Has Europe faced the same OSR challenges as the UK? Analyst insight

Thursday, 30 October 2025

Market commentary

- UK feed wheat futures (Nov-25) closed down £2.60/t (1.6%) yesterday finishing at £161.45/t. However, May-26 futures closed at £177.95/t, down just £0.10/t (0.1%) on the day

- The US Federal Reserve cut US interest rates by 25 basis points yesterday. However, the dollar did not move downwards as analysts expected most likely due to optimism around US-China relations. The cut therefore, has not supported US and so UK grain prices

- Paris rapeseed futures (May-26) gained €1.75/t (0.4%) closing at €479.00/t. Winnipeg canola (rapeseed) futures (May-26) gained 0.2%, while US soya beans futures (May-26) lost 0.1% on the day

- Ukrainian oilseeds production has been hit by poor weather throughout harvest and drier weather earlier in the year. The sunflower seed harvest is expected to fall from last years 12.0 Mt to 10.5 Mt according to the vegetable oil producers’ union. Additionally, the soya bean crop is expected to fall by 21% from 2024 levels to 5.2 Mt this year. Plus, rapeseed output is expected at 3.3 Mt, down 0.3 Mt (8.3%) from 2024’s level

- Talks between the US and China held this morning appear to have gone well. The US president declared that Beijing would buy ‘tremendous amounts’ of soya beans (LSEG), but more details are needed for any certainty

- Chinese officials also met with the Canadian agricultural minister to discuss developing food and agriculture trade. This comes after China imposed an anti-dumping tariff on Canadian rapeseed in August 2025 and will be a key watch points over the next few weeks

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Key Points

- Crop area fell most significantly in England

- Harvest yields declined on average across all countries

- Profit margins were low across all countries

This analysis explores the production and profitability of oilseed rape (OSR) in the UK compared to a selection of EU countries; Germany, France, and Poland. As some of the largest producers of OSR in the EU, and countries benchmarking data through agri benchmark, we can make comparisons to the UK results to see the impact this has had on production up to 2024.

Each year, AHDB submits data representing a range of ‘typical’ UK farms into the agri benchmark international benchmark database. This enables us to compare and analyse how, on average, UK production of key cash crops compares to the main producers and competitors around the world.

Yield

Yield is very variable year-to-year in OSR, due to weather and pest susceptibility. Pressure has increased in the UK since the 2018 total ban on neonicotinoids, leaving farmers few options to reduce the effect of pests, especially Cabbage Stem Flea Beetle (CSFB), in OSR crops.

Average yields have fallen in the UK since the ban, by 0.63 t/ha on average when comparing the average of harvests 2014–2018 with 2019–2024. Germany has also experienced yield pressure, with extreme weather conditions an additional cause to yield losses of 0.38t/ha on average.

While Poland saw yields increase by 0.19 t/ha over the same period, anecdotal reports suggest this is due to poor weather conditions in 2016–2019, and much more favourable rainfall and temperatures between 2020–2024. While pressure has started to increase from CSFB, this is a relatively new issue for Polish farms in comparison to countries in western Europe, such as France and Germany.

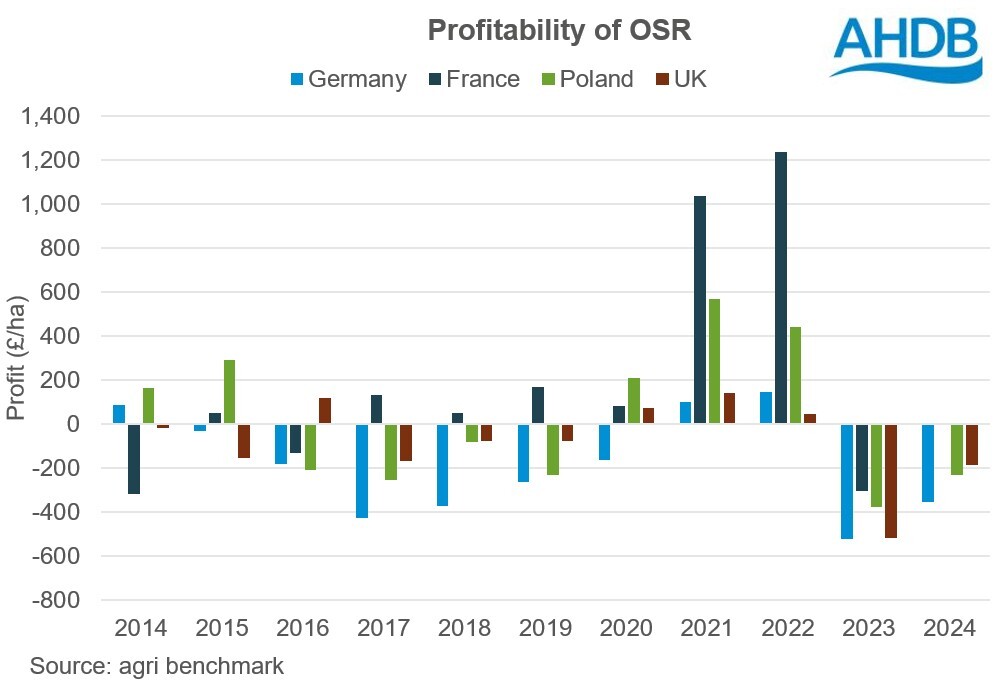

Profitability

As with yield, profitability of OSR was variable between 2014–2024 across the countries in this article. In general profitability was highest between 2020-2022, which corresponds to the years when markets were strongest. This is potentially linked to low European planting areas in 2019 and then the start of the conflict in Ukraine. At the peak in 2022, prices were 163–193% of the 2014 price, so even with moderate yields all countries achieved a profit.

