Are further rises in rapeseed price sustainable? Grain Market Daily

Tuesday, 21 July 2020

Market Commentary

- UK feed wheat futures (Nov-20) closed at £166.50/t, a fall of £2.25/t. UK markets continue to track the global sentiment, with Paris milling wheat futures (Dec-20) closing yesterday at €183.50/t, €2.75/t lower on the day.

- Concerns in the past week have built for dry and warm weather in the US Corn Belt during the silking phase. However, the latest US crop condition report shows the percent of the crop rated “good” or “excellent” stable on the week. As a result US corn futures (Dec-20) have opened the week lower.

- Rapeseed futures (Nov-20) ended yesterday up €0.75/t on Friday’s close at €383.50/t.

Are further rises in rapeseed price sustainable?

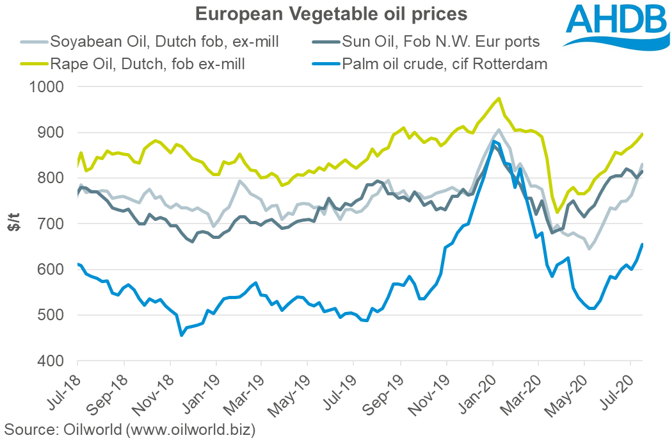

Paris rapeseed futures (Nov-20) have shown mixed fortunes of late, with gains made through to the middle of last week minimised by Friday’s close. However, the vegetable oil market has seen some significant support of late, and this could offer short-term support to rapeseed values.

One of the key drivers of rapeseed prices is the value of vegetable oils. The most recent data from the Oilworld publication (www.oilworld.biz) suggests that the contribution to the crush margin is currently 73% in favour of oil, over meal at 27%. This is similar to values seen in January and suggest that rises in the value of oil are having an increasingly strong influence over the value of rapeseed prices.

Vegetable oils have seen some significant support over the past week. Nearby soyabean oil futures are up $43.21/t (7.0%) (Refinitiv), Friday-Friday. The support for soyabean oil follows increased demand for soyabeans from China.

Equally, strong support for vegetable oils has been seen in Malaysian palm oil futures. In yesterday’s weekly market report we highlighted the report by the Malaysian Palm Oil Association, stating that annual production estimates could be missed by 10-25%, due to coronavirus related labour shortages. As a result, nearby Malaysian Palm oil futures have gained 11.0% Monday-Monday.

Vegetable oil markets, including rapeseed oil, have been on a steady uptrend since the onset of widespread coronavirus lockdown measures. However, the ability of recent rises to extend further or be sustained is an important point to consider.

Global stocks of major oilseeds are expected to grow this season, so too are stocks of vegetable oils. This will likely cap the gains which can be made in the oilseed and vegetable oil markets.

From an EU and UK perspective, rapeseed prices will remain firm relative to other origins and other oilseeds to attract imports. But, the value of substitutable seeds, oils and imports of biodiesel will need watching closely throughout the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.