How are the key dairy regions coping with coronavirus?

Wednesday, 13 May 2020

By Felicity Rusk

With coronavirus affecting nations all over the globe, it is difficult to keep track of the developments. We take a look at what has been happening in some of the key regions for the global dairy market.

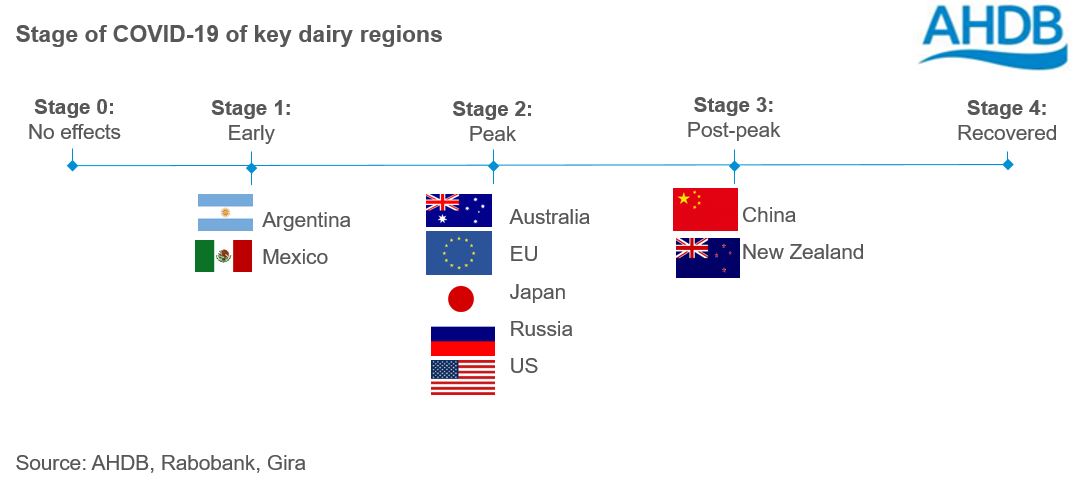

These key nations can be categorised based on their current stage of COVID-19 infection.

Stage 1- Early

During this ‘early’ stage, only a limited number of COVID-19 cases will have been reported. Social distancing regulations may be coming into effect and there will be some redirection of food from any closures in the foodservice sector into retail. There will likely be changes to consumer demand, as consumers stockpile goods.

- The Government introduced nationwide mandatory quarantine measures on March 20. The nation experienced some logistical problems in the days following.

- The Government has made US$1 billion of finance available at reduced interest rate to support small and medium sized companies.

- Demand for liquid milk and yogurt has reportedly increased. Meanwhile, the closure of the foodservice sector has meant that demand for cheese and dulce de leche (caramel made from milk) has fallen dramatically.

- Milk production recorded strong growth (+7.6%) in the first quarter of the year, supported by favourable weather. April was drier, although soil moisture was reportedly sufficient to maintain pasture quality

- Milk prices have been on the rise in the local currency. Moderate input costs have meant most producers have still seen positive margins.

- Earlier in the year, the milk destined for the foodservice sector was diverted into powder production, which has led to high stocks of WMP. Reports suggest that this will likely continue.

- Social distancing measures were introduced in late March.

- Since the start of the year, the Mexican peso has fallen by 24% against the US dollar. This makes Mexican exports more price competitive on the export market, however reduces domestic consumers’ spending power.

- Weakness in oil markets and the expected decline of the tourism sector will likely supress economic growth further. With no announced financial stimulus program, the nation could see a longer-term impact on demand.

- Reports suggest that logistical challenges have led to retail shortages of dairy products in some areas. The pandemic has reportedly boosted sales of UHT milk by up to 30%. In contrast, sales of cheese and yogurt have fallen.

- Milk production has recorded strong growth this year, with the first quarter up by almost 4%. While some regions have recorded a reduction, particularly strong growth in the Coahuila state has compensated.

- Reports suggest that producer margins are suffering. An oversupply of milk in some areas has put downward pressure on farmgate prices. Meanwhile, the devaluation of the peso has increased the cost of imported inputs, such as feed.

