GB milk production: January production slightly down

Wednesday, 14 February 2024

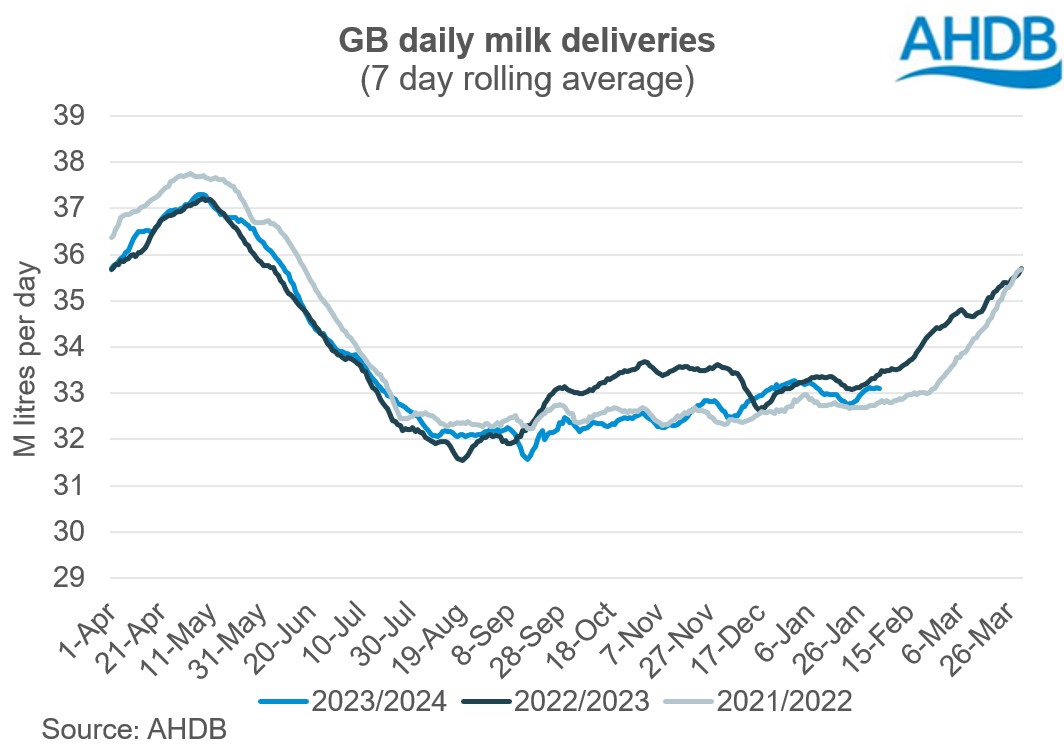

GB milk production was estimated at 1,023 million litres in January, up on forecasted deliveries and 0.7% less (7.6m litres) than the same month last year. Daily deliveries averaged 33.01 million litres per day. Milk production went into decline from September 2023 onwards. However, the rate of decline in deliveries has slowed down from that seen in the Autumn, although is steeper than in December which was only 0.4% back. This year’s milk season (April-January) totals 10,296 million litres, running behind (-0.5%) the same period in 2023.

Improving farmgate prices, and lower costs, during the last few months have resulted in a more favourable milk-to-feed ratio thereby encouraging production for some which has meant production declines are less than expected. Coupled with this, announcements in price increases from the beginning of the year for many contracts has begun to mediate the pessimism.

Although the current market conditions suggest some slow recovery, factors on the demand and supply side do not paint a rosy picture in the months ahead which could hold back price growth. Consumer demand is expected to remain sluggish through 2024 as economic growth remains subdued and consumer confidence remains disappointing. China is expected to return to the market this year, but not in a large way. Rabobank expect Chinese imports to stabilise after two years of decline and the extent of this demand will play a major role in supporting prices.

Labour shortages and higher interest rates combined with the continued burden of high input costs on working capital requirements are likely to limit further yield growth. Although input costs have eased recently, they remains above pre-covid levels. Ongoing weather, animal diseases including bluetongue and Schmallenburg, and economic/political issues in many of the key buying regions, means that 2024 will continue to see some challenges.

For an insight into potential trends in the coming months, take a look at our Agri market outlook.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.