A bullish USDA report supports wheat & the latest GB harvest report: Grain market daily

Friday, 13 August 2021

Market commentary

- The USDA released its latest world agricultural supply and demand estimates (WASDE) yesterday evening, painting a bullish outlook for global markets.

- Due to this, UK wheat futures (Nov-21) closed at £194.85/t, gaining £5.40/t or 2.85% on Wednesday’s close. The May-22 and Nov-22 contracts gained £5.50/t and £1.15/t respectively over the same period to close at £200.00/t and 177.00/t.

- This publication is in two parts, firstly presenting the headlines of the (1) WASDE report and the latest (2) AHDB harvest progress report.

A bullish USDA report supports wheat & the latest GB harvest report

Part 1: August WASDE overview

Wheat

The global outlook for 2021/22 is for reduced supplies, lower consumption, and smaller ending stocks than last month. Ending stocks are now estimated at 279.1Mt, down 4% on last month (July) and 3% below 2020/21.

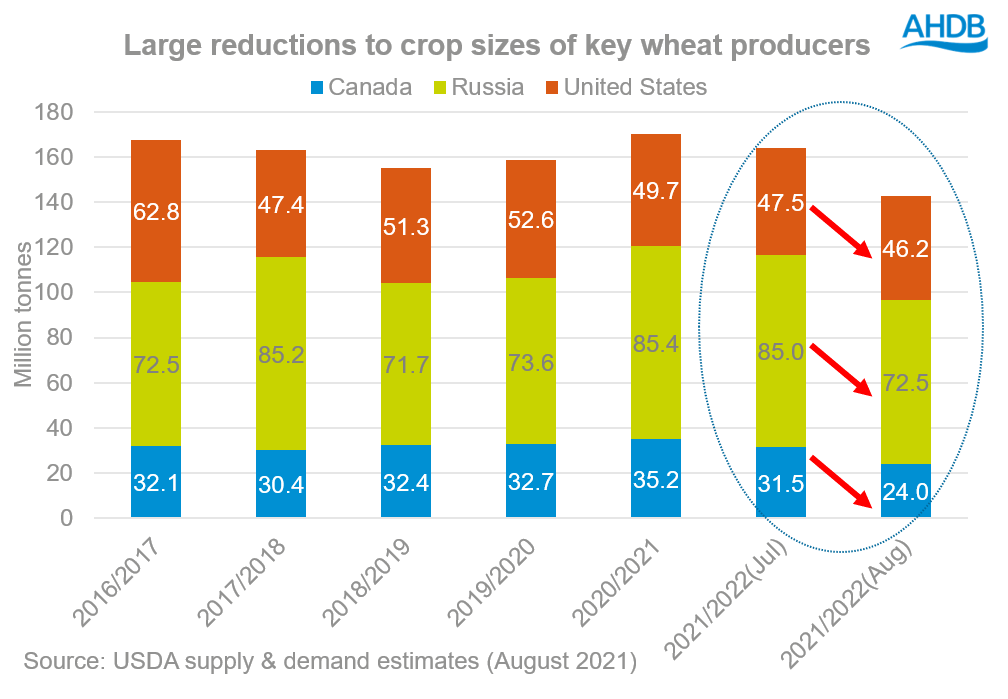

There were sharp cuts to crop sizes in key wheat growing areas such as:

- Russia (-12.5Mt). The Russian crop is drastically reduced on updated area data and lower than expected yields.

- Canada (-7.5Mt). While this reduction was expected due to the drought conditions across the Prairies, this will be the smallest wheat crop since 2010/11.

- US (-1.3Mt). There was a further reduction to the US crop due to dry weather. This is the lowest US wheat crop in 19 years.

Chicago wheat futures (Dec-21) closed up 3.37% yesterday at $280.97/t, gaining $9.37/t on Wednesday’s close.

Maize

The global outlook for 2021/22 is for reduced production, animal feed usage, and smaller ending stocks. Ending stocks are down 2% on last month at 284.6Mt.

Key changes within the August report:

- US maize production is down 10.5Mt from July at 374.7Mt. This reduction is due to dry soils in key western growing areas and cuts the potential for a bumper harvest.

- Improved production outlook in Russia (+1.1Mt) and Ukraine (+1.5Mt).

Chicago maize futures (Dec-21) closed up 2.50% yesterday at $225.69/t. This is a gain of $5.51/t on Wednesday’s close.

Soyabeans

The global outlook for 2021/22 is reduced production, but also lower crush demand. This means increased ending stocks, which are estimated up 2% on last month at 96.15Mt.

