Analyst Insight: Lower yields predicted to push up unit costs of production

Friday, 11 September 2020

Lower yields mean that costs per tonne will be higher for spring barley, winter wheat and oilseed rape (OSR) despite some lower input costs in the last 12 months.

Prices for some inputs, most notably fertiliser and fuel, will have contributed to lower overall costs for the 2020 harvested crops. However, any savings that might have been seen will be outweighed by the lower yields reported for 2020 harvest - leading to higher costs per tonne.

This will influence and can feed into marketing decisions to help either maximise margins or minimise losses in the months to come.

The analysis

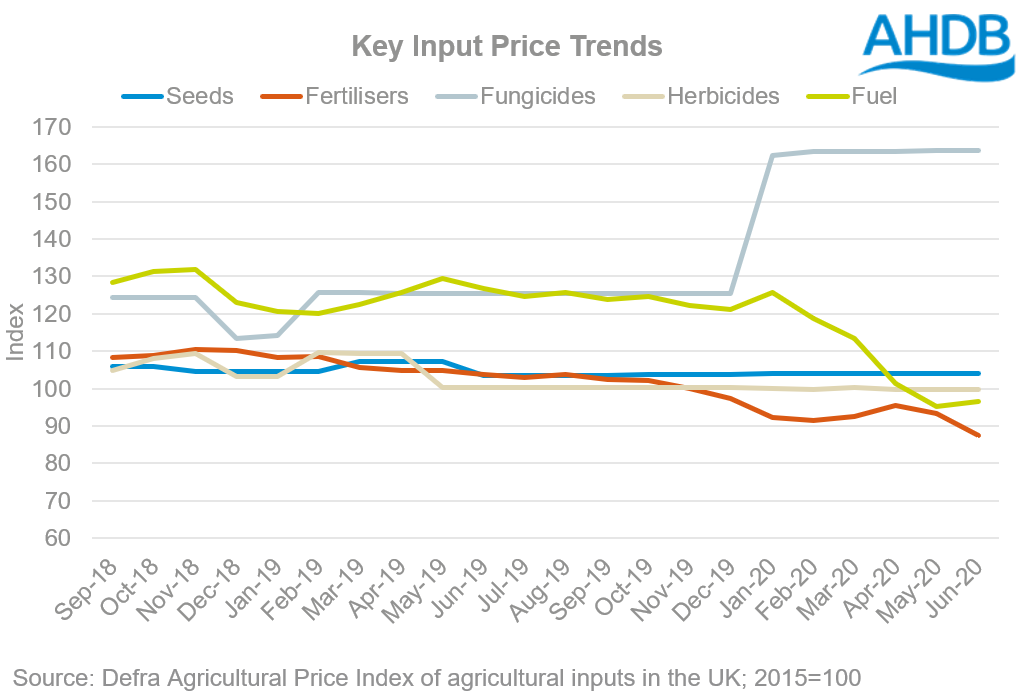

Over the last 12 months, some key input costs have changed relatively little while others have shifted significantly. For example, the loss of some of the cheaper fungicide products from the market has left the more expensive products available. In contrast, fertiliser prices have been falling since autumn 2019. Nitrate prices dropped as there was weaker demand for the product and lower production costs due to gas prices being lower than last year. Similarly, fuel prices also took a dive in 2020 with reduced demand due to the COVID-19 pandemic driving down crude oil prices and so red diesel costs.

The individual business impact of these costs will, of course, be affected by exactly when and how the inputs were purchased and used. But, on average, it is predicted for 2020 that the total cost of production for the three crops will have been lower on a per hectare basis.

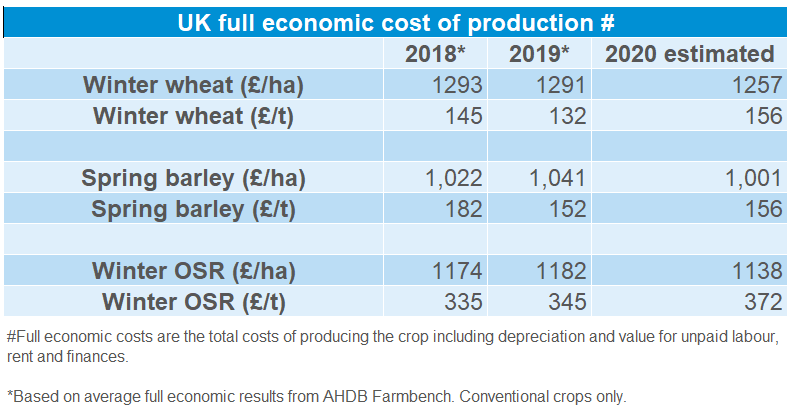

For winter wheat, costs per hectare are estimated to have fallen 3% on average due to the reduction in the key input costs. Both spring barley and winter OSR are predicted to have seen a 4% drop in total costs of production per hectare.

However, average 2020 yields are being reported as significantly lower than in 2019. Wheat could end up being around 18% lower. With spring barley and winter OSR reporting yields 6% and 11% down year-on-year respectively.

When these provisional yields are factored into the equation, the cost per tonne to produce winter wheat in 2020 is estimated at £156/t, around 19% up on 2019. Despite estimated spring barley costs per tonne looking 3% higher than last year (2019) they are still predicted to be lower than in 2018. On the other hand, with average OSR yields declining over the last 3 years, the cost per tonne is predicted to continue to increase in 2020 by around 8% on 2019.

In conclusion

For many growers, it has been a difficult growing season and it was hoped that lower input costs would provide some relief to margins. However, the news that many are reporting significantly lower yields, particularly with winter wheat and OSR means that unit costs of production will increase.

Knowing the unit cost of production can help with ensuring when taking decisions around marketing the crop, so that margins can be maximised or losses minimised. Growers are encouraged to calculate their own unit cost of production for their crop using tools such as Farmbench from AHDB. This will leave growers better informed when planning their marketing strategy no matter what the season.

About the figures

- 2018 and 2019 figures derived from weighted average AHDB Farmbench data: ahdb.org.uk/Farmbench

- Figures used are conventional winter wheat, OSR and spring barley excluding any seed or hybrid variety crops.

- Farmbench data based on over 898 spring barley, 1,453 winter wheat and 492 winter OSR separate crop enterprise results.

- Estimated 2020 figures are based on Farmbench 2019 results and Defra Agricultural Price Index of agricultural inputs in the UK.

- The costs do not include a scenario where the crop may have been re-drilled. If this occurred this will need to be factored into the costs presented.

- Full economic means they include all non-cash costs to the business. These are the costs you can’t see going out of your bank account – machinery and buildings depreciation, unpaid labour and the rental value of owned land.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.