- A weaker peso could also result in a reduction of dairy imports in the next couple of months, which would particularly affect the US dairy market.

Stage two- Peak

During the ‘peak’ phase, social distancing regulations may have been in force for some weeks. Demand from the foodservice sector has largely disappeared and supplies are instead being redirected to the retail sector. Consumers have already moved through the ‘stockpiling’ phase and retail demand has begun to stabilise. A key challenge in the supply chain for these nations is labour availability. In some nations, producers and processors are starting to react to the rapidly changing environment by reducing production.

- Milk production growth is expected to be relatively modest this year, at around 0.5%. As seen in the UK, milk processors in some member states are trying to curb the production growth, particularly as production heads towards its seasonal peak.

- Closure of foodservice channel has severally affected dairy. An estimated 36% of cheese and 27% of butter is consumed in the foodservice channel. While retail sales have picked up, it has not been enough to offset the loss in volume terms.

- Labour availability remains a key challenge within the EU. This has mainly affected processing lines, due to worker absenteeism. There is also challenges with the potential lack of drivers, which is leading to higher transportation costs in some areas.

- Managing stock levels is also a key challenge, particularly for SMP and cheese. On 4 May, the EU Commission formally adopted the regulation to open a private storage aid scheme for dairy products, including butter, cheese and skimmed milk powder.

- By 12 May, just over 15,000 tonnes of butter had been registered across various nations. There was also good demand for cheese scheme, with the UK filling their entire allocation (4,499 tonnes). Meanwhile, only 1,200 tonnes of SMP had been registered, all within Germany.

- Around 13% of dairy produced in the EU is exported. Reports suggest that some exporters have had difficulties sourcing containers, particularly refrigerated ones, which has increased freight rates. Looking ahead, Gira expect EU dairy exports could be down by up to 10% this year.

- Reports suggest that movements of inputs, including fertilisers, crop protection chemicals are continuing as normal. However, there are some challenges with feed ingredients such as amino acids and vitamins, due to the supply disruption from China, the main supplier of these products.

- At the national level, the US is in the acceleration phase of the pandemic, with different states seeing varying levels of COVID-19 activity. Social distancing measures have been in place since mid-March, although the level of restrictions does vary between states and cities.

- The number of citizens filing for unemployment is expected to reach 20-30%. An estimated 16 million citizens registered for unemployment in the 3 weeks to 12 April alone, which added downwards pressure to futures markets.

- An estimated 60% of butter and 55% of cheese is sold through the foodservice channel, making them highly exposed to changes in demand of this sector. While retail sales have picked up, it has not been enough to compensate for the drop off from the foodservice channel. Gira expected US dairy demand to fall by 10% in 2020.

- A combination of subdued demand and rising production has meant that some producers have had to dispose of milk on-farm. Gira estimates up to 10% of April volumes could be ‘dumped’. Nevertheless, an oversupply situation will only put further downwards pressure on price.

- With producer’s cash-flows likely suffering, culling rates are expected to rise. However, this could be limited by the availability of processing capacity.

- US dairy exports have already faced some challenges. Shipments to Mexico, the US’s largest export destination, have already fallen away since the start of the year. Gira estimate that overall exports are expected to drop back by around 30%. However, there could be opportunities on the SMP market, if US product is priced competitively.

- Quarantine measures have started to ease in some regions.

- A recent report from Rabobank suggest the Australian dollar could fall lower against the US dollar than it did during the global financial crisis. While this does make Australian products more competitive on the export market, this will put upwards pressure on imported input prices.

- Retail sales represent the largest proportion of consumption. A combination of panic buying in early April and retail price inflation has supported prices through the value chain.

- With limitations on movement, consumption by long distance hauliers, a sector that typically provide higher returns, has all but disappeared.

- Rabobank expect that milk prices for the 2020/21 season will fall. However, reduced feed costs and better livestock tradition conditions are expected to support farmgate margins.

- Milk production is expected to record growth in 2020/21, supported by a better seasonal outlook.

