How did the pandemic affect UK beef trade in 2020?

Friday, 19 February 2021

We now have full UK trade data for 2020. Let’s take a look at how imports and exports of beef fared during what was an unforgettable year.

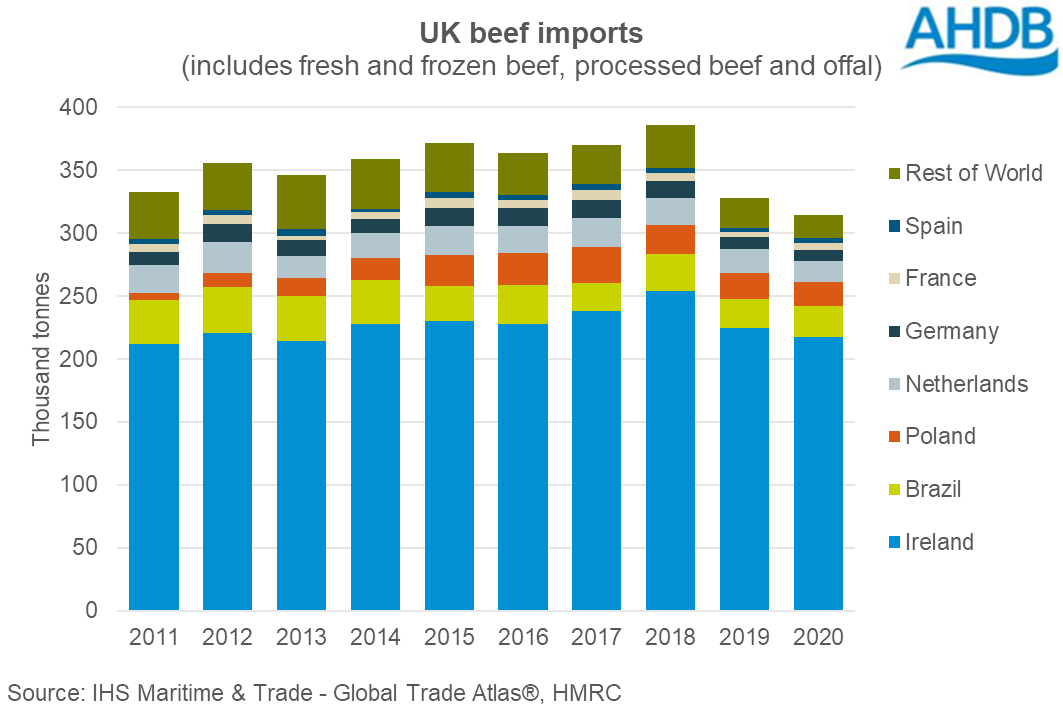

Imports

During 2020, the UK imported 314,000 tonnes of beef (shipped weight; includes fresh/chilled, frozen, processed and offal), down 4% from the year before, according to HMRC. There were declines in all categories, particularly in fresh and frozen beef, which combined continued to make up just over 75% of all beef imports.

While imports were lower in volume, they were on average 3% more expensive than in the previous year. An average unit cost of £3,800/tonne placed the total shipments at £1.2 billion. A generally weaker sterling/euro exchange rate throughout 2020 will have contributed here, as well as higher cattle prices in key supplying countries like Ireland.

On a country basis, shipments from Ireland (responsible for 69% of the UK’s imports in 2020) fell by 3% year-on-year overall. The main beef category imported from Ireland is fresh/chilled beef, which actually saw a slight increase (1%). However, lower volumes of frozen and processed beef offset this.

Volumes also fell from Poland (-13%) and the Netherlands (-11%), as well as from other smaller European suppliers. France was one of the only European suppliers to increase shipments. The UK mainly imports corned beef from France (4,000 tonnes in 2020), which was behind most of the overall growth.

The story was similar further afield. Brazil is the key non-EU supplier of beef to the UK (although still only accounts for around 7-8% of total volumes), with the majority being corned beef. During 2020 Brazil was one of the few countries to send more beef to the UK, with overall shipments growing by 10% to 25,300 tonnes. The growth in corned beef imports may have been to supply increased demand for meat through retail, a key effect of the pandemic.

