Arable Market Report - 15 May 2023

Monday, 15 May 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

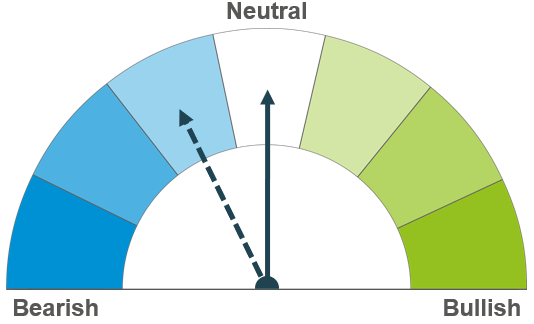

Wheat

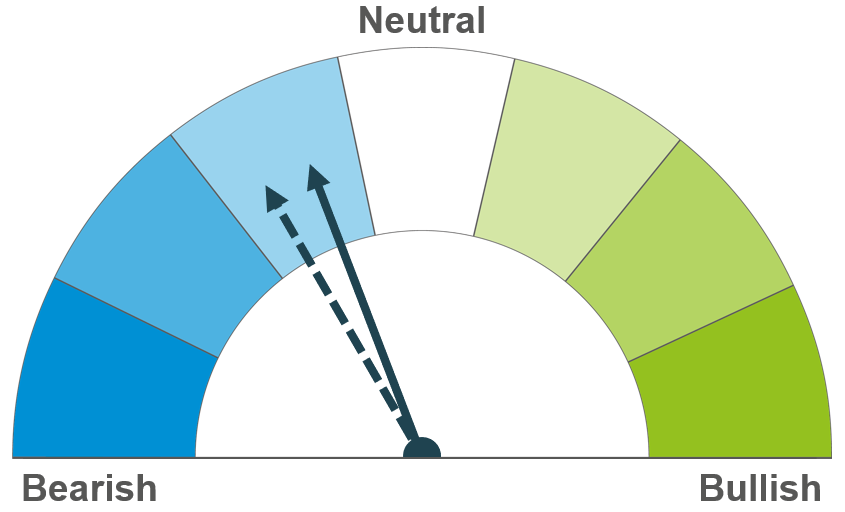

Maize

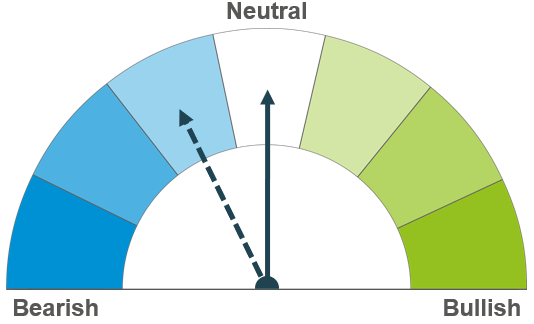

Barley

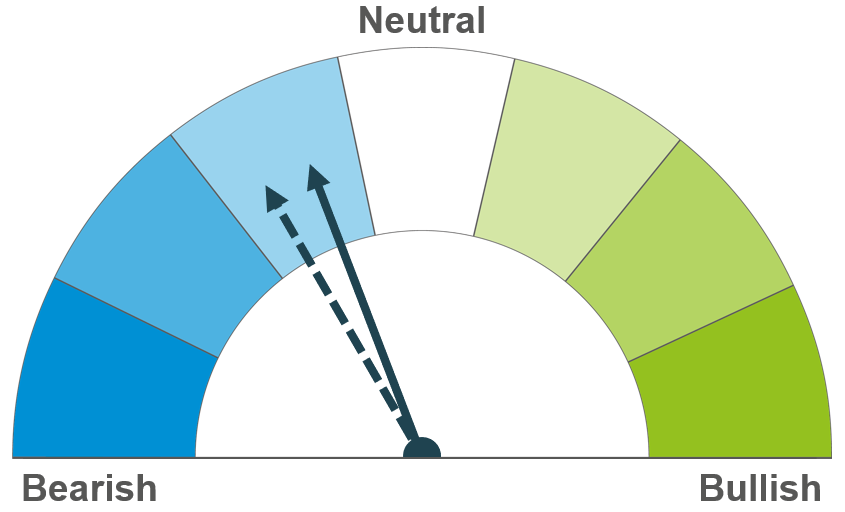

Short term, volatility is expected from expiry of the Black Sea Initiative renewal this week and on a smaller US crop forecast. Longer term, ample supplies on the continent and domestically weigh on the new season outlook, despite forecast tightening of global 2023/24 stocks.