In contrast, 2023 and 2024 results show all countries making a loss. This is partly due to lower yields but also impacted by an average cost of production increasing by £228/ha (2014–2018 average vs 2019–2024 average). Of this increase, £98/ha related to fertiliser alone.

The UK managed to keep cost increases lower compared to the other countries considered, possibly to minimise risking inputs on OSR which has a higher chance of poor yields. On the other hand, it could be that farms with higher costs have stopped growing OSR, so increases to costs of production slowed, only up by £79/ha between these periods, which has helped minimise the impact of falling yields on profit.

Area

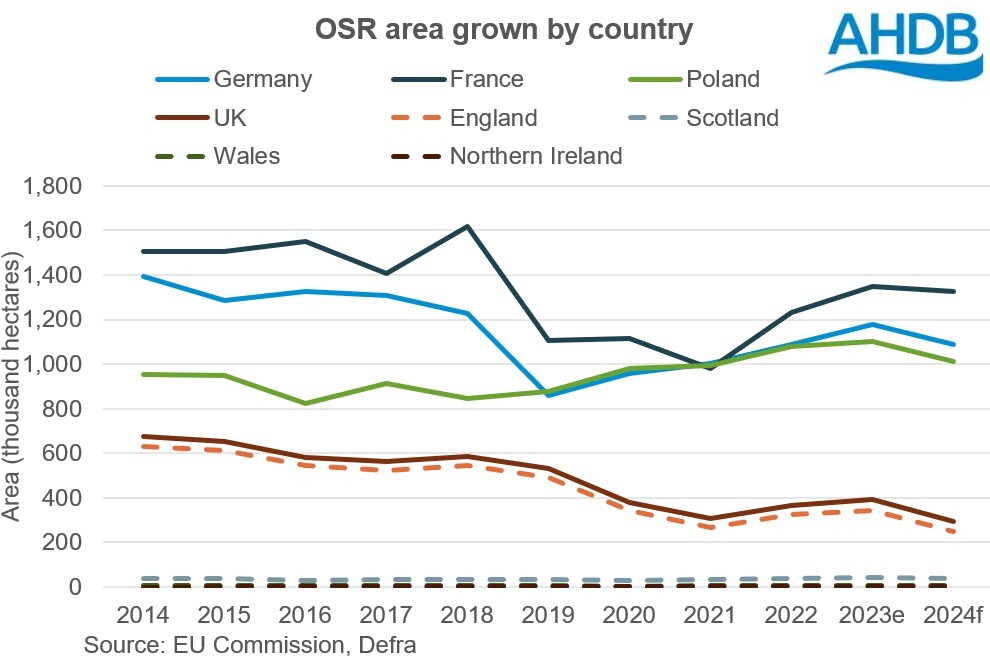

These challenges in yields and profitability have impacted the popularity of OSR on farms in the UK and EU, resulting in an 11% average decline in area from 2014–2024 (EU Commission, Defra).

The UK experienced the largest decline, of 57%. It’s generally accepted within the UK that English OSR has experienced the most challenges in production, with more significant flea beetle infestations. The production data backs this up, with the English OSR area falling by 60%, followed by a drop of 1% in Scotland. Wales and Northern Ireland saw increases in area of 11% and 62%, though this is based on small areas grown.

Some countries, such as France and Germany saw similar area declines to the UK, with a steep drop post-2018 when neonicotinoids were banned. Germany also introduced policy measures to encourage farmers to grow pulse crops in place of some OSR which contributed to the decline, particularly in OSR dense areas. In contrast, increasing yields, relatively good profitability and low pressure from CSFB have led to an increasing area of OSR in Poland.

Decisions made by farmers across Europe and the UK to increase OSR area in 2023 were likely supported by good market prices. Future planting decisions are likely to be impacted by market price, particularly as OSR prices compare relatively well in comparison to cereal crops, as markets currently stand.

Overall

We can see there are challenges in OSR production across the countries analysed, which impacts the area grown each year. With the rapid decline of the Basic Payment Scheme (BPS) payments in England and uncertainty around environmental schemes, it’s never been more important that farmers in the UK focus on profitability. Growing OSR is still a profitable option for some farmers, the 2024 Farmbench data shows the top 25% of performers achieved net margins of £423/ha. It is likely these growers achieved this through a combination of keeping costs under control, good marketing, and attention to detail in managing pests where possible.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.