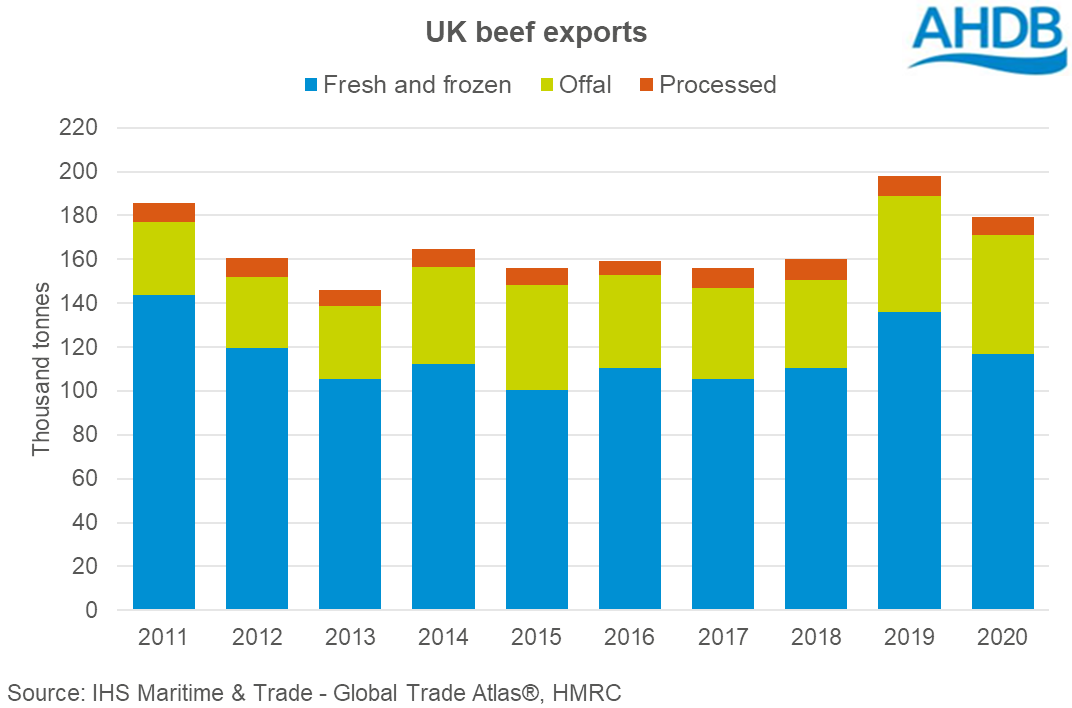

Exports

For trade going in the other direction, volumes of exported beef (fresh/frozen, processed and offal) fell by 9% (18,300 tonnes) year-on-year to 179,500 tonnes (shipped weight) in 2020. This was worth £508 million.

There were declines in most categories, namely fresh and frozen beef (-14%). Combined, these categories made up 65% of total beef exports by volume, and were responsible for the majority of the overall slip in exports for the year. It is worth bearing in mind that exports in 2019 were particularly high, so for 2020, volumes have moved to be more in-line with historic levels.

While exports of frozen beef actually increased by 13%, this was not enough to outweigh a 24% drop in fresh shipments. Shipments of beef offal continued to rise, reaching 54,200 tonnes, or 30% of total shipments in 2020. While a cheaper product, these exports are important for the value of the overall carcase.

Ireland remained the key destination for UK beef shipments (34% of total volumes), although the quantity remained largely unchanged on the year at 60,300 tonnes. The declines came in shipments further afield, particularly to the Netherlands (-33%). Overall, shipments to the EU-27 fell by 15% to 129,600 tonnes, which still made up 72% of the UK’s beef exports.

In contrast, shipments to non-EU destinations grew by 9% year-on-year to 48,700 tonnes, the highest level on record (back to 1997). The largest growth came in shipments to Canada, which nearly doubled on the year to 5,900 tonnes. Exports also grew notably to Ghana, the US, Japan and South Africa.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.