More imported wheat milled in February 2024: Grain market daily

Friday, 5 April 2024

Market commentary

- May-24 UK feed wheat futures edged lower yesterday, down £0.70/t to settle at £169.85/t. There were lower declines for new crop prices with the Nov-24 contract back £0.30/t to £192.80/t. This puts the carry from May to November at almost £23.00/t and offering a growing incentive to store for the new season.

- A fall in French grain futures was a contributing factor to the fall in UK prices. French futures fell on a stronger euro and easing concerns about Russian exports. However, there were rises for Chicago maize futures supported by a weaker US dollar and better than expected US export sales (LSEG).

- Paris rapeseed futures fell due to falls in Chicago soyabean futures on the back of weaker than expected export sales. The Nov-24 Paris contract fell by €6.25/t to €452.25/t. There was a larger decline (€12.25/t) for the May-24 contract to €436.00/t, with technical trading potentially a factor. There are just over three weeks of trading left until the May-24 contracts’ final trading day.

- French spring barley planting progress also slowed again, up just 4 percentage points to 86% complete by 1 April. French winter crop ratings also edged lower between 25 March and 1 April (FranceAgriMer).

More imported wheat milled in February 2024

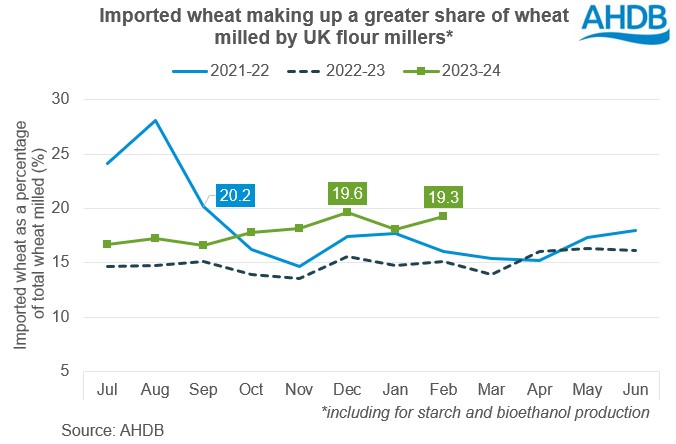

UK flour millers, including wheat milled for starch and bioethanol production, used more imported wheat in February 2024 in the latest AHDB usage data. The data shows they used 93.7 Kt of imported wheat in February, up 7% from January and 22% more than February 2023.

As a result, imported wheat took a greater share of wheat milled during February at 19.3%. This is the second-highest proportion of imported wheat used by UK flour millers, including wheat milled for starch and bioethanol production, since September 2021. The higher proportion of imported wheat reflects the poorer quality of the 2023 harvest, plus the worries about 2024 production.

There is potential for this trend to continue, with more imported wheat in stock and price relationships suggesting imported wheat looks attractive against UK values. Yesterday, UK feed wheat futures for May-24 delivery were just £1.73/t below the May-24 Paris milling wheat futures contract. On the same date (4 April), Nov-24 UK feed wheat futures were £3.42/t above the Dec-24 Paris milling wheat futures contract.

Meanwhile, just over 90 Kt of imported wheat was held in stock at the end of February by UK flour millers, plus starch and bioethanol users. This is the highest imported wheat stock level since the end of December 2020 (91.1 Kt).

In terms of the total usage levels, it is important to note that there were five weeks in January’s statistics, while there were four in February. The total amount of wheat milled, including for starch and bioethanol production, was up 1.4% year-on-year in February at 484.5 Kt. This is a lower rate of year-on-year rise than earlier in the season, though the amount of wheat milled rose notably in the latter part of last season due to bioethanol demand.

Mixed picture on ‘other flour’

‘Other flour’ production data gives a proxy for trends in wheat milled for bioethanol and starch production. ‘Other flour’ production is up 10% between January and February, despite February being a shorter month. This points to some recovery in ethanol production after lower ethanol prices impacted margins for bioethanol production earlier in the winter.

However, ‘other flour’ production in February was still down 4.1% from February 2023. The year-on-year trend will be important to watch to see if this recovery in wheat usage continues. There is an expectation that comparatively more maize will be used in place of wheat over the rest of the season as it begins to price more competitively.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.