Have you thought about your marketing strategy for 2021/22?

Friday, 11 September 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £177.75/t, gaining £3.35/t on Wednesday’s close.

- Paris milling wheat futures (Dec-20) closed yesterday at €189.75/t gaining €1.00/t in a trading session.

- Political discourse and trade negotiations between the UK and the EU are influencing currency, which is driving our domestic grain market, due to a weakening sterling.

- Closing yesterday at £1 = €1.0835, sterling has weakened by 3.4% against the Euro since last Friday’s close.

- The fourth AHDB harvest report is now out. An estimated 400kHa of total crop area was cut in the last two weeks of August. With total hectares harvested standing at 2.8Mha.

Have you thought about your marketing strategy for 2021/22?

In this article I want to discuss what the future could potentially hold for markets of wheat, barley and oilseed rape.

Analysis from our Farm Economics team has put figures on cost of production for the 2020 harvest. Lower yields are predicted to push up unit costs of production for 2020.

By knowing your cost of production this can feed into marketing decisions which can in some cases maximise margins and others minimise losses.

Domestic planting intentions will formulate change the sentiment of the 2021/22 marketing year. With planting commencing in the coming weeks, have you considered your end market and cost of production?

Wheat

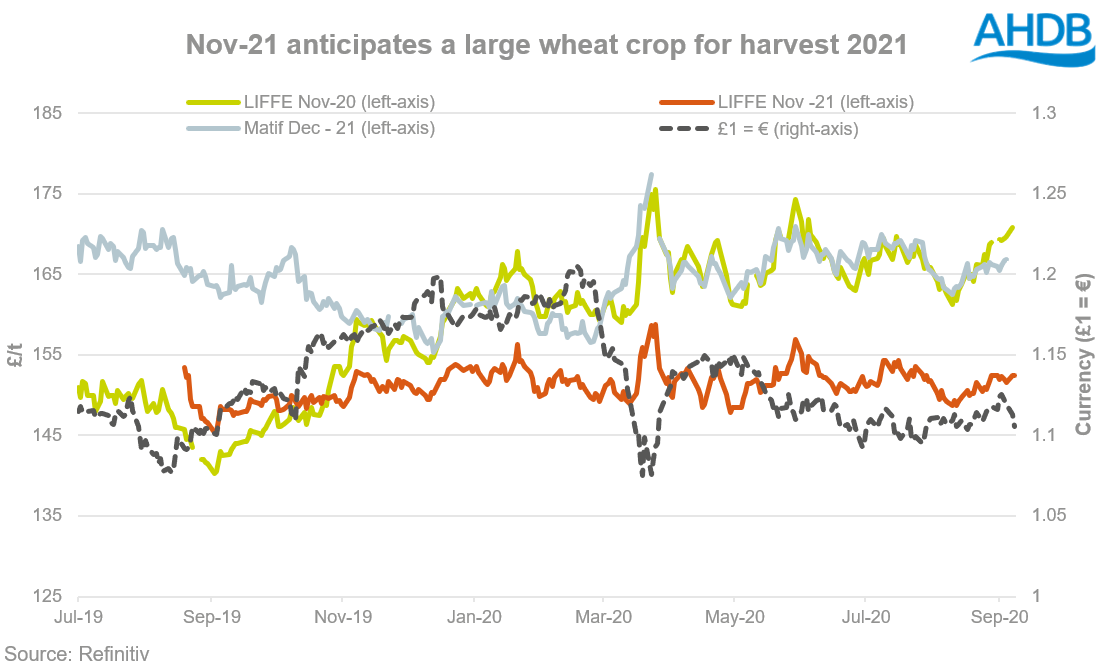

If good weather allows, we are expecting a resurgence in wheat area for 2021 harvest. Therefore, if we are expecting a typical weather year, we should be grain secure (with the exception of imports of high protein wheat) with the possibility of an exportable surplus.

In the graph above we can already see that Nov-21 has factored in a return of the UK’s production, and is trading at a discount of around £15.00/t to Matif (Dec-21).

If you take the average cost of production between 2018-2020, it stands at £144.00/t for winter wheat.

With Nov-21 futures currently trading at c.152.00/t means that wheat is currently trading at a break-even to a small profit if we take the average cost of production figures.

What is key to note is that if the continent sees a large resurgence in wheat planting that will pressure Matif which in-turn will pressure our domestic market, if we maintain that discount to Matif (unless domestic planting is compromised).

