How could 2022/23 global crop availability be affected? Grain market daily

Tuesday, 22 March 2022

Market commentary

- Commodity markets continued to move higher yesterday on the back of Black Sea supply concerns.

- UK feed wheat futures (May-22) jumped £9.90/t from Friday’s close to settle at £302.90/t yesterday. Similarly, new crop (Nov-22) moved up £10.50/t to close at £260.50/t.

- Paris rapeseed futures (May-22) closed yesterday at €970.00/t (c.£812.00/t), up €32.25/t from Friday’s close. The new crop (Nov-22) contract also gained, albeit a lesser jump (€10.75/t), to close the day at €744.00/t (c.£623.00/t).

- Chicago grain markets (May-22) also recorded gains with the wheat contract gaining $20.39/t and the maize contract gaining $5.71/t, to close yesterday at $411.21/t and $297.74/t respectively.

How could 2022/23 global crop availability be affected?

With Ukraine and Russia being such key players to global commodity markets we have seen volatility and record high prices set across almost all key futures contracts since the Russian invasion.

Over the past few weeks, we have talked about the longer-term outlook too. Discussing how tensions could affect new crop supplies for the 2022/23 marketing year.

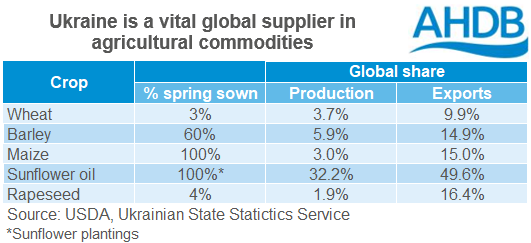

The Ukrainian Ministry of Agriculture has encouraged farmers to continue with spring sowing where possible. The key crops that will be affected are maize and sunflower as the entire campaign is in Spring. Also, particularly for sun oil, Ukraine is a significant global supplier.

Winter crops are also at risk. War-torn areas may have physical damage but most damage will likely come from reduced inputs, resulting in lower yields and poorer quality.

According to UkrAgroConsult the Ukrainian Ministry of Agriculture estimate reduced materials and equipment available for spring planting:

- Seed -30%

- Fertilisers -20%

- Plant protection products -50%

- Fuel -80%

Other restrictions could include, lack of personnel, damage to infrastructure causing logistical issues and lack of financial resources. Many farmers may not have sold all their old crop yet and current limitations, particularly to exports, could prevent movement soon. Thus restricted cash flow would likely make 100% advance payments for input supplies near impossible. This is what is reported by farmers in the latest UkrAgroConsult report.

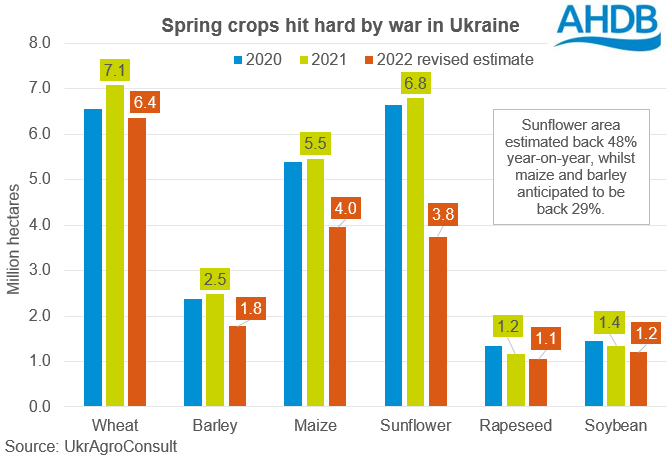

The Ukrainian consultancy service has updated its estimates for harvest-2022 planted area. These estimates assume that the Russian army will withdraw from Ukraine in the next 4 weeks.

Some might say that the cuts to spring crops are somewhat cautious given the assumption of Russian withdrawal within 4 weeks. Also, particularly for sunflower and maize production, the major growing regions are located on the eastern side of the country where hostilities are most prevalent.

Considering the importance of Ukrainian production on global supplies (see table above), interruption to spring plantings and management of winter crops through to harvest will continue to drive markets. Some of the disruption will be priced in but increased concerns and confirmation of struggles will likely continue to lift markets higher. As UK markets track global price movements this will inevitably feed into domestic prices to some extent.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.