GDT price index reaches 8-year high

Thursday, 3 February 2022

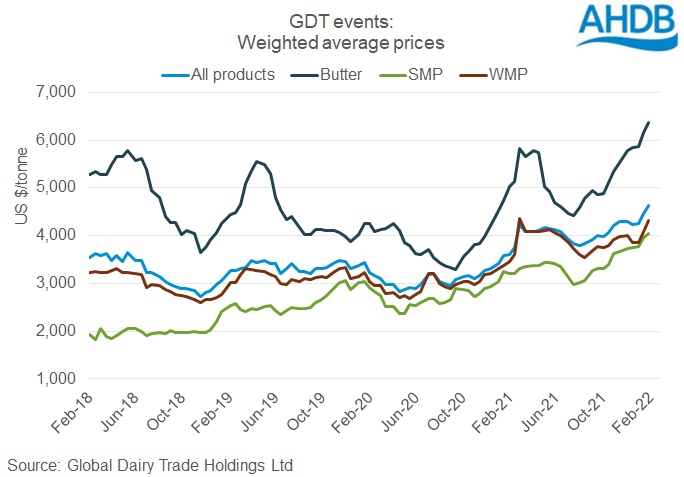

The Global Dairy Trade (GDT) price index reached its highest point since March 2014 at the event on 1 February 2022. At US$4,630/tonne, it also jumped 4.1% from the previous event (18 Jan).

The price indexes for all available products rose at the event, but the main driver was a 5.8% increase in the price of whole milk powder (WMP). Skim milk powder (SMP) and butter values also saw strong increases from the previous auction, reaching 5-year highs.

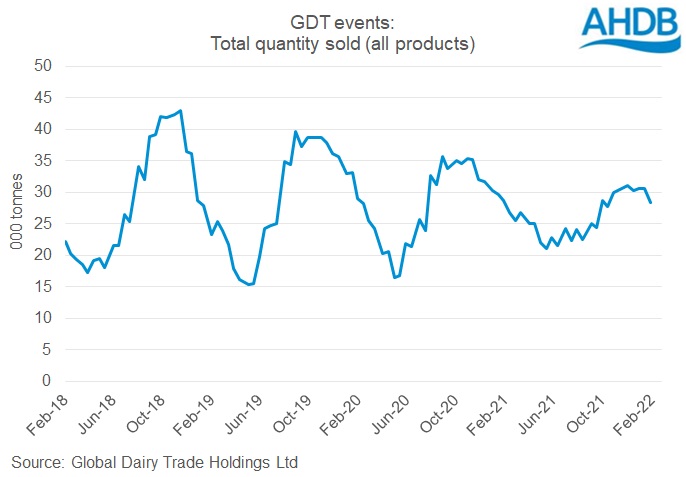

These rising prices appear to be supported from both the supply and demand sides. On the supply side, lower milk output across key exporting regions has meant lower production of dairy products. Although the auction platform is global, Oceania is the biggest supplier of product to the platform, and the volumes of product available on the platform tend to peak around October/November, in line with the southern hemisphere flush. This year, the southern flush was disappointing, and in turn we can see lower volumes have been offered in the last 6 months compared to the same periods in previous years, heightening competition for supplies.

On the demand side, firm global demand will have further depleted inventories. The biggest volumes sold on the GDT platform are of WMP and SMP, and China is a key buyer of those. China has imported record quantities of milk powder in the past 2 years, and the elevated demand has been supporting prices. This eased off somewhat towards the end of the year, but annual figures remained strong.

However, the high purchase volumes may also mean they have built up stocks to make sure they had sufficient inventories to meet growing demand, and potentially also due to concerns over shipping delays. At some point, stores will be full, so demand can’t be relied upon to rise indefinitely. At the moment, the picture is unclear – according to Rabobank, weaker market fundamentals within China and more positive sentiments outside China are leaving traders uncertain about the direction the market may take.

However, with the 2022 outlook for global supplies looking tight, and global consumer demand expected to improve as we move out of the pandemic, there still appears to be some support to the markets, which could partly counterbalance any downward pressure from a potential drop in imports from China.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.