EU yield prospects cut to below five-year average: Grain market daily

Tuesday, 21 June 2022

Market commentary

- With harvest well underway in the US and in some parts of Europe, global grain markets closed down yesterday. Following this trend, UK feed wheat futures (Nov-22) lost £1.40/t from Fridays close, settling at £306.60/t yesterday.

- While harvest progression is adding pressure, the ever-dwindling prospects of an export corridor from Ukraine is acting as a floor for markets.

- The sixth biggest global importer of wheat, Japan, has put out a tender to buy 168.33Kt of food quality wheat from the US, Canada and Australia.

- Nov-22 Paris rapeseed futures closed at €737.25/t yesterday, down €23.00/t from Fridays close, following the trend of the wider oilseed complex. Oilseed/ oil markets have been coming down partly on the back of further COVID-19 restrictions in China dampening demand.

EU yield prospects cut to below five-year average

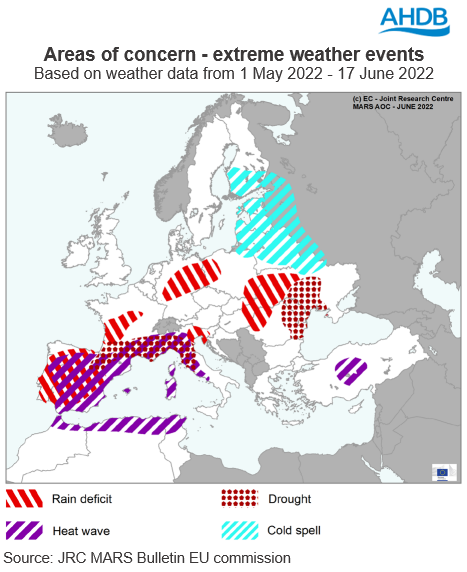

Estimated wheat and barley yields for harvest 2022 have been cut for the third month in a row by the European Commission in its latest crop monitoring report. At a European level, yields for soft wheat, durum wheat and winter barley are now pegged at below five-year average levels, due to the adverse dry conditions across the bloc. In countries such as Spain, where drier than usual conditions have been met with hotter weather, the impact is expected to be greater. On the other hand, crops in growing regions around the Baltic Sea, have been impacted by colder than usual weather.

The latest report pegs EU soft wheat yields at 5.76t/ha. This is down from both the 5.89t/ha forecast in May’s bulletin, and the five-year average of 5.84t/ha. At the start of June, the EU Commission pegged soft wheat production for 2022/23 at 130.39Mt, based off an area of 21.79Kha and a yield projection of 5.98t/ha. If we take the latest soft wheat yield projection from the MARS report and apply it to the same area, production would come in at 125.49Mt. This is nearly 5Mt down on the current estimate, and 4.66Mt down on 2021/22 levels. While this is a rough calculation and the two datasets do not completely align, it gives us an idea of what harvest 2022 may bring.

With regard to the current heatwave, the French Agricultural Ministry yesterday reported that this should have limited impact on yields, given the lateness in the season. However, higher than expected temperatures or less than forecast rainfall could have a further negative impact on yield prospects in other parts of Europe. Equally, there is always the risk of untimely harvest rains affecting crop quality. With a tight global supply picture of wheat due to the ongoing war in Ukraine, developments in Europe are a watch point. Tighter than expected European supply would likely add support to both domestic and European markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.