Support or pressure for rapeseed in 2020/21 marketing year? Grain Market Daily

Thursday, 23 July 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £167.55/t, gaining £0.55/t on Tuesday’s close. Furthermore, Paris milling wheat futures (Dec-20) also gained €0.25/t to close at €185.00/t.

- Chicago wheat futures (Dec-20) gained $2.20/t, to close at $198.30/t yesterday. Gains in paris and UK wheat futures were limited compared to those in Chicago with sterling and the euro strengthening against the dollar.

- The UK is due to formally leave the EU at the end of 2020. Speaking today after the latest round of Brexit negotiations Michel Barnier has highlighted that the UKs position on key issue makes a trade deal “unlikely”.

Support or pressure for rapeseed in 2020/21 marketing year?

This analysis will unpick how rapeseed could be priced going forward by:

- Showing how globally the stocks-to-use ratio of rapeseed is reducing going into the 2020/21 marketing year, which inherently should support prices.

- I will then look at previous pricing of the Paris rapeseed futures contract and how it is supported or pressured in the second half of the season.

- I will then discuss imports from the EU, and the coloration between pricing and where the EU sources imports from.

We have seen support for the vegetable oil complex over the last few weeks which in-turn has supported rapeseed prices. This has been in part driven by reviving crude oil markets as the cogs of capitalism start to turn once again.

I believe a significant degree of sustained recovery in the vegetable oil complex will be dependent on the ability of the global economy to continue recovering from COVID-19.

This recent support for rapeseed could pose a short-term opportunity, as there are potential risks to longer-term pricing that we need to consider.

Decreased stock-to-use, could it offer support?

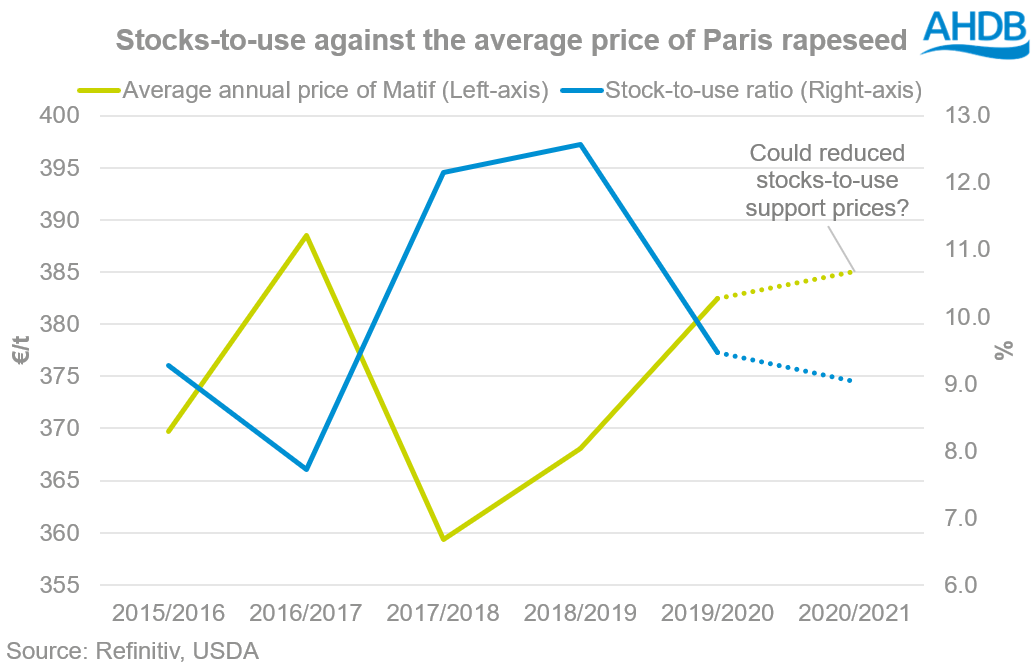

Looking at the bigger global picture now, as we start 2020/21 the USDA forecast a decrease in the stock-to-use ratio of rapeseed.

