UK wheat futures enjoying global price rally: Grain Market Daily

Wednesday, 21 October 2020

Market Commentary

- Chicago maize futures (Dec-20) closed at their highest point since August 2019 following crop risks in South America and continued strong levels of demand. Managed money net-longs in Chicago maize extended to 10.8% as of 13 Oct.

- The USDA reported a flash sale of 132.0Kt of soyabeans to ‘unknown’ destinations yesterday, marking the sixth consecutive day of ‘flash sales’ of either maize or soyabeans reported by the USDA.

- Ukrainian wheat exports have totalled 9.94Mt so far this season according to the country’s economic minister, this is 56.8% of the agreed wheat export quota set in place for this season. Ukrainian milling wheat export prices (FoB) hit a 21-month high of $255.0/t yesterday.

UK wheat futures enjoying global rally.

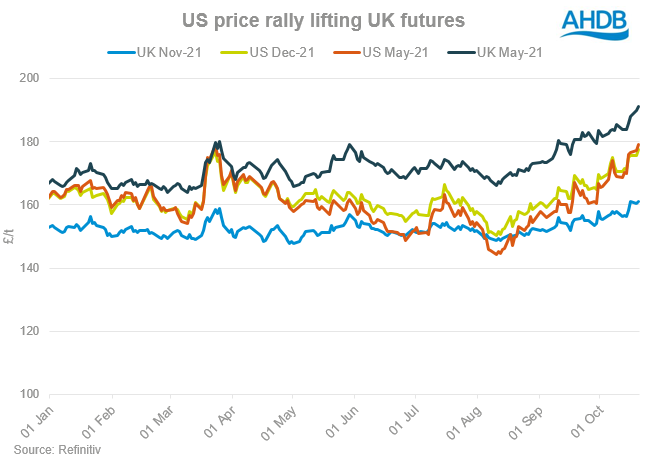

We took an in-depth look at global wheat markets in our Grain Market Outlook conference last week. Within this was the ongoing price rally in wheat markets, which has developed in recent weeks amidst dry soil conditions across big wheat producers and exporters. A frequent run of international wheat tenders from importing countries has lent support too. My colleague Helen examined these dryness concerns across the US plains yesterday.

This price rally has supported a rise in domestic wheat prices with the UK May-21 futures contract up £10.75/t since 10 September, the point when the contract broke above its previous high for 2020 set in March. Yesterday the contract closed above the £190.00/t price point for the first time. This pushed the contract above relative strength index (RSI) channels indicating we may see a pause or change in current price trends.

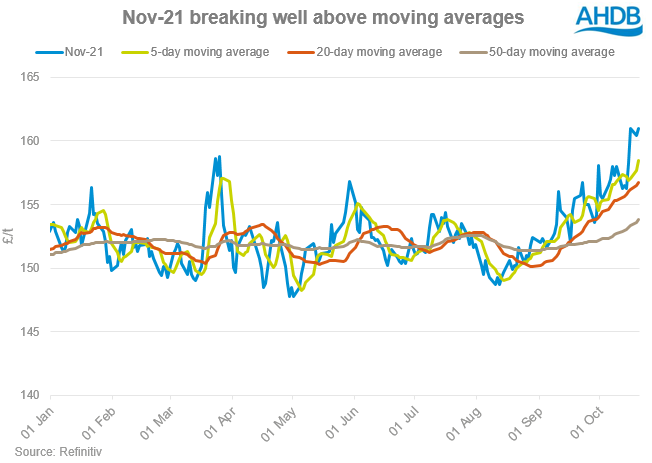

New-crop UK futures (Nov-21) have benefited too from this price rally, up £5.25/t since the start of October to close yesterday at £161.00/t, breaching the £160.00/t price point for the second time in five days. Whilst futures contracts continue to track this rally, it may be worth examining new-crop marketing strategies at these price points considering direct payment reductions in the years ahead.

The rally has pushed both May-21 and Nov-21 high above their specific 5, 20 and 50 day rolling averages.

Typically wheat markets would see pressure from maize markets. However, with US maize enjoying large Chinese purchases and crop risks for Ukraine and South America too, sentiment remains bullish for the grains.

Rainfall events in these regions over the next few weeks would partially ease concerns, with greater focus now placed on the US spring wheat planting campaign in a few months’ time. Uncertainty risks also arise from an economic perspective, with Brexit talks ongoing over the next few weeks. The US election could likely result in volatility in the dollar value too. News in either direction will have the propensity to impact on movements in grain markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.