For next season, although wheat supplies look tighter, total grain supplies still look heavy.

Maize

Forecasts for a record Brazilian 2022/23 Safrinha crop and a large 2023/24 US crop are weighing on markets. Longer-term, supplies continue to look heavy, with increased forecasts for Argentina in 2023/24.

Barley

Global barley prices continue to follow movements in the wider grain complex. Forecasts of larger feed grain supplies for the new season keep sentiment bearish. As at 18 May, new crop feed barley (delivered E.Anglia, Nov-23) was £21.50/t below feed wheat.

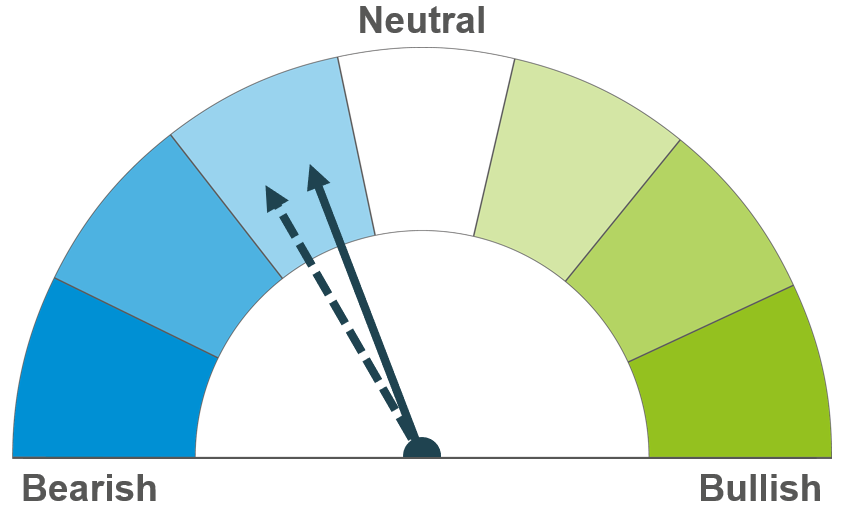

Global grain markets

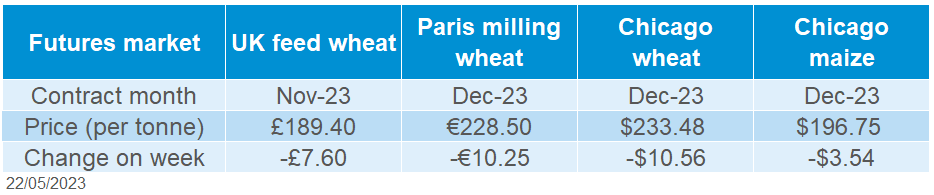

Global grain futures

Global grain prices fell last week, after choppy trading in the earlier part of the week. There was uncertainty in the market ahead of Thursday’s deadline for extending the Ukrainian export corridor. The deal, officially known as the Black Sea Initiative, was extended for 60 days on Wednesday afternoon. This means easier access to supplies from the region until 17 July. Wheat prices fell sharply after the announcement but recovered slightly on Friday.

There’s also uncertainty about the US debt situation, as negotiations to avoid a default continue. This is generally negative for agricultural commodity prices.

A US crop tour reported poor winter wheat yield prospects in Kansas, which supported prices mid-week. Kansas mainly grows Hard Red Winter wheat. Recently, futures for hard milling wheat, such as Kansas futures and Minneapolis futures, have developed larger premiums over other wheat futures prices. This points to the potential for wider spreads between types of wheat globally again in 2023/24.

The International Grains Council (IGC) raised its forecast for 2023/24 global maize production by 9.2Mt, largely due to good prospects in China and Brazil. These increases more than offset more cuts to the US wheat crop. So, despite wheat and barley output being down from this season, the IGC still expects ample supplies at a total grain level.

Meanwhile, French wheat and winter barley crop condition ratings dipped slightly last week but remain very good. Spring barley remains in excellent condition and maize planting is nearing completion (FranceAgriMer). Crops need regular rainfall as ground water reserves are low, but this is not currently a concern.

SovEcon raised its 2023/24 Russian wheat production forecast by 1.2Mt to 88.0Mt. This is now 4.4Mt above the latest IGC figure for next season, though still less than this season’s record (95.4Mt, IGC).

