How are UK wheat import origins faring? Analyst Insight

Thursday, 30 July 2020

Market Commentary

- UK feed wheat futures (Nov-20) gained £0.70/t yesterday, to close at £166.40/t. As of midday today, the contract had fallen to £165.00/t. Uncertainty surrounding domestic yields has added a degree of volatility to UK wheat markets.

- With favourable weather conditions expected over the next week, US maize futures (Dec-20) have moved lower this week, closing at $128.44/t, down $3.25/t from Monday.

- Paris rapeseed futures declined €3.75/t yesterday to close at €380.25/t. Oilseed markets have been increasingly concerned at deteriorating US/China relations and its effect on US soyabean exports to China.

- The first AHDB Harvest Report will be released on Friday 31st July focusing on the winter barley and oilseed rape harvests so far. Look out for all the details in tomorrow’s Grain Market Daily.

How are UK wheat import origins faring?

Domestic wheat prices will be more exposed to global fundamentals this season following the hefty decline to UK wheat production estimates. We are likely to sit closer to import parity levels. Though with potentially 17.0Mt less wheat produced in the EU-27 this season, the import parity level may sit higher to due to a sharply lower European crop in 2020/21.

In previous years of low production figures, the UK has turned to our European neighbours to meet our supply deficit. However, much of Southern Europe faces poorer production figures. Other import origins including the US and Black Sea regions have also featured in recent UK import schedules.

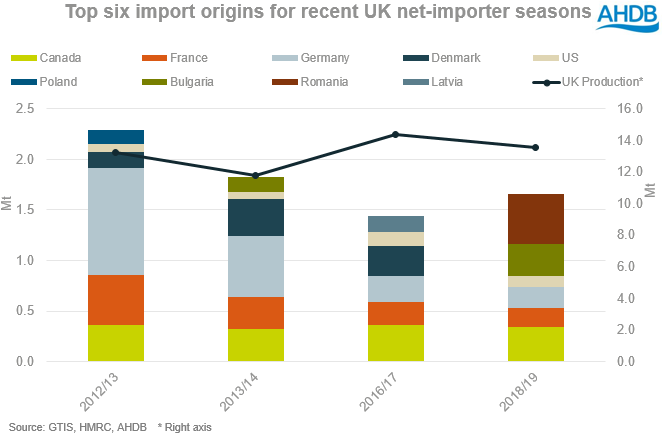

The UK makes use of three ‘core’ import origins which feature prominently in import data, particularly so in seasons of lower UK wheat production. As you can see from the graph below, these origins are Canada, France and Germany.

What has happened to the ‘core’ origins this season?

The Canadian, and portions of the German, imported supply is high protein wheat destined for inclusion into the bread milling sectors. Imports of Canadian wheat have averaged 342.0Kt per year in the last five marketing years, suggesting a stable level irrespective of domestic production figures.

Already this season, the UK has imported 73.76Kt of non-EU wheat as of 26 July, according to EU commission data. Looking at the import origins; Canada takes the lead with 78.15Kt of wheat exported to the EU, whilst Russia are second with 9.68Kt in the season to 26 July.

This year, some EU countries have seen repeated reductions to yield forecasts. France in particular is facing its lowest soft wheat crop since 2016, forecast at 29.22Mt, a 26% decline from the bumper crop last season.

Though, in the 2016/17 season which featured a 27.56Mt production figure, France still exported 6.13Mt of wheat to the EU-28, of which 228.24Kt was UK bound. Yesterday, French milling quality wheat (11.5%) was quoted at $218.00/t FOB (£167.77/t).

Germany is expecting much smaller declines for its estimated 22.46Mt wheat crop, 2.6% below last year. Rainfall over the last two months has eased concerns for the crop and it is seemingly in good condition. As such, it is likely Germany will pick up the slack and feature more prominently in UK import schedules.

Could Black Sea regions provide a solution?

As James analysed yesterday, Black Sea regions will again pressure the direction of global wheat markets. Recent increases to Russian wheat production estimates, coupled with the announcement of the largest Russian wheat planted area since the 1970’s, have acted as a weight on wheat markets. As such, any impacting weather events to the Russian crop could well ease this price pressure.

In the 2018/19 season, the UK imported an estimated 1.85Mt of wheat, of which around 500.66Kt was Romanian origin. History repeating itself this season is somewhat unlikely.

Firstly the two UK bioethanol plants that imported large tonnages of feed wheat are not operating this season; and, Romania has also been affected by drought-like conditions. This drought has resulted in an estimated 7.0Mt wheat production figure this season. For reference, 10.27Mt of wheat was harvested in Romania in 2018/19.

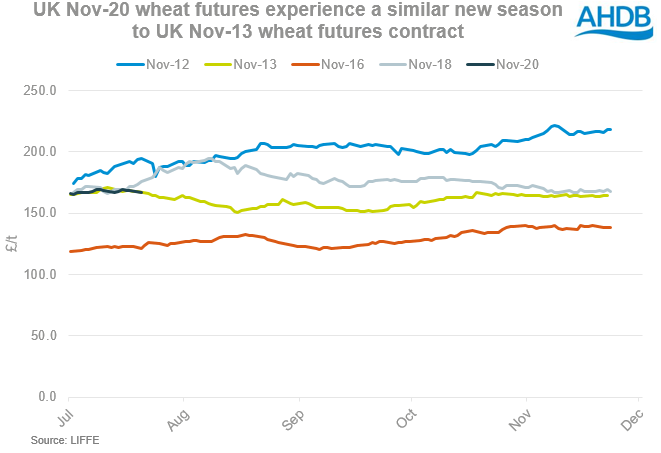

The graph above charts the London November wheat contract within their respective ‘low’ UK production seasons from July until the contract close. As you can see, the Nov-20 contract has so far tracked almost identically to the 2013/14 season which had an 11.80Mt wheat crop. With our first 2020/21 harvest report due tomorrow, we will update UK production estimates once we have better regional data.

So why aren’t prices higher, could we follow 2018/19 or more?

At a headline level, rises or falls to the UK wheat price will largely depend on movements in global markets, with currency impacting too.

At the moment, we remain forecast to be in a global wheat surplus this season. As mentioned above, Russia expecting a large wheat crop offers pressure. So too does the resurgence of Australian wheat production, which is forecast up 75% on last year at 26.7Mt.

Bearish global maize sentiment also offers pressure for wheat markets, given partial interchangeability in feed rations. With maize being competitively priced into the UK, imports could likely replace some demand for wheat in feed markets. Maize markets have seen bioethanol demand plummet in the face of the coronavirus pandemic, whilst increased maize supply from Brazil, the EU and the US will pressure over the long-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.