- Quarantine measures began to be introduced in mid-March. These were extended to at least May 12, in a bid to prevent a second wave of the disease.

- Russian farmgate prices came under pressure in March. However, in rubel terms this was fairly minimal (-0.3% MOM), it was considerably more in euro terms (-15.4% MOM). This was due to the devaluation of the rubel against the euro.

- Government enforced plans of the compulsory tagging of dairy products, aimed to prevent counterfeit goods, has been postponed until 2021. The compulsory tagging is expected to add around 5% to the price of dairy products.

- In the first two months of this year, export volumes remained in line with the previous year, at 23,300 tonnes.

- Meanwhile, import volumes in the first two months of the year recorded a 2.3% increase. Shipments from Belarus, the number one source nation, fell by almost 5% on the previous year. Interestingly, imports from New Zealand recorded an uplift of over 80% on the year, though this only accounted for 5% of total imports.

- Quarantine measure were introduced in gradual phases, which limited ‘stockpiling’ behaviour of consumers.

- The postponements of the Olympic and Paralympic games has caused major economic damage.

- It is expected that a rise in unemployment rates will be fairly minimal and temporary, as not common practice within the culture.

- Although the foodservice sector was closed for around a month, the impact on consumption is expected to be relatively limited, mainly affecting consumption for the high-value ‘table’ cheeses.

- Demand for powders is expected to remain relatively stable, as the majority is used for manufacturing. However, stocks are expected to accumulate over the next couple of months.

- Demand for yogurt and other fermented dairy products is expected to benefit, due to the associated health benefits.

Stage 3- Post-peak

These nations were some of the first to be affected by COVID-19 and so are furthest along the road to recovery. For the most part, labour and logistical challenges are largely resolved. The foodservice sector has begun to re-open, although progress is slow due to persistent consumer concerns. The longer-term impacts are likely to be trade related and driven by a slowdown in the global economy.

- In mid-April, economy and trade are starting to recover. Reports suggest that 95% of factories are back online, although operating on reduced hours. Universities and middle schools are beginning to reopen, and offices started to reopen to staff.

- Foodservice outlets are reportedly starting to reopen although social distancing measures are still in-place. Recovery is slow due to consumer cautiousness. Many smaller restaurants have had to shut down permanently.

- Imports were largely unaffected in the first quarter, due to the long transportation routes. As such, expectations are that import volumes will likely record a decline from the second quarter onwards. Imports of cheese and milk powders are expected to fall in 2020, due to a combination of stock accumulation and reduced consumer spending powder. In contrast, imports of solid dairy fats (butter) are actually expected to increase in 2020, supported by strong demand from the bakery sector.

- Demand for infant milk formula remains steady, with many of the challenges coming from supply chain disruption. Some companies have used this as an opportunity to increase their market shares.

- Fresh dairy consumption was severally affected by the closure of the foodservice sector, particularly by the closure of coffee shops, schools and travel lanes. Retail sales did pick up, however were restricted by consumers limiting their shopping trips.

- The Chinese government has been promoting dairy consumption to residents, with the recommendation that individuals should consumer 300g of milk per day, and highlighted the health benefits of live yoghurt.

- The number of new cases of COVID-19 reported are low. However, there is an ongoing threat of a potential second wave.

- The nation has recorded some of the lowest infection and fatality rates among reporting countries. Borders were closed for non-residents from 20 March and quarantine measures were introduced on 25 March. From 22 April, these regulations have started to ease.

- There has been recent recovery in the New Zealand dollar exchange rate, reflecting the optimism around food exports and the nation’s potential quick recovery from the virus.

- Milk production is expected to be largely unaffected for the season, as supplies are currently moving down seasonally.

- An estimated 94% of total milk production is exported as a dairy product. As such, the nation is highly exposed to movements on the global market.

- The domestic retail sector is only a small proportion of the dairy sector. Domestic retail recorded an uplift throughout the lockdown period, and was largely unaffected by disruption to the economy.

- Disruption to exports have been fairly minimal, as the nation has reportedly avoided challenges with container availability. However, growing high stocks within some of the Asian nations could weigh in on export demand later on in the year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.