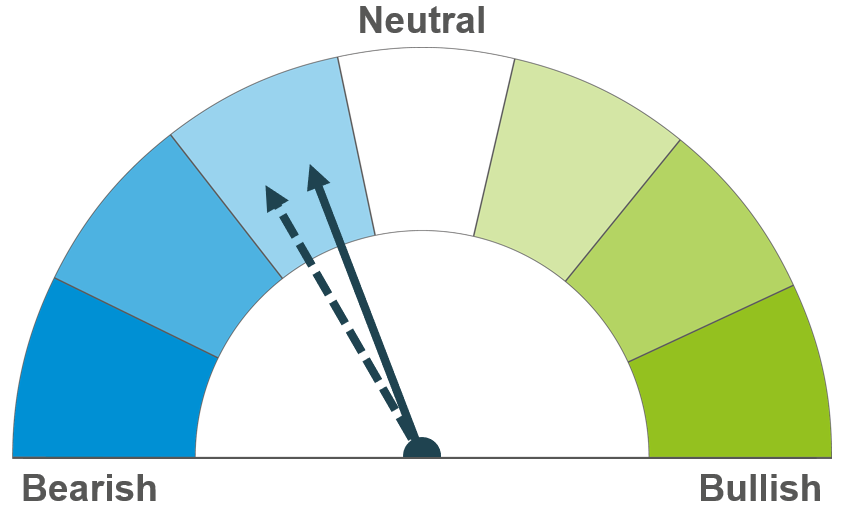

UK focus

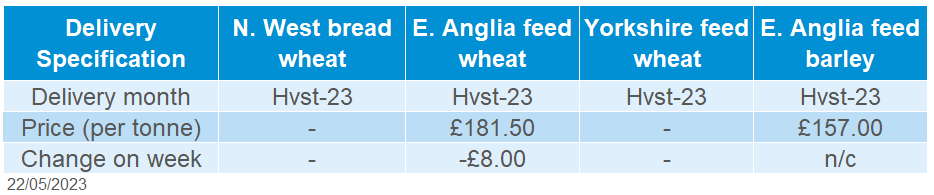

Delivered cereals

Nov-23 UK feed wheat futures lost £7.60/t last week to close at £189.40/t. This follows the drop in global markets. The May-23 contract expires and finishes trading tomorrow (23 May).

Trade was reportedly thin last week due to uncertainty in global markets. As a result, AHDB was able to publish fewer delivered prices than usual. Delivered feed wheat in East Anglia (Nov-23) was £188.00/t, down £7.00/t from the previous week. Feed barley delivered in the same period (East Anglia, Nov-23) was quoted at £165.50/t, £22.50/t below feed wheat.

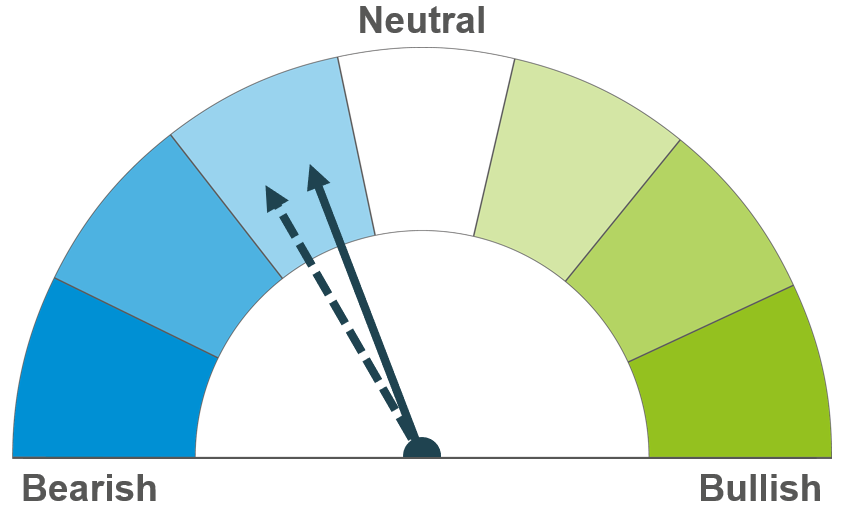

Oilseeds

Rapeseed

Short-term, favourable EU crop conditions and pressure from soyabeans weighs on rapeseed prices. Longer-term, stocks-to-use ratios are going to increase for rapeseed in 2023/24.

Soyabeans

Short-term, U.S. soyabean planting going well is weighing on the market. The potential for a record US soyabean crop could weigh longer-term on the market too.