Barley

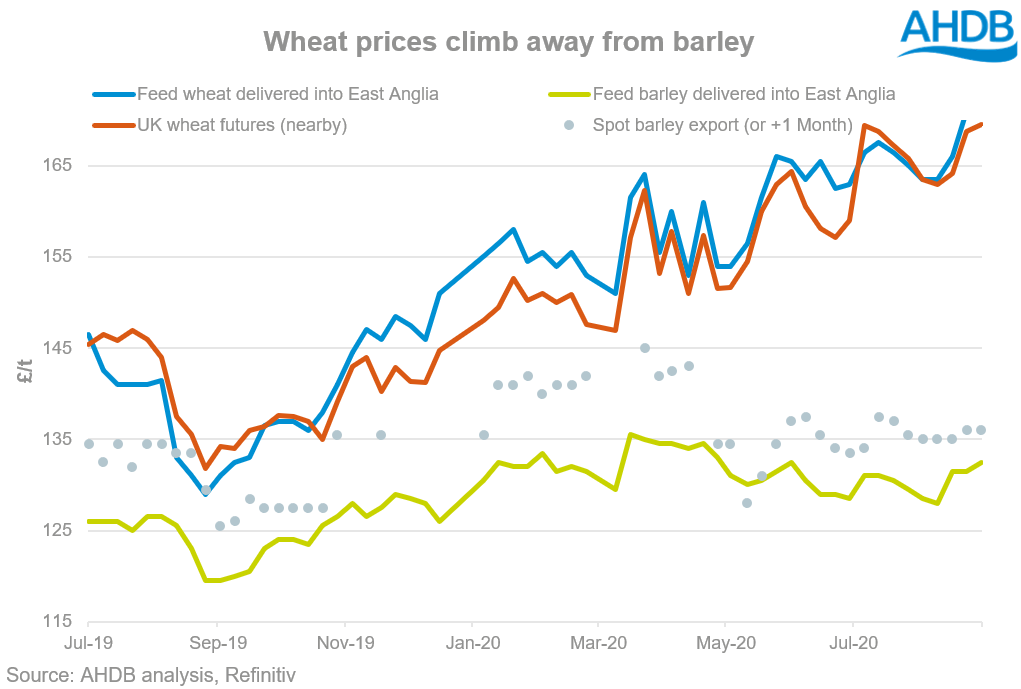

Support in wheat markets combined with large back to back production of barley in 2019 and 2020 has caused barley to trade at a substantial discount to wheat.

At the start of the 2019/20 marketing year between August and October the average discount of domestic delivered barley in comparison to wheat was c.10%, but since November 2019 that average has grown to 17%.

If we take the average full economic cost of production for spring barley from 2018 – 2020 the figures this stands at £163.00/t, which is significantly above the ex-farm price at the moment.

With an increase in wheat production due to trend yields and more favourable gross margins, as James’ analysis showed yesterday I would anticipate that the current 17% discount to wheat will narrow as we head into the 2021/22 marketing year, partly from the price of wheat reducing but then at the same time barley production reducing as growers switch back to wheat.

However, even without stocks reducing, barley will always trade at a healthy discount to wheat, to maintain competitiveness, and they will never be the same price due to calorific specification of the grain.

Nov-21 wheat futures currently around £152.00/t, even at a 10% discount delivered barley will be at c.£137.00/t.

Another pointer to consider within the export market is the current trade negotiations with the EU are not posing significantly optimism for a market in the EU post-December.

Therefore drying barley for third country export may be the only option if the UK is only granted a 300Kt Tariff free quota to EU markets.