Larger global supplies and ending stocks are forecast for the new season, weighing on the price outlook. As such, demand going forward will be key to watch. Renewal of the Black Sea Initiative will be important for Ukraine’s maize availability, something to watch.

Global barley prices continue to follow movements in the wider grain complex, with larger feed grain supplies forecast for the new season. The discount of ex-farm UK feed barley to UK feed wheat stood at £14/t as at 04 May.

Global grain markets

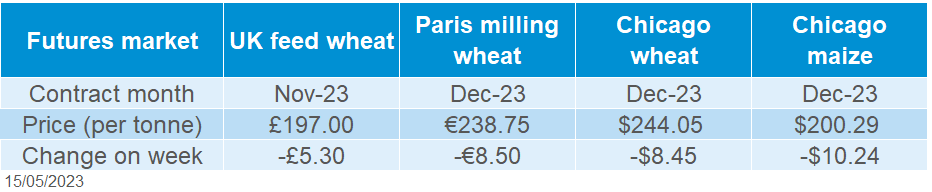

Global grain futures

Overall, global grain futures felt pressure last week, weighed on by improved US weather, slow US export sales, and ample Black Sea supplies. The concern over expiry of the Black Sea Initiative continues to curb losses. Despite an overall week on week fall, global wheat markets firmed on Friday, in anticipation of and reacting to, the USDA’s World Agricultural Supply and Demand Estimates (WASDE).

Renewal of the Black Sea Initiative (Ukraine export corridor) remains a key watchpoint in markets, with expiry due on 18 May. After days of talks last week in Istanbul, a deal is reportedly nearing according to a statement released by Turkey’s Defence Ministry on Friday (Refinitiv). Though a deal has not yet been reportedly secured. Markets may remain volatile this week as we approach expiry.

The feel of ample Black Sea supply is still apparent as we end the season. On Wednesday, Algeria’s state agency OAIC bought 500-600Kt of milling wheat for delivery in July. Russia, Romania, and Bulgaria origin are believed to make up much of the purchase.

Much of the market focus is on new season supply and demand (2023/24), with the latest WASDE released on Friday. For maize, this report set out larger global supplies, increased global demand and increased global ending stocks next season, following market expectations. World maize production is forecast for a record high at 1,219.6Mt (+69Mt), with increases for the US (+39Mt), EU (+11Mt), Argentina (+17Mt) and China (+3Mt) forecast, despite smaller crops expected for Ukraine (-5Mt) and Brazil (-1Mt) year on year.

For wheat, the picture looks different. The US all wheat production forecast is smaller than market expectations, at 45.2Mt. Just under 0.3Mt more than last season on increased harvested area forecast, despite lower forecast yields. Above-average abandonment in Texas, Oklahoma, and Kansas is forecast for harvest 2023 considering the recent drought conditions. Though rain has been falling of late, is it too late?

The 2023/24 global wheat outlook is one of lower supplies, trade, consumption and ending stocks. Despite a record global production forecast at 789.8Mt, a lower total carry in stock is forecast for the new season down mostly to tighter stocks in India (-10Mt), despite larger carry in expected across the EU and Russia particularly. Global wheat demand is expected to contract slightly down to increased feed grain supplies, as well as reduced global wheat trade. Global ending stocks are forecast at 264.3Mt, which if realised would be the lowest since 2014/15 and with more than half forecast to be held in China.

Though it is important to note these are first estimates for 2023/24, and a lot can happen in the new season.