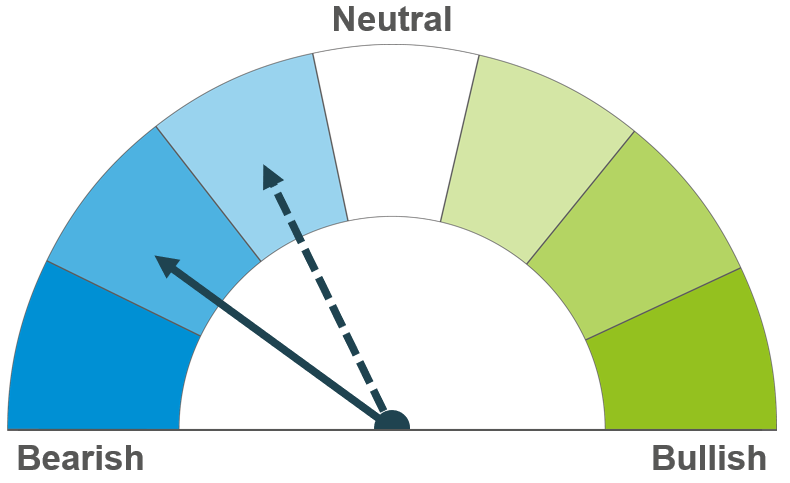

Global oilseed markets

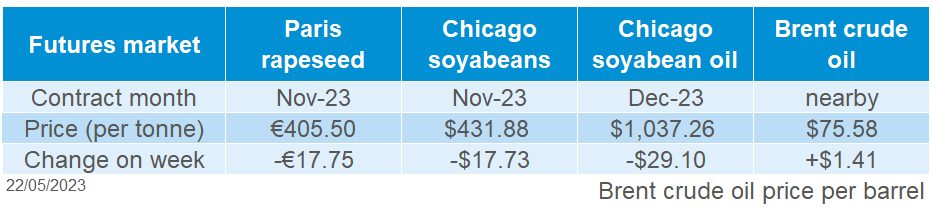

Global oilseed futures

Pressure continues across the oilseed complex and Chicago soyabean futures (Nov-23) were down 4% across the week, closing Friday at $431.88/t. Pressure from the renewal of the Black Sea Grain Initiative filtered into oilseed prices, combined with favourable conditions for new-crop U.S. soyabean planting.

U.S. soyabean plantings (up until 14 May) are estimated at 49% complete, ahead of the same point last year (27%) and ahead of the 5-year-average of 36%. The progression is weighing on the market as this U.S. soyabean crop currently is estimated to be a record 122.7Mt. A further update will be released this evening.

Also pressuring the market is the record Brazilian soyabean crop, which is now being exported to the global market. As harvest progresses Brazilian consultancies have started revising their crop estimates up. Safras & Mercado now estimate at the 2022/23 Brazilian soyabean crop at a record 155.66Mt.

In other news, the amount of U.S. soyabeans crushed in April fell short of average trade estimates. The National Oilseeds Processors Association estimated the April crush at 4.7Mt of soyabeans, down 6.8% in March. But the crush remained up 2.0% from April 2022 due to the on-going demand for soy oil as a feedstock in biofuels.

U.S. weather is currently in focus for price direction, and so far, it has just weighed on prices. Over the next week scattered rains are expected over parts of the U.S. Midwest, with plantings pace expected to be on-going.

Rapeseed focus

UK delivered oilseed prices

Pressure on soyabeans and palm oil filtered into rapeseed prices last week. Paris rapeseed futures (Nov-23) closed Friday at €405.50/t, down €17.75/t across the week.

We were unable to published domestic delivered prices in the AHDB delivered survey due to insufficient quotes.

In the latest EU commission data the EU has imported 6.9Mt of rapeseed since the start of this marketing year up until 16 May 2023. This is up 44% from a year earlier. Australia (47.1%), Ukraine (42.6%) and Uruguay (4.1%) account for the highest origin shares for the season to date.

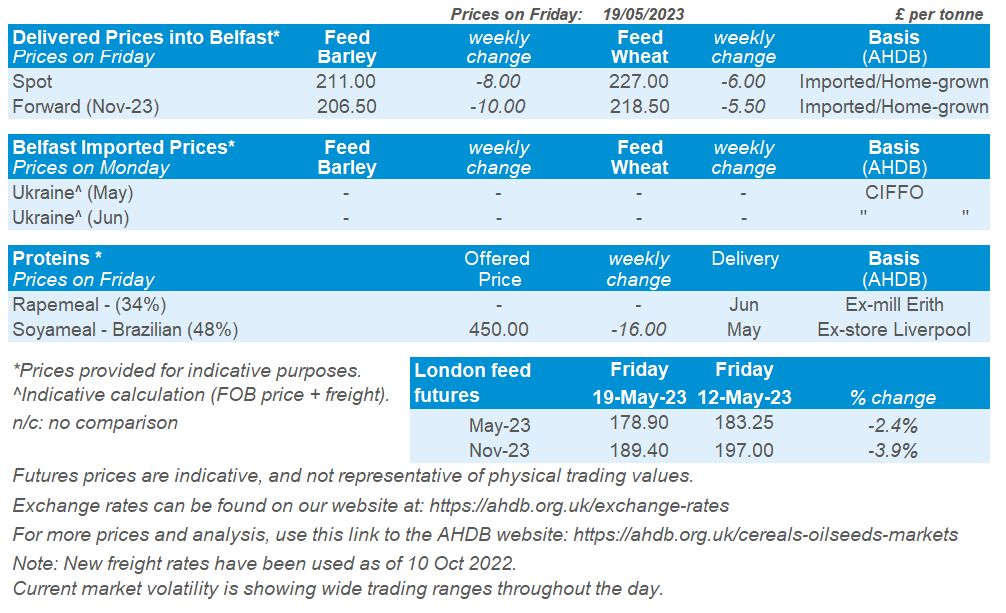

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.