This inherently means that supplies of OSR are getting tighter as we progress through the marketing year.

It is important to note that oilseed use, to some degree can be interchangeable, and commodities within this complex can change depending on price.

Analysis of previous pricing to gain prospective

With declining stocks globally, in theory we should see some support for rapeseed, to a point, as we progress throughout this marketing year.

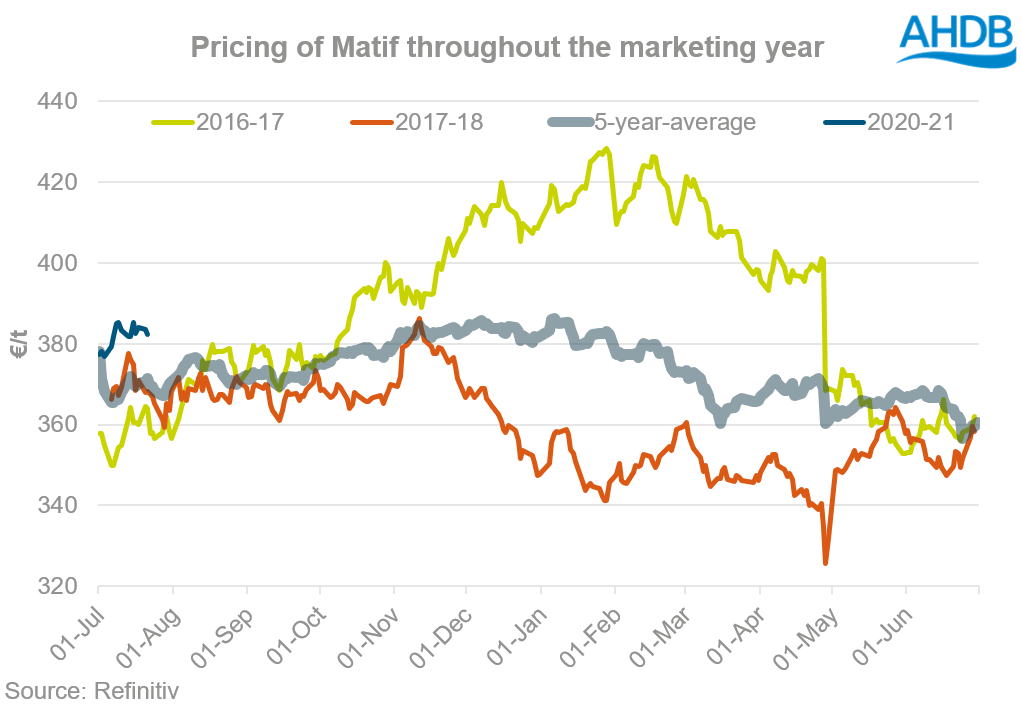

Looking historically at nearby rapeseed futures in euro terms, we see a relatively stable price in the first half of the marketing year. This is due to a relatively well supplied Northern hemisphere, with close by supplies.

But come the second half of the year prices can converge or diverge depending on the supply and demand of the oilseed and the potential origin of EU imports.

Plotted in the graph above are the extreme high and low of futures (in the last 5 years) moving away from the 5-year-average into the second half of the marketing year.

What is going to happen in the second half of this marketing year?

This marketing year will pose a different challenge as there is relatively subdued demand for biofuels at the moment, but we are slowly seeing that come back online.

