A bumpy start to the Oceania milk season

Wednesday, 8 December 2021

By Kat Jack

It’s been a rough spring so far for dairy producers in Oceania, as wet weather has hampered milk production in the key flush months. On the upside, however, this has supported both wholesale and farmgate milk prices.

New Zealand milk production has been running below year-ago figures since August. Overall, 6.9bn litres has been produced in August-October 2021, down 0.3bn litres (4.0%) on the same period in 2020. Australia produced 2.5bn litres in Aug-Oct ’21, down 0.1bn litres (2.8%) on a year previous – although monthly figures have been down year-on-year since June.

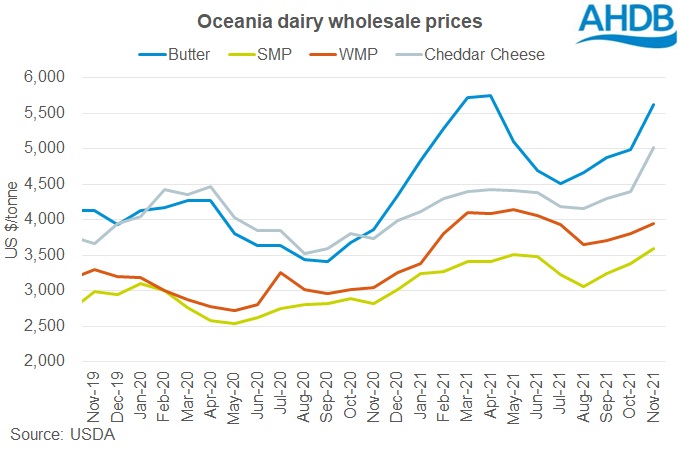

The slowdown in milk production has likely contributed to the rise in Oceania wholesale prices we have seen in recent months. In our world wholesale prices series, Oceania prices have risen month on month since September. In November, butter and cheese price increases were particularly strong, rising 13% and 14% on the month respectively.

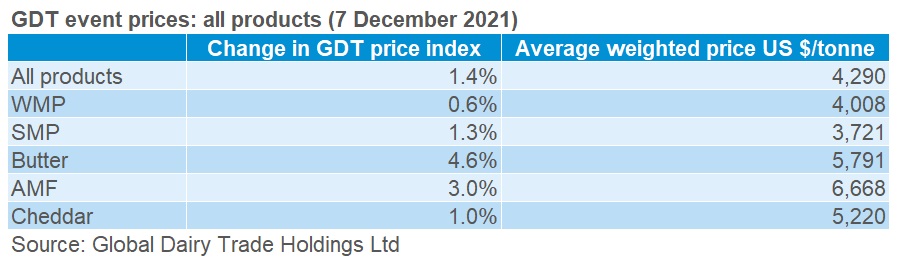

We’ve also seen price increases at the Global Dairy Trade auction events. The overall GDT price index has been increasing (or in one case steady) since the 17 August event. In the latest event, on 7 December, the overall price index rose 1.4% to USD 4,290 per tonne.

Forecasted farmgate prices for both New Zealand and Australia have been adjusted in response to these market dynamics. In June, when the New Zealand milk season starts, the forecasted price for the season was set at $7.96[1] per kg of milk solids (kgMS) by the New Zealand Exchange (NZX). By November, this forecast had increased to $8.84/kgMS. Similarly, Rabobank predicted an opening price of $6.90/kgMS[2] for the 2021/22 Australian season in their June forecast, increasing it in December to $7.75/kgMS.

While typically, higher prices would incentivise some increases in milk production, rising input costs are likely to limit any production response from farmers. With the flush now passed, and the delay in implementing any yield increases, it will be difficult to make up the shortfall in the current season. This could mean that current price levels remain supported in the short term.

[1] New Zealand dollars

[2] Australian dollars

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.