Final survey results show milling wheat quality challenges continue: Grain market daily

Friday, 5 November 2021

Market commentary

- UK feed wheat futures (May-22) gained £0.35/t yesterday, to close at £225.35/t. Whereas, the Nov-22 contract climbed £2.80/t yesterday, to close at £198.80/t.

- Global wheat contracts are on path for another weekly gain on tight supply and demand. Stronger-than-expected demand has supported gains this week, including tenders from Saudi Arabia, Egypt, Japan, Jordan, and Pakistan. This is met by increasing supply concerns from dry planting conditions in the US and Black Sea regions.

- Argentinian rains over the week have boosted wheat development and maize sowings, according to the Buenos Aires Grains Exchange. The wheat harvest is forecast at 19.8Mt and harvest is expected to start in December.

- French maize harvest was 73% complete to 1 November, up 19pp from a week earlier. Though, the harvest still lags the previous 5-year average by 11 days.

- What could a deal with Australia mean for UK food and farming? Follow this link to the Horizon report released today.

Final survey results show milling wheat quality challenges continue

The final set of results are now available for the AHDB Cereal Quality Survey (CQS). Challenges look to remain in group 1 milling wheat especially, as we see premiums continue to grow.

Wheat samples persist with low specific weights

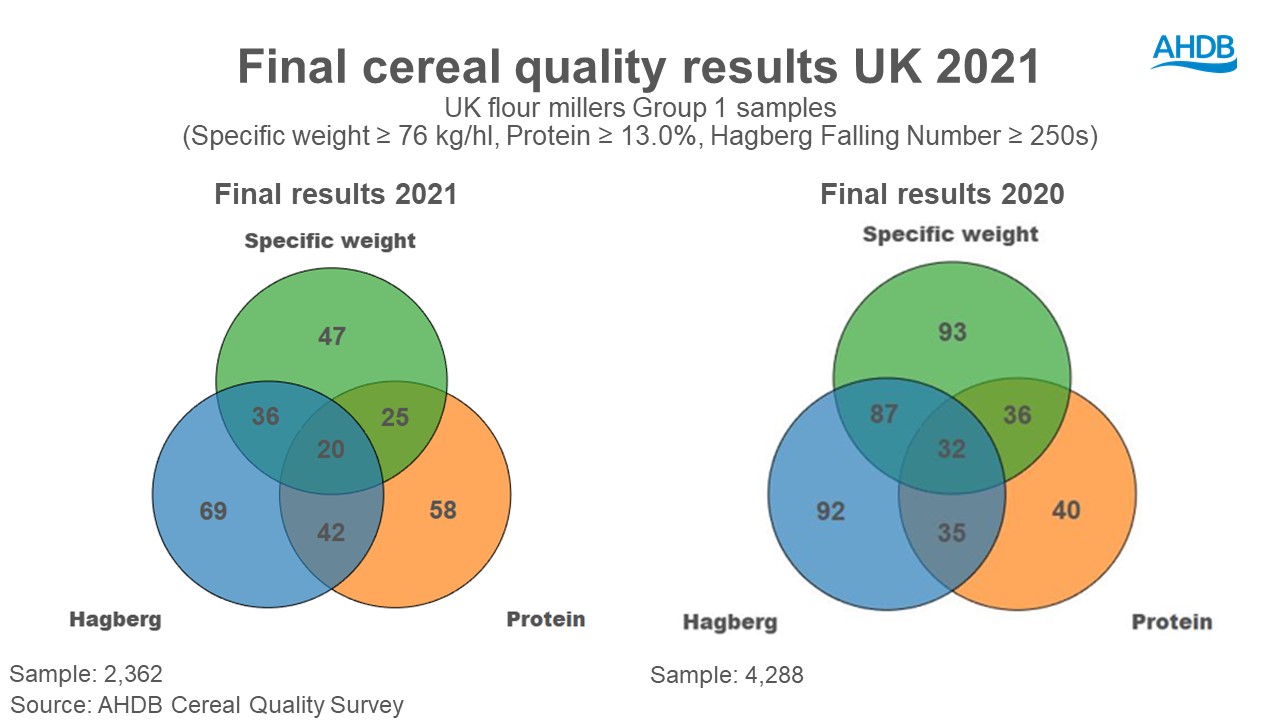

Final quality results from harvest 2021, capturing data to 26 October, show milling wheat samples continue to display low specific weights.

