High prices but high fertiliser cost: Grain market daily

Friday, 11 March 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £293.00/t, down £4.50 on Wednesday’s close. Prices have drifted down after a contract high was set at £303.00/t on Monday. New crop futures (Nov-22) closed at £244.50/t yesterday, gaining £0.35/t over Thursday.

- Old crop prices followed the global market, as Chicago wheat futures (May-22) closed down 9.5% yesterday. However, new crop futures gained by 0.75%. The reason for the loss for old crop was cited as the recent hiking of prices making grain too expensive for potential buyers.

- In February Russia banned Ammonium Nitrate (AN) exports until April. However, yesterday Russia hit back at Western sanctions with export bans which include more than 200 products. The full list isn't available yet but doesn't seem to include raw materials, though this remains a risk.

High prices but high fertiliser cost

In the last two weeks commodity markets have risen sharply, but amongst these high prices are now ever higher input costs for farm businesses. In this article I want to discuss what is driving fertiliser prices and present tools and guidance from the AHDB to help with business decisions for managing this cost.

Tools

With input costs such as fertiliser rising, the latest nutrient management guide (RB209) update on the AHDB website could help your business adapt to this increase. This will help you make the most of organic materials and balance the benefits of fertiliser use against the costs, both economically and environmentally. Also, our nitrogen fertiliser adjustment calculator tool enables you to adjust the amount of nitrogen to apply to cereals and/or oilseeds crops, depending on commodity prices.

Further to that, information on adjusting N rates and alternative fertiliser management options can be found in Georgina Key (Resource Management Scientist) blog.

Rising fertiliser costs

The Russian-Ukrainian war has caused large volatility in grain markets, as the market commentary above outlines. The conflict is also supporting energy market significantly, as outlined in recent analysis:

- A summary of the impacts of the Russian invasion of Ukraine on energy markets

- Fuel feels the burn on further sanction tensions: Grain market daily

With rising natural gas prices come on-going upward pressure to fertiliser prices as this is key feed stock for producing nitrogen fertilisers.

In response to high gas prices Yara announced on Wednesday 09 March that its European ammonia and urea production is anticipated to operate at approximately 45% capacity by the end of this week.

This news, combined with the Russian news outlined in the market commentary, will have implications globally. Higher fertiliser prices mean costs of production globally will increase, which could alter which crops are grown or crops are grown on marginal land. Also, the quality of grain (such as milling wheat) may well be reduced if fertiliser input is reduced. Finally, yields could be lower if farmers choose or are forced to reduce fertiliser applications, potentially impacting global production.

UK focus

In January spot AN – UK produced averaged £645.00/t in our GB fertiliser prices survey. Since this point though, anecdotally AN prices have been rising further.

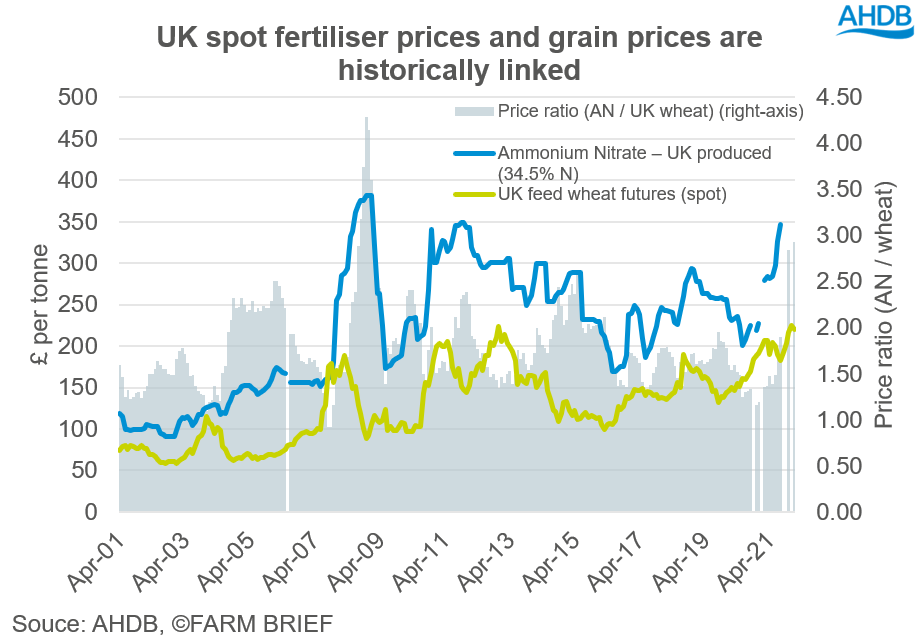

As shown in the graph above there is a relationship between domestic AN prices and UK feed wheat futures. Based on the last 20 years, AN is usually 1.5-2.0 times the price of wheat. However, anomalies do exist such as the end of 2008 and right now.

High grain prices currently are absorbing an element of these increased input costs, but not all. What’s more, the time is approaching to procure fertiliser for harvest 2023. Knowing your potential cost of production with these increased input costs is key for knowing when it’s a good time to market your grain.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.png?v=637826059780000000)