Fuel feels the burn on further sanction tensions: Grain market daily

Tuesday, 8 March 2022

Market commentary

- UK feed wheat futures (May-22) rose for the sixth consecutive session yesterday, up £18.00/t to close at a record £303.00/t. However, only 150 contracts were traded during the day, the lowest traded daily volume since 17 February 2022 (Refinitiv). New crop (Nov-22) also rose (£11.00/t) from Friday’s close, to £249.00/t, a contract high.

- Markets are said to have paused while traders wait to see the outcome of several international tenders this week. These will allow greater insight into the price and availability of wheat.

- Both Chicago maize (May-22) and soyabeans (May-22) eased back yesterday, $1.38/t and $0.37, closing at $295.57/t and $609.70/t respectively. Despite the Black Sea supply turmoil, improving conditions in Argentina have removed a bit of the heat.

Fuel feels the burn on further sanction tensions

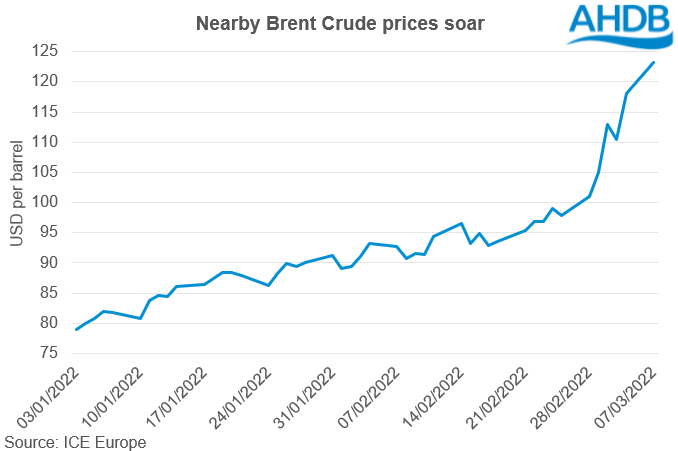

Brent crude oil prices have continued to surge. The USA announced on Sunday (6 March) that active discussions were underway with European allies to fast-track negotiations banning Russian oil imports. While Russian oil shipments only accounted for 7% of US oil imports in late 2021, the EU is much more dependent on supply. Approximately 30% of European oil and 39% of gas is sourced from Russia.

Even though Germany and the Netherlands rejected the plan yesterday, it remains on the table for the US.

In response, Russia has threatened to close off Nord Stream 1, the main gas supply line from Russia to Germany.

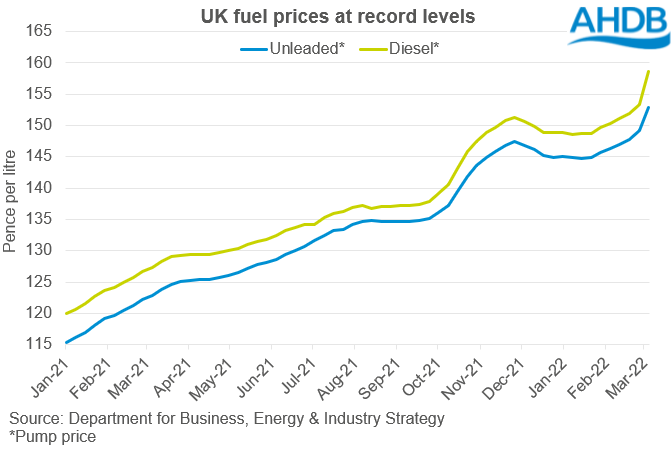

This increased uncertainty to global supply, when the outlook was already tight before the conflict began, is adding additional support to surging oil prices. And this is being felt here in the UK at the pumps.

UK pump prices are at record highs, and these rising costs are coming forward as spring fieldwork campaigns begin for many growers. So, while UK new crop prices are at record levels, input costs are rising in concert.

Equally, with gas prices soaring and availability restrictions being threatened, there is no let up on the horizon for fertiliser prices. Even for those UK growers who are covered for this season, it would be mindful to think ahead to 2022/23 and the potential cost of replacing supplies should the Ukrainian conflict draw out.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.