UK focus

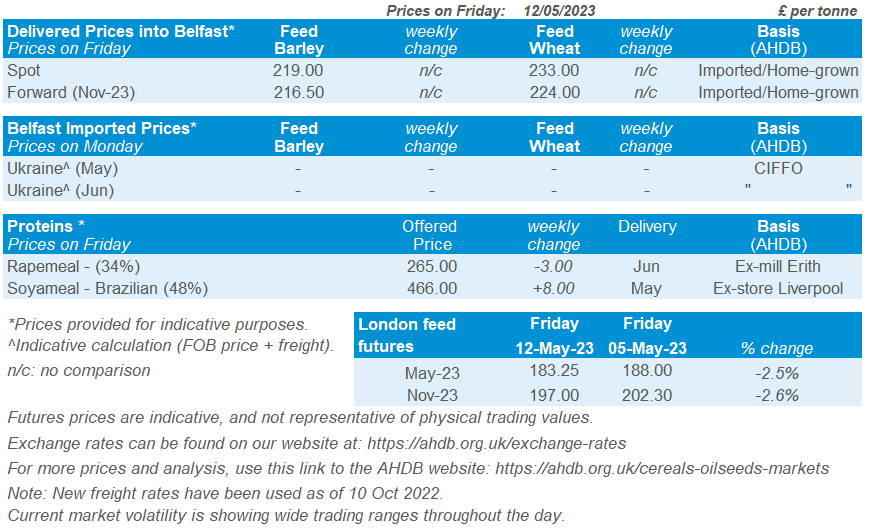

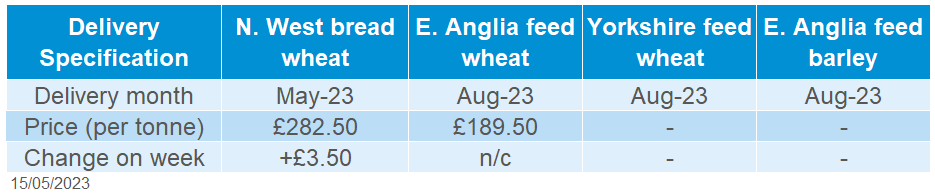

Delivered cereals

UK feed wheat futures (Nov-23) closed on Friday at £197.00/t, down £5.30/t on the week. Domestic futures followed pressure on Paris and Chicago wheat markets.

Domestic delivered feed wheat prices followed pressure, Thursday to Thursday. On Thursday, feed wheat delivered into East Anglia (August delivery) was quoted at £189.50/t. For the same destination, feed wheat was quoted for Nov delivery at £195.00/t, down £4.50/t on the week.

Bread wheat delivered into the North West was quoted on Thursday at £282.50/t for May delivery, up £3.50/t on the week. Milling wheat premiums are firm currently, to hear why and if this will continue, read our analysis here.

Last week, the HMRC released the latest UK trade data to March. Season to date (Jul – Mar), wheat exports totalled 1.14Mt, up 278% from the same period last season. Barley and oat exports over the same period totalled 877.4Kt and 136.1Kt, up 41% and 150% over the same period respectively. Maize imports over this period totalled 1.72Mt, up 8% from last season July to March.

The USDA forecast larger carry in stocks for the UK into next season, plus the UK’s harvest 2023 crop is pegged at 15.5Mt, just below this year’s crop. Ending stocks are forecast for the new season at 2.6Mt, with stocks to use calculated at 15.1%.

Oilseeds

Rapeseed

Soyabeans

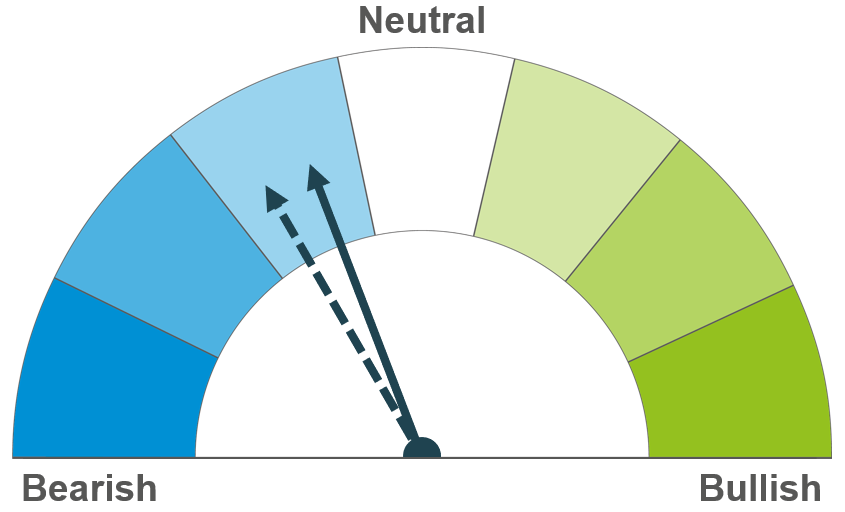

The EU rapeseed crop is faring well with a large production expected from the EU. Longer-term the global market is expected to be well-supplied with global ending-stocks growing in 2023/24.

