Global harvest pressure to continue? Grain market daily

Wednesday, 22 June 2022

Market commentary

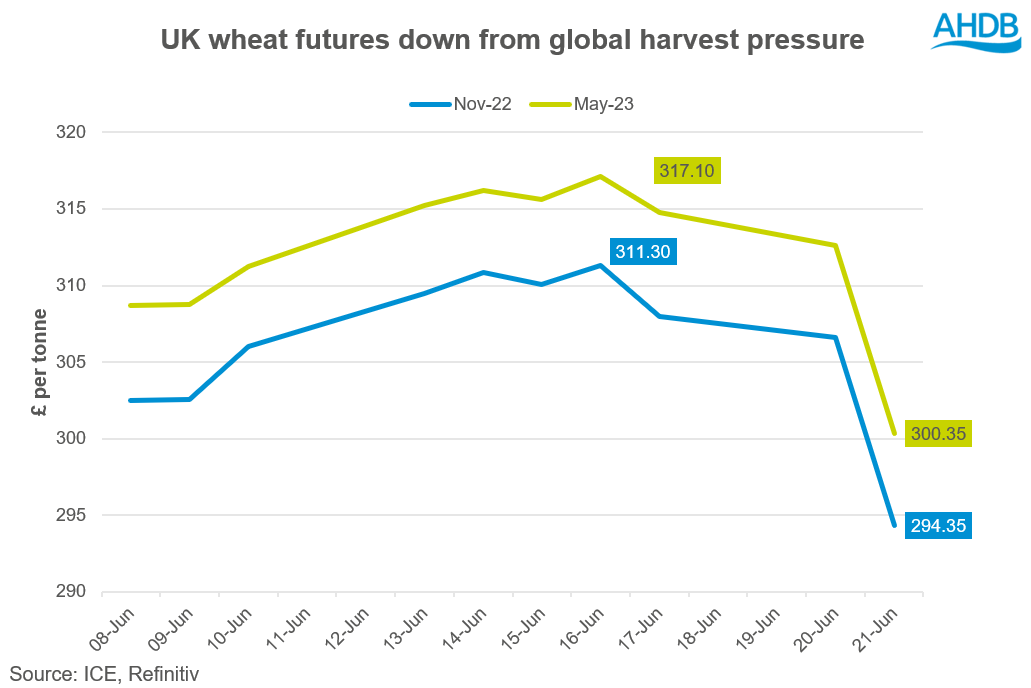

- UK feed wheat futures (Nov-22) closed yesterday at £294.35/t, down £12.25/t on Monday’s close. The May-23 contract declined by the same amount, closing yesterday at £300.35/t. Nov-23 was back £8.95/t on Monday’s close, closing yesterday’s session at £259.40/t

- Domestic prices were down across the day following the trajectory of both the Chicago and Paris markets. On-going Northern Hemisphere pressure is cited to be causing pressure on global wheat markets, with favourable weather allowing progress. Read more below for further insight.

- Paris rapeseed futures (Nov-22) closed yesterday at €718.50/t, down €18.75/t on Monday’s close.

Global harvest pressure to continue?

Huge volatility continues in global grain markets and continues to filter down into domestic prices. UK wheat futures (Nov-22) have fallen in three consecutive sessions, closing at £294.35/t yesterday and down £16.95/t since last Thursday.

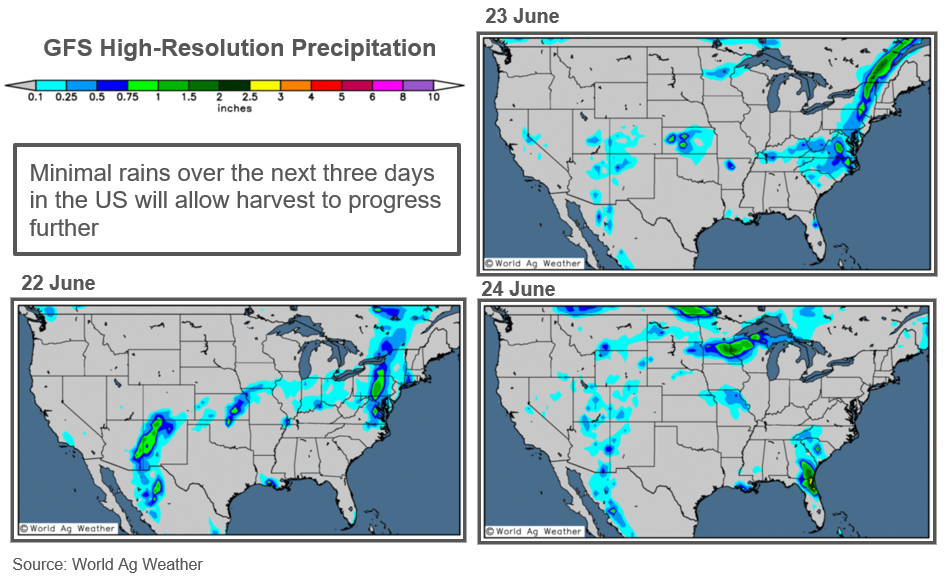

US harvest pressure, combined with a strong US dollar impacting US exports, is behind much of this price softening. The latest US crop progress report, released by the USDA yesterday, pegged winter wheat harvest progress at 25% complete, higher than the five-year-average of 22%, and last year at this point (15% complete).

Warmer weather and minimal rain forecast over the US Midwest over the next couple of days is expected to help maintain the harvest pace. However, widespread rains are expected this coming weekend.

Harvest pressure doesn’t stop there though. The EU harvest is now underway, with some southern regions in France commencing their wheat harvest, following the acceleration of the winter barley harvest due to their heatwave. However, initial yields are reportedly down, because of the spring drought. A clearer national picture will become apparent once more northern French regions begin harvesting. In addition, Russia is anticipated to start harvesting their 2022 wheat crop in the coming days. Russia agriculture consultancy SovEcon increased their estimates yesterday by 0.6Mt, now forecasting a record high of 89.2Mt. This projection sits significantly higher than the 75.2Mt estimated for 2021 harvest (USDA).

Weather in Russia will be a key watchpoint over the coming weeks as harvest progresses. First yield estimates, if significantly different to trade expectations, could impact markets if they infer substantial swings from production forecasts. We saw this last year, with last August’s World Agriculture Supply & Demand Estimate report showing a sizeable downgrade to Russian production on area and yield revisions for their 2021 crop.

Conclusion

In short, we will likely continue to see some global harvest pressure as the wheels of combines turn in the Northern Hemisphere, which will filter down into domestic prices. Of course, much of this will depend on the pace of harvest and the yield and quality of the crop being combined.

But there are many bullish factors that still underpin this market, such as the drought impacted US winter wheat crop and the European wheat yield estimates being revised down, as Millie outlined yesterday. These are in addition to the market support floor being provided by the war in Ukraine.

Unknowns around Ukrainian grain exports via the Black Sea continue to cause volatility. It has been reported that Turkish and Russian officials will meet again to discuss terms of a grain corridor from the port of Odessa to exit the Black Sea, but no agreement has been reached yet (Refinitv). Additionally, it was reported a few days ago that the EU are looking to ramp on Ukrainian exports by road, rail and river, aiming to transport Ukrainian grain via these routes to the Danube in Romania and then onto Romanian ports. This would, however, involve a revamp of Ukrainian infrastructure.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.