Rapeseed

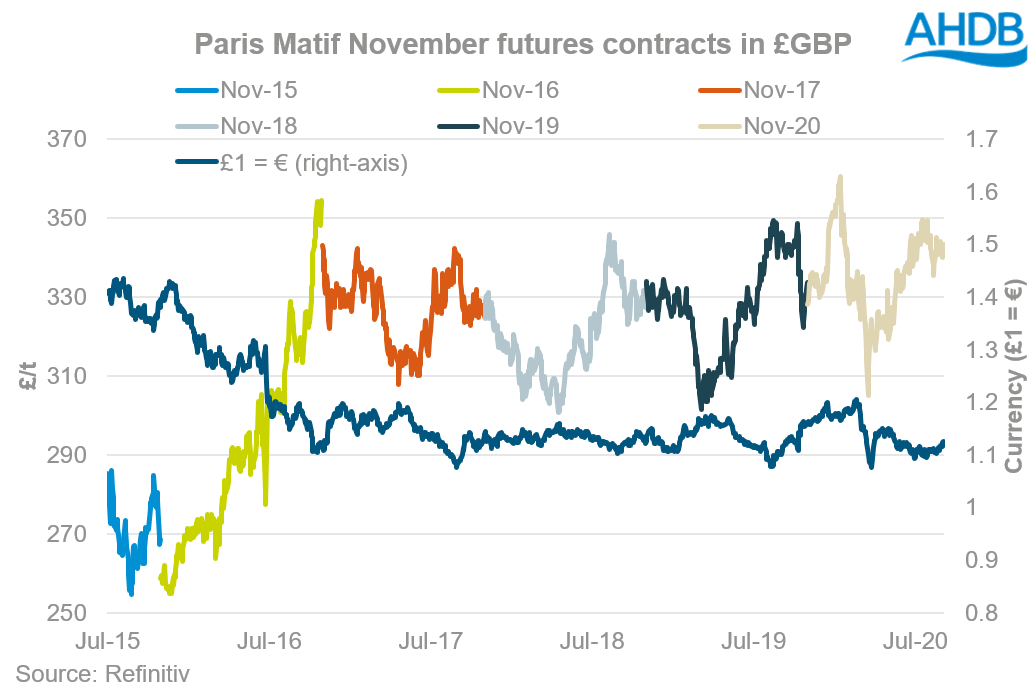

With rapeseed pricing off continental futures contracts, the strength or weakness of the Sterling will have a degree of impact in our domestic rapeseed prices.

Since the UK voted to leave the European Union in 2016, much of the domestic rapeseed price has been significantly supported due to the weakening of the Sterling against the Euro.

The full economic cost of producing rapeseed has had a large degree volatility due to adverse pest pressure. For 2020 this cost has increased to £372.00/t, much of this increase has come from the loss in yield.

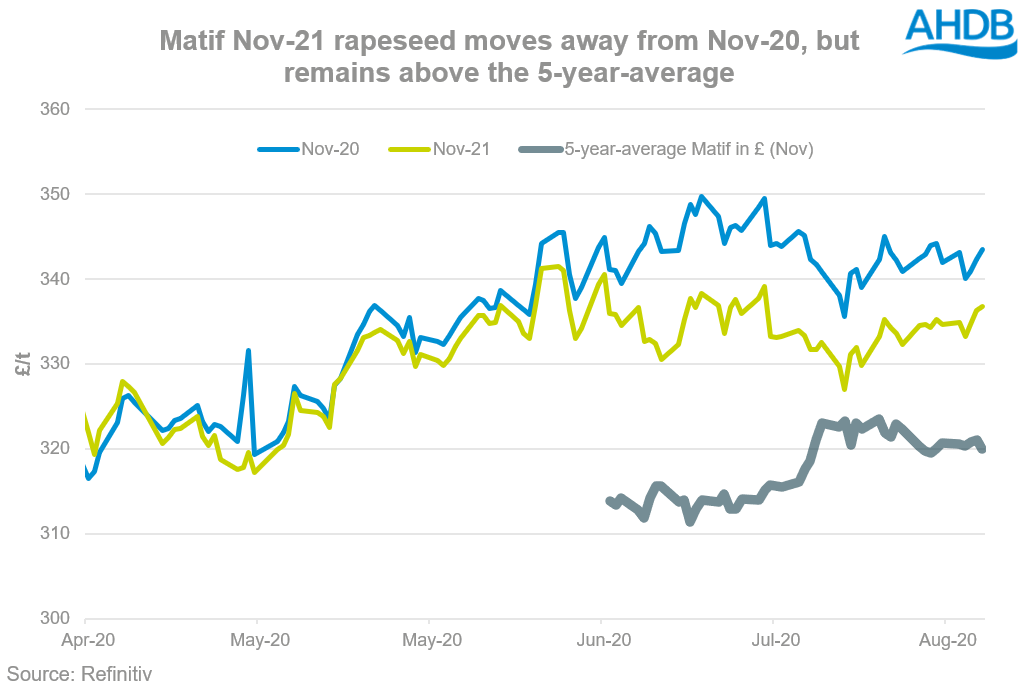

We are expecting the area for 2021 to reduce again year-on-year, as many growers turn to alternative break crops.

However, although we are anticipating a reduced crop for 2021 the 2021/22 domestic market may not be significantly supported.

In the graph above we can see Nov-21 move away from Nov-20 rapeseed prices. But what is critical to note is that these contracts are still trading above the 5-year-average, as the EU’s harvest has not been as large as anticipated. This will increase imports from the Ukraine, Australia, and Canada. To gain further prospective of OSR be sure to read; support or pressure for rapeseed in 2020/21 marketing year?

Conclusion

In the coming weeks when planting for 2021 harvest consider the end market of your crop. Does the value of your end market exceed your budgeted cost of production at current prices?

What might seem like an inflated market at the moment, may possibly be pressured once it comes to selling your grain.

Further to that, global weather, politics, supply and demand will bare weight on the market which will inherently filter down to your ex-farm price. Be sure to sign up to our outputs as we start this marketing year and give further analysis and scope.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.