The average specific weight of UK flour millers Group 1 varieties remains at 75.4kg/hl, the lowest since 2012 (70.7kg/hl). This sits below the milling specification of greater than or equal to 76.0kg/hl. These results are down 5 percentage points (pp) (4.0kg/hl) from 2020, and 4pp (3.1kg/hl) from the 3-year average (2018-2020).

Looking at other quality measures of group 1 wheats, Hagberg Falling Number remained at 286 seconds (s). This is 36s below 2020 results and 33s below the 3-year average. This is the lowest value since 2017. There is a clear difference between central (309s) and southern samples (263s) in Hagberg numbers, though this may be down to varietal breakdown within the regions.

For protein content, final figures show group 1 samples are averaging 13.2%. This is up 2.6pp (0.3%) from last year and above the 3-year average by 3.7pp (0.5%). Perhaps not surprising with specific weights down.

Overall, results show that 20% of group 1 samples are meeting a typical group 1 specification (specific weight≥76kg/hl, protein≥13.0%, HFN≥250s). This is down 3pp from provisional 2021 results and down 12pp from 2020.

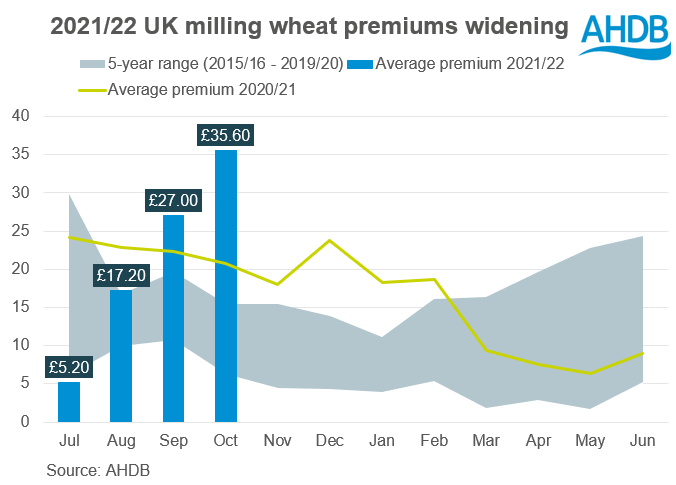

With a reduced number of samples meeting a full milling specification, it is unsurprising premiums have continued to grow. Although there is also support from elsewhere as well. However, lower specific weights, may cause a drop in extraction rates. As a result, a higher volume of wheat could be needed to meet flour demand.

Barley nitrogen content remains lower year-on-year

Using data up to the 25 October, results show average GB nitrogen content is 1.49%. This is the lowest GB value in AHDB’s historic data, back to 1977. The closest comparative year is 2015, at 1.52%. Though to note, a higher volume of Scottish samples has been included in the survey this year compared to last year. Scottish nitrogen content remains comparatively lower than English values due to requirements from distilling markets in Scotland.

Final winter barley averages remained at 1.57%, the same as earlier results. Though we did see an increase to spring barley nitrogen, up 0.03% from initial results to 1.48%.

Lower nitrogen content is an area to watch for brewers, maltsters, and distillers (BMD). The latest BMD usage data released yesterday, showed barley usage year-to-date (Jul-Sept) was down 5pp compared to the pre-covid 3-year average (2017/18-2019/20).

Specific weights are down versus initial results, and lower year-on-year, for both winter barley (at 64.8kg/hl) and spring barley (at 63.0kg/hl).

The proportion of barley retained by a 2.5mm sieve, compared to initial 2021 results, increased clearly for winter barley (up 2.5% to 87.8%) and marginally for spring barley (up 0.1% to 95.4%). Yet, winter results remain down 7pp year-on-year. Spring results are in line with last harvest.

Interesting to note, sales of barley and screenings for 2021/22 season-to-date (Jul-Sept) are down by 6pp compared to the pre-covid 3-year average for the same period (2017/18-2019/20).

Note

This year’s wheat sample is down year-on-year from final 2020 results. We have been hearing sampling has been difficult this year, due to labour availability. The barley sample size if relatively consistent year-on-year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.