- Home

- News

- Grain Market Daily: Are large international tenders driving wheat prices gains set to continue?

Grain Market Daily: Are large international tenders driving wheat prices gains set to continue?

Friday, 23 October 2020

Market Commentary

- Both the Nov-20 and May-21 wheat contracts eased back yesterday to close at £187.60/t and £189.10/t, respectively. Notably the May-21 contract lost any momentum gained mid-week to only gain just £0.65/t from Monday’s close.

- 2020/21 Chinese maize purchasing is set to continue as the government is expected to issue more quotas to meet animal feed demand in the wake of tighter domestic supplies. Imports of 12Mt of US corn have already been booked under already approved quotas.

- Chicago soyabean futures dipped yesterday to close at $394.54/t after hitting their highest point since July 2016, at $398.76/t. The latest rise follows private export sales of 152Kt to Mexico and 132Kt to unknown. So far in 2020/21 the US have committed 45.35Mt of soyabeans for export, 76% of the USDA’s full year forecast (Sept-Aug).

- Buenos Aires Grain Exchange have cut their latest estimate for the Argentinian wheat harvest in 2020/21, down 700Kt to 16.8Mt, due to dry weather.

Are large international tenders driving wheat prices gains set to continue?

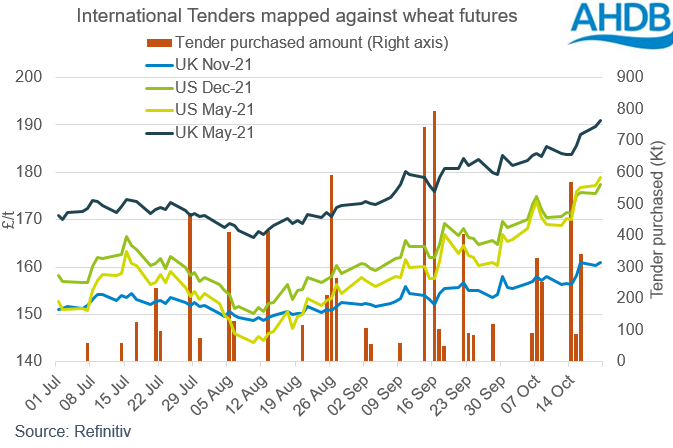

Over recent weeks and months, global wheat prices have gained momentum and UK wheat futures have risen as a result. One of the key drivers of this has been the high volume of large international grain tenders over the past few months, but will this continue?

In anticipation that Covid-19 could cause severe port disruption and disarray on global trade links, it is evident nations are increasing purchasing to boost wheat reserves and ensure food security. This is adding to supply concerns with dryness issues in a number of key regions for 2021/22 production.

Who are issuing the big tenders, and will this continue?

Egypt

Egypt are the biggest importer of wheat globally, and it is no surprise they issued a large volume tenders over the past few months. Egyptian state grain buyer GASC purchased of 2.4Mt of wheat between July and August, 18% of the USDA forecast for full season imports (13Mt), although private imports will have also taken place.

In the first two months of 2020/21 alone GASC raised purchases by almost 40 percent year-on-year, in order to maintain at least 6 months of strategic reserves of essential goods. There seems to be no slowing of Egypt’s import demand with tenders issued for Dec 1-10 and Dec 11-20.

Algeria

Algeria are also providing large price support, importing 1.7Mt of wheat from the start of July. September saw the contracting economy’s government reduce consumption subsidies on common and durum wheat. Alongside this, tender specifications for milling wheat were relaxed to allow imports of Black Sea grain and increase competition.

Calls have been made by Russia for further relaxation of specifications on bug damage. If relaxed we may see further competition with France for future Algerian tenders, potentially capping EU wheat values.

Pakistan

As a result of Covid-19, flour shortages were seen in Pakistan, causing exponential price rises for both flour and bread. Subsequently, Pakistan has had to shift from its traditional position as a net-exporter to importing a high volume of wheat this season.

From July onwards, the government has tendered for imports of 880Kt of wheat, 59% of the USDA’s 2020/21 projection.

From importing only 1Kt in 2019/2020, Pakistan import projections are 1500 times larger than last year, at 1.5Mt.

Turkey

Turkey are also relying on international wheat tenders to suppress rising local wheat prices and to feed their flour export programme, although forecast imports are 35% lower year-on-year at 7Mt. To date, Turkey have only tendered for 11% of their projected 2020/21 imports.

Taiwan

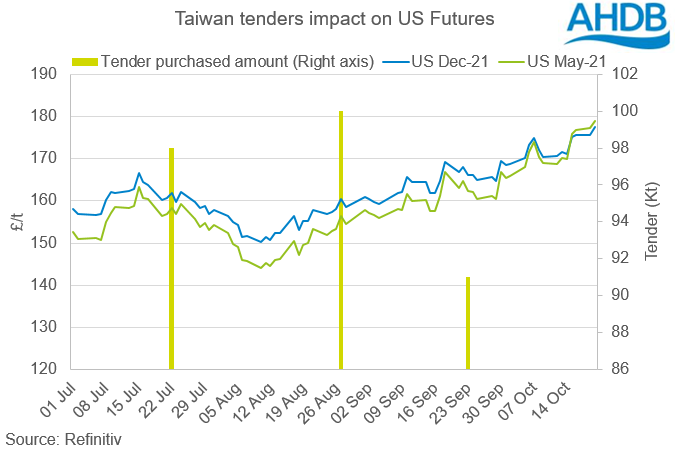

Taiwan’s imports totalled 289Kt between July and September, 21% of the USDA’s forecast of annual imports. A further 89Kt of US origin wheat was purchased today.

With increased political tensions in the region and food reserves being accumulated, future tenders for US wheat could be seen in the coming months, offering further support to US prices specifically.

Conclusion

There is no evidence to suggest these international tenders are due to ease in coming months, with nations looking to build food reserves and depress rising domestic prices. Alongside this, ongoing supply concerns over Black Sea and US dryness for 2021/22 production continues to support prices.

However, should imports only continue in line with expectations support for prices in the longer term may be limited.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.