Heavy rains impact European crop conditions: Grain market daily

Wednesday, 10 April 2024

Market Commentary

- UK feed wheat futures (May-24) closed at £170.25/t yesterday, down £1.15/t from Monday’s close. New crop futures (Nov-24) closed at £193.55/t, down £0.75/t over the same period.

- Domestic wheat futures edged downwards yesterday, following Chicago wheat price movements. The USDA reported stable conditions of US winter wheat crops this week, despite current unfavourable weather. Improved crop prospects in Russia also weighed on global markets. Argus, the commodity analysis firm, has raised its forecast for 2024/25 Russian wheat production to 92.1 Mt, with an increase in estimated winter wheat area.

- Paris rapeseed futures (May-24) closed yesterday at €448.25/t, up €5.50/t from Monday’s close. The Nov-24 contract ended the session at €461.75/t, up €2.75/t over the same period.

- Support in rapeseed prices comes as traders express their concerns over dryness issues prior to plantings on the Canadian Prairies. Expectations of reduced Malaysian palm oil supplies have also boosted the market, with the release of Malaysian palm oil stocks data due out on April 15.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Heavy rains impact European crop conditions

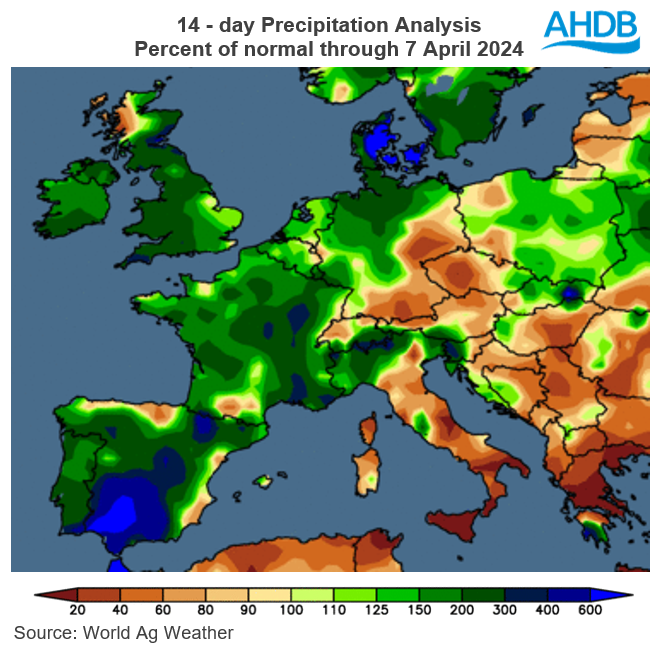

Since the start of the season, many crops have been continually impacted by unfavourable wet conditions across Europe’s key production regions. In large areas of western, northern, and parts of eastern Europe, wet weather in excess has negatively impacted sowing, emergence, and development of winter crops. It also continues to impact sowing of spring crops in certain regions too, with high levels of precipitation over the past few weeks.

Throughout autumn and winter there was little relief from these unfavourable conditions, curbing the success of autumn planting, and impacting post-planting field work. As such, crop conditions have been driven downwards in major producing countries, including France and parts of northern Germany.

FranceAgriMer reported last week that the state of French soft wheat this season is the poorest since 2020, when similar weather patterns were seen. As at 1 April, 65% of French soft wheat was rated as being in good or excellent condition, this was down from 66% a week earlier and down 93% compared to the same point last season.

With poor winter and autumn conditions, reliance upon spring planting weighed heavily on French farmers. Planting of French barley was 86% complete on Monday, from 82% the week before, with sowing accelerating following a slow start. Despite this, it is well behind the previous five-year average, and last season, when the entire crop had been planted at this point. Additionally, according to FranceAgriMer spring barley conditions are the worst on record, with 61% of spring barley crops rated good or excellent, down from 97% last season. The spring barley area remains uncertain, and despite an increase being expected due to a lack of winter cropping, current weather leaves doubts over the size of the crop.

In Germany, a key source of milling grade wheat for the UK, record levels of precipitation were seen from Nov 23 until mid Feb 24. This resulted in flooding in many key regions, putting stress on winter crops. However, many crops were expected to be resown in the spring, making up for some of the winter losses, with rainfall back to usual levels in late February and March.

What does this mean?

Given that the UK has also experienced continued wet weather this season, it is likely that our requirement for imported wheat will be historically high in 2024/25. Though given the volume of feed wheat in the UK at the moment, and the fact that feed wheat imports compete with maize, it’s likely that much of what we will import will be of milling standard.

Typically, the milling wheat imported to the UK is largely of German and Canadian origin, and therefore conditions in these countries could have the greatest impact on our domestic prices. On the other hand, France makes up a smaller proportion of total milling wheat imports.

For this reason, conditions in Germany remain a key watchpoint. The EU Commission currently estimates German wheat production for 2024 down 11% on the year. If the quality of German wheat suffers even more due to ongoing rains, we could see UK milling premiums strengthen further. Though as it stands German wheat is still pricing into the UK and imports remain firm.

Over the next few weeks, weather conditions in Germany will be a crucial watchpoint, as final spring plantings go in and crops continue to develop.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.