Even lower rapeseed prices next season? Grain market daily

Tuesday, 16 May 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £187.00/t, gaining £3.75/t on Friday’s close. New crop futures (Nov-23) closed at £200.50/t, gaining £3.50/t over the same period.

- The domestic market followed both the Chicago and Paris market up yesterday. Reasons for this were due to lower-than-expected US wheat production for 2023/24, more information is available here.

- Also, there are doubts over the renewal of the Black Sea Initiative, which is set to expire this Thursday. Ukrainian officials announced yesterday that no further talks are planned this week to extend to the deal. The end of this agreement cannot be ruled out yet, markets await official announcements. However, the UN Aid Chief stated yesterday that efforts will continue to renew the deal, as two final ships are due to leave Ukrainian ports today.

- Paris rapeseed futures (Nov-23) closed yesterday at €430.50/t, gaining €7.25/t on Friday’s close. This followed gains in soyabean and crude oil markets.

Even lower rapeseed prices next season?

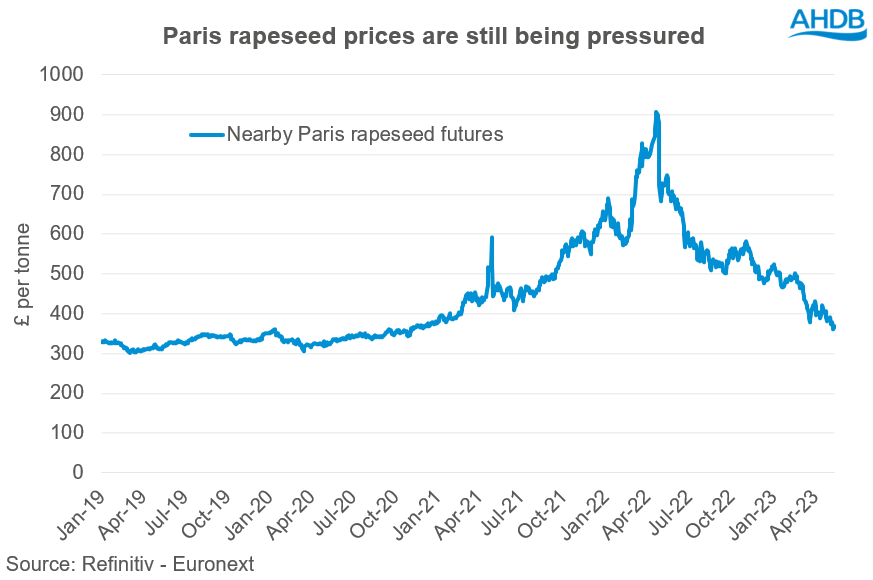

Over the past two years, rapeseed prices have seen significant support in comparison to historic averages. This support has been from both the drought in Canada in 2021/22 and then following that, Russia’s invasion of Ukraine.

However, since April 2022, prices have been on a downward trend. They are even approaching prices that haven’t been seen since the 2020/21 marketing year. Spot delivered rapeseed (into Erith, May-23) was quoted at £363.50/t in the AHDB delivered survey on Friday, down from the peak in April 2022, when spot prices were at £820.00/t.

Just to give context, last week harvest 23 delivered prices (into Erith) were quoted at £362.50/t. At the same point and location last year, harvest 22 was quoted at £724.50/t. Domestic harvest values are nearly 50% lower than last year.

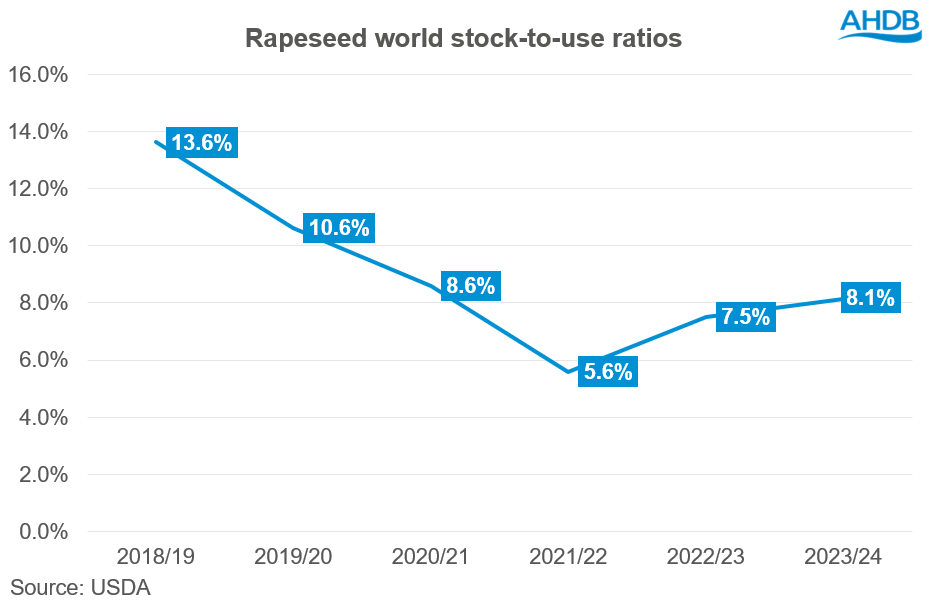

So, where now for rapeseed prices? The USDA 2023/24 crop outlook released on Friday further confirms it is unlikely the highs experienced over the past two years will continue in the coming marketing year.

Rapeseed for 2023/24 initial forecast shows that global production is going to marginally decrease from 87.3Mt to 87.1Mt, with a smaller crop forecast in Australia but larger crops due year-on-year for the EU and Canada. Total crushing is pegged to increase 1.1Mt. Global ending stocks are forecast at 6.9Mt, the highest since 2019/20 and up year-on-year. This is due to higher opening stocks for 2023/24 forecast, 2.1Mt higher than 2022/23 marketing year, interestingly EU opening stocks are estimated at 1.7Mt, the highest since 2019/20. This is leading to global stocks-to-use (STU) increasing year-on-year from 7.5% to 8.1%.

Stocks to use levels (STU) increasing indicates that the tight rapeseed supply of previous seasons is easing, STU levels are approaching what was estimated in 2020/21.

This is a preliminary estimate, and a lot can change with weather and demand outlooks. However, this is just further information to indicate that rapeseed prices are unlikely to climb to the highs seen from September 2021 to April 2023. If anything there is probably argument for them to drop further, especially with the current bearish outlook for US soyabean production.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.