US wheat ratings steady despite dry weather: Grain market daily

Tuesday, 9 April 2024

- There were mixed movements for global grain prices yesterday. There was slight support for prices from ongoing worries about whether reported issues with phytosanitary certificates could slow the pace of Russian exports. Old crop (May-24) Paris wheat futures prices edged up, with gains also for Chicago maize futures, while Chicago wheat prices dipped.

- UK feed wheat futures also dipped; the May-24 contract closed at £171.40/t, down £1.10/t from Friday, while the Nov-24 contract fell £1.00/t to £194.30/t.

- Oilseed prices declined yesterday as the Brazilian soyabean harvest reaches its latter stages. Conab reported harvesting was 76% complete by 7 April. May-24 Paris rapeseed futures fell €3.00/t yesterday to €442.75/t, while the Nov-24 contract lost €1.00/t to settle at €459.00/t.

- AgResource increased its forecast for the 2023/24 Brazilian soyabean crop by just over 1.5 Mt to 145.4 Mt yesterday due to a larger area estimate. But the company also trimmed its forecast for the maize crop (down 0.7 Mt) to 114.2 Mt due to ongoing drought in a couple of key states.

US wheat ratings steady despite dry weather

US winter wheat crop condition ratings were stable last night, despite drier weather in key US wheat-growing areas over the past fortnight.

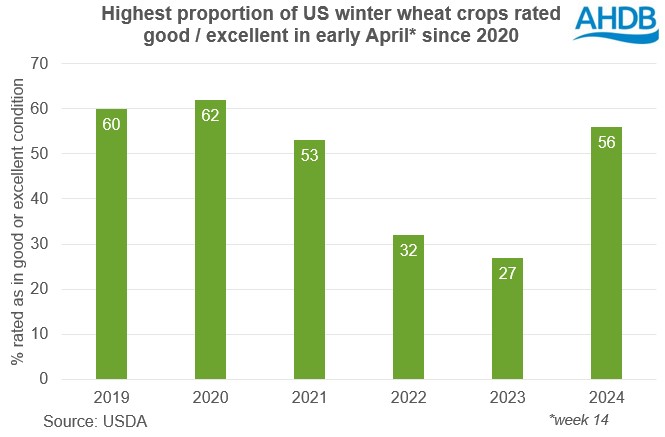

Last night, the USDA reported that 56% of the US winter wheat crop was in good or excellent condition, unchanged from the previous week. This condition score is well above last year’s 27% and the highest since 2020. Dips in condition ratings in some states, such as Oklahoma, are offset by improvements elsewhere.

The proportion of the winter wheat growing area in drought rose to 18% as of 2 April from 12% a fortnight earlier (National Drought Mitigation Centre). This follows below-normal rainfall across parts of the Midwest and the Great Plains over the past month. The proportion of the winter wheat area in drought has expanded notably in Kansas and Oklahoma compared to mid-March, with more recent expansions in Midwestern states, such as Illinois and Indiana.

Conditions overall are still much better than in recent years. But, with more dry weather forecast for most of the Great Plains in the coming week, this will be an area to watch. Kansas and Oklahoma alone planted 35% of the US winter wheat area for harvest 2024. Rain is forecast for much of the Midwest this week.

The potential impact of drier weather was a talking point yesterday, though a poll by Reuters showed the market expected the USDA to keep crop condition ratings stables (LSEG).

Winter wheat in many states is still in its vegetative growth stages. But the market is likely to become more sensitive to potentially adverse weather over the coming weeks as crops approach the reproductive growth stages. Currently, 6% of the US winter wheat crop has ears emerged (approx. GS 59).

The better crop condition overall compared to recent years is the key factor for the market currently, though the dry weather will need to be monitored moving forward. With speculative traders still heavily short in Chicago wheat futures, any escalation in worries about the crops could trigger short covering and add to price rises.

Planting of US spring crops is also underway, with 3% of spring wheat and 3% of maize planted by 7 April. This will be something to watch in the weeks ahead.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.