Black Sea wheat moves markets lower, but spring wheat a watch point: Grain Market Daily

Wednesday, 29 July 2020

Market Commentary

- UK feed wheat futures (Nov-20) moved £1.20/t lower yesterday, to close at £165.70/t, the lowest point since 2 July. Global wheat markets also saw declines, with a bearish sentiment for Black Sea grain markets setting the tone.

- Up to Friday, the 20-day moving average for UK feed wheat futures (Nov-20) looked set to break above the 50-day average, which would have provided a bullish signal. However, news surrounding the Black Sea market pushed the short-term average lower again.

- Yesterday, Egypt’s state grain buyer, GASC, purchased 470Kt of wheat, 360Kt of Russian origin and 120Kt of Ukrainian origin.

Black Sea wheat moves markets lower, but spring wheat a watch point

This season, like most seasons in recent history, Black Sea grain supplies will be pivotal to the direction of global markets. Adjustments to production estimates from the Black Sea regions set the tone for domestic and international prices, especially in a year when other Northern Hemisphere producers, most notably the US, EU and Ukraine, are set for smaller wheat production.

This week has been very similar in that regard. On Monday, global wheat futures took a hit and Paris and UK new crop markets (Dec-20 and Nov-20, respectively) have continued to fall throughout the week. The common theme? An increase in the estimated area planted to wheat in Russia. Russia’s official statistics agency upped its estimate of 2020 wheat area estimate to 29.4Mha, reportedly the highest area planted to wheat since the 70’s.

In response, the Russian Institute for Agricultural Market Studies (IKAR) revised its production estimate back up to 78Mt, have previously dropped to 76.5Mt in the week commencing 13 July. Depending on the area figures being used by global forecasters, we could see further rises to production estimates for Russia in the coming weeks.

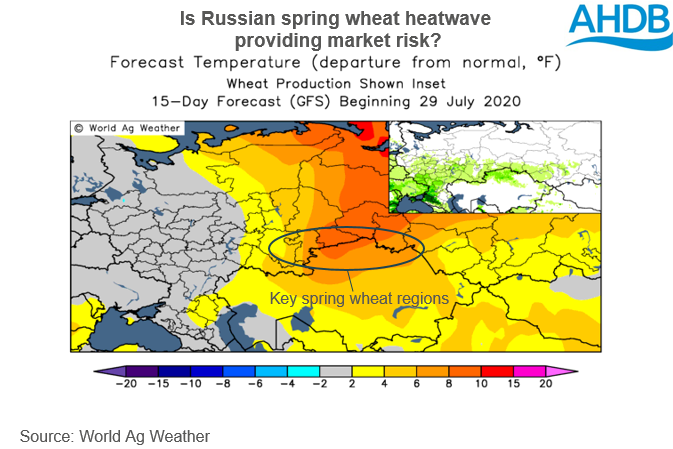

Russian harvests and crop development will continue to be watched closely for market sentiment particularly Siberia, which accounts for a large volume of the nation’s spring wheat production. Temperatures in Siberia have been significantly above average of late, and look set to remain so in the coming fortnight. With spring wheat currently flowering in the region yields could well be impacted, which could limit production forecasts despite the increased area figures.

Another key region for wheat market trends is Ukraine. A recent report from Ukragroconsult highlighted the Ukrainian wheat harvest was 53% complete at 23 July. Average yields stand at 3.62t/ha, versus 3.82t/ha the same period. If yields continue at the same level production would reach 24.3Mt, down from the circa. 28.5Mt harvested last season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.