Currently markets eyes are on US soyabean plantings, with a record crop expected. The price outlook remains bearish, especially with the recent record Brazilian crop and global production for 2023/23 at a record too.

Global oilseed markets

Global oilseed futures

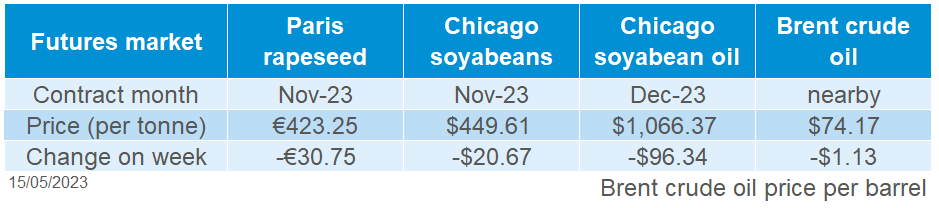

Chicago soyabean futures (Nov-23) closed Friday at $449.61/t, down 4% across the week. The consistent pressure across the week has been from the US progress with their soyabean plantings. As at 7 May, 35% had been planted, which is ahead of last year and the 5-year-average. A further planting progression update will be released this evening from the USDA.

Moreover, the first new crop (2023/24) estimates from the latest USDA World Agricultural Supply & Demand Estimate (WASDE) confirmed that a record US soyabean crop is expected in the new marketing year. The first estimates pegged the crop at 122.7Mt, up 5% from last year. This record crop means that US ending stocks are forecast to grow to 9.1Mt, the highest since 2019/20.

2023/24 highlights from the latest WASDE report include:

- The 2023/24 global oilseed outlook shows higher production, crush, and ending stocks compared with the last marketing year.

- Global oilseed production is forecast to rise 43.8Mt to 671.2Mt, mainly on higher year-on-year soybean production in South America (Brazil +8.0Mt, Argentina +21.0Mt) and the US (+6.4Mt)

- The EU is estimated to produce a record sunflower seed crop of 11.5Mt, up 2.2Mt year-on-year.

- Rapeseed production year-on-year is expected to grow in both the EU (+964Kt) and Canada (+1.3Mt). Partly offsetting the lower rapeseed production from Australia, who’s yields are forecast lower after 3 years of exceptional weather conditions.

- Combined oilseed production for major South American producers (Brazil, Argentina, Paraguay, and Uruguay) is expected to grow 31.9Mt after last year’s drought in southern South America and a higher expected area.

This is just a first estimate into 2023/24 and a lot can change from an economic, social and meteorological perspective that could impact both the supply and demand of oilseeds over the 2023/24 marketing year. However, initial estimates indicate that we are possibly heading towards a more bearish outlook for oilseeds.

Rapeseed focus

UK delivered oilseed prices

Pressure across the week on rapeseed came from the weakness in soyabeans, marginal weakness in crude oil, favourable new crop rapeseed conditions in the EU, and further to that, Sweden announced plans last week to cut biodiesel requirements from the start of 2024.

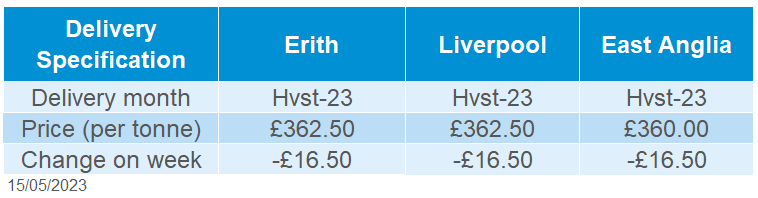

Paris rapeseed futures (Nov-23) closed Friday at €423.25/t, down €30.75/t across the week. This filtered into our domestic prices with delivered rapeseed (into Erith, Hvst-23) being quoted at £362.50/t, down £16.50/t on the week.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.