Key changes within the August report:

- US soyabean production is down 1.8Mt at 118.1Mt. However, US ending stocks are only slightly lower than last month as domestic use and exports are both reduced.

- Chinese imports are down 1.0Mt at an estimated 101.0Mt, as domestic crush is reduced by 2.0Mt.

Chicago soyabeans (Nov-21) closed yesterday at $492.68/t, gaining $0.36/t on Wednesday’s close.

Part 2: winter barley & oilseed rape yields improve as GB harvest progresses

Today, the AHDB published the second harvest report of the 2021/22 season. This report shows how harvest is progressing, plus initial indications as to yields and quality.

Despite some progression, this latest report still shows delays.

By 12 August 88% of GB winter barley has been harvested. This is a significant increase from the first report (up to 27 July), when progress was estimated at 47%. It’s reported that much of the winter barley harvest was completed during the good weather in July.

The most significant progress in this latest report is the winter oilseed rape (WOSR) harvest, which is estimated at 61% complete. This is up from the 9% reported in our first report two weeks ago.

With crops slow to ripen, harvest is delayed. Due to this, the 2021 WOSR harvest is the slowest recent harvest (2015-2020).

Localised heavy downpours and hail have caused some pod damage, affecting yields. Further to this, most WOSR harvested in the last fortnight required drying.

Small areas of oats, spring barley, and winter wheat have been harvested. But, the areas are too small to estimate yields and quality at the moment.

Improving yields for winter barley & oilseed rape

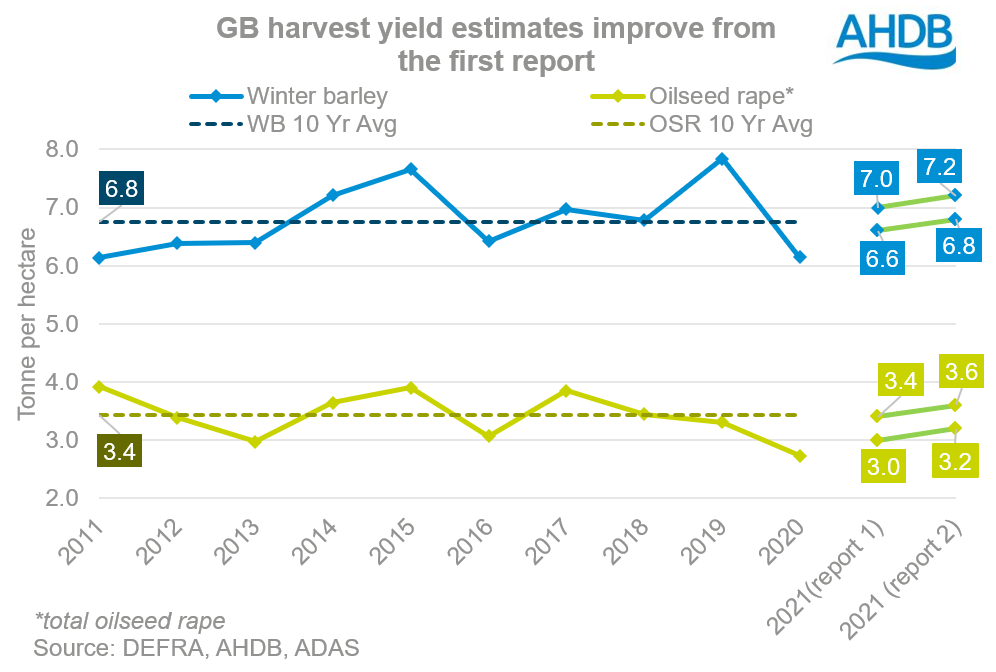

The latest report shows improved yields on both winter barley & oilseed in comparison to a fortnight ago.

For GB, yield indications show that:

- Winter oilseed rape crops harvested to 12 August are averaging 3.2 – 3.6t/ha, up on the first report (3.0 – 3.4t/ha). The mid-point is within the boundaries of the five-year average (3.3t/ha) and ten-year average (3.4t/ha).

- Winter barley crops harvested to 12 August are averaging 6.8 – 7.2t/ha. The whole range has also increased on the first report (6.6 – 7.0t/ha), with the midpoint now above the five-year average (6.8t/ha).

The latest report shows some optimism for domestic yields. However, it is critical to note that the bulk of the harvest is still to go due to unsettled weather. Improving conditions within the coming week should aid progression and allow us to have further insight into GB 2021 harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.