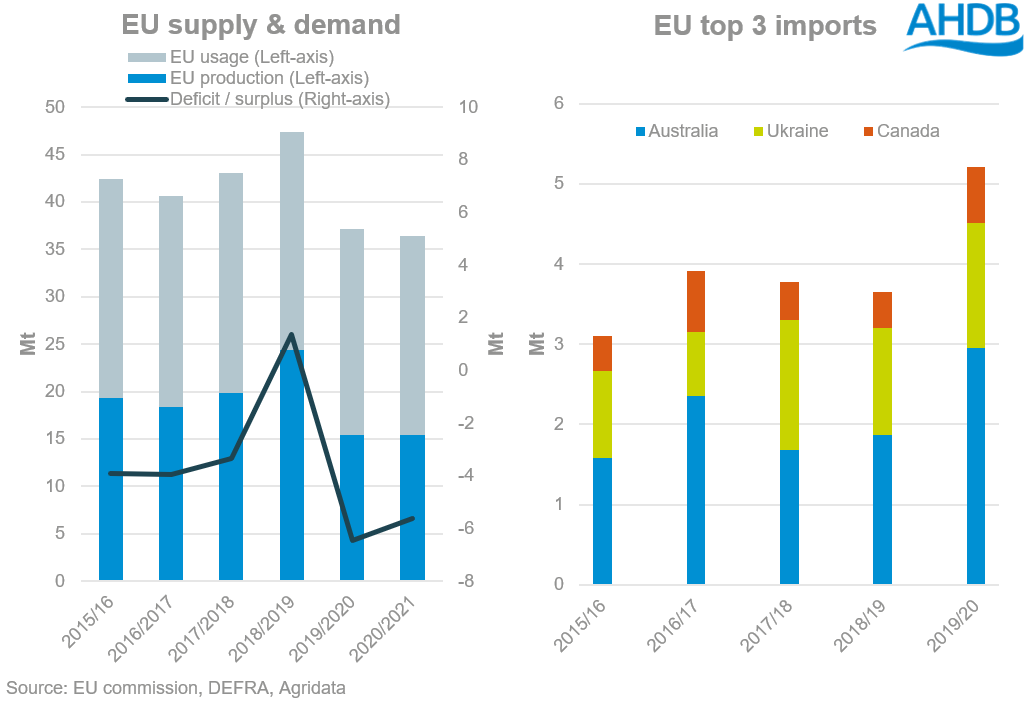

The EU in general is usually in a rapeseed deficit, as their usage will exceed their demand.

For the first half of the season, continental supplies are utilised, and into the second half of the season the EU will need to import from third countries such as the Ukraine, Australia, and Canada or alternatively import other oilseeds or bio-diesel.

In the graph above we can see the top three origins of rapeseed imports into the EU in the last 5 years. Origins of rapeseed can have an impact on the continental price of EU rapeseed as we enter the second half of the marketing year.

Referring back to the first graph where we can see the two extremes of prices in 2016/17 and 2017/18 against the 5-year-average.

In 2016/17 we can see how the EU imports over 3.1Mt from Australia and Canada, but a small amount, 800Kt, from the Ukraine. Prices had to move to a higher level in order to attract Australian and Canadian seed.

But, in 2017/18 prices were depressed, with its combined imports from Australia and Canada just under 2.1Mt, and imports from the Ukraine at nearly 1.7Mt.

Therefore, where the EU imports of rapeseed come from for the second half of the marketing year will affect continental pricing.

Conclusion

Under normal conditions we would see elevated prices through the second half of the season in order to attract imports of rapeseed.

However, as we enter 2020/21 there are many unknowns for the demand for rapeseed, as a large proportion is utilised in the energy sectors. This will remain an important swing factor for prices, with the pace of recovery in the global economy also a key watch point.

If significant supplies are required for the 2020/21 marketing year, we could see rapeseed futures maintain support amongst the oilseed complex. Furthermore, there are current questions over how large the Ukrainian crop could be, but the EU will import a significant proportion.

From there Australian or Canadian supplies will be utilised and they are currently forecast to be well supplied, but weather will be a key watch point.

Finally, it is also important to consider the relative supply and demand of other oilseeds, with global stocks-to-use of 7 major oilseeds set to grow this season (www.oilworld.biz).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.