Export pace key for UK oat market: Grain market daily

Tuesday, 15 February 2022

Market commentary

- Global wheat prices rose yesterday due to the ongoing situation between Russia and Ukraine. If exports from the region are disrupted, it could push more demand to the EU and US. Old crop (May-22) UK feed wheat futures gained £1.95/t to close at £223.00/t, while new crop (Nov-22) futures rose £1.35/t to close at £202.50/t.

- Oilseed prices eased back yesterday, reportedly due to potential rainfall in parts of South America, which could improve conditions for later planted crops. This was despite prices rising earlier in the day as more forecasters reduced their estimates of the Brazilian soyabean crop.

- Harvesting of the Brazilian soyabean crop was 25% complete by 12 Feb, while planting of the country’s Safrinha maize crop reached 35% complete (Conab).

- Old crop Paris rapeseed futures (May-22) fell €6.00/t yesterday to close at €685.50/t, while new crop (Nov-22) futures dropped €3.25/t to close at €613.50/t.

Export pace key for UK oat market: Grain market daily

The 2021/22 oat market looks well supplied following the biggest crop since 1972. But, some industry source suggest the market feels tighter than the numbers suggest. The export pace is key to minimising carryout stocks to avoid a hangover into 2022/23.

Bigger crop, but higher demand?

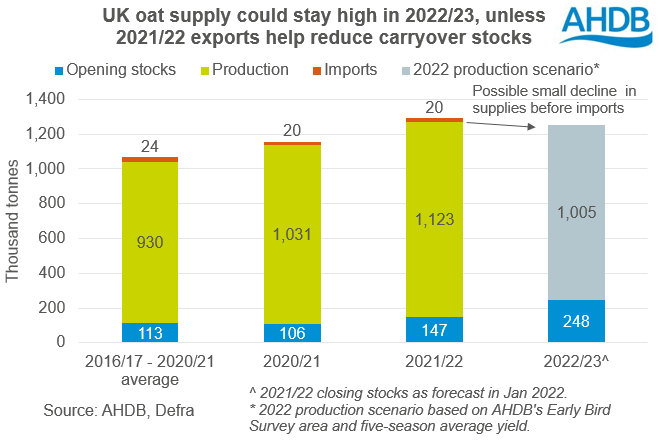

Defra confirmed in December that the 2021 crop was the biggest since 1972 at 1.12Mt. This final figure is 25Kt smaller than the provisional estimate, but still 92Kt more than 2020. With larger opening stocks, supplies are the largest in AHDB’s electronic records back to 1999/00. However, some industry sources suggest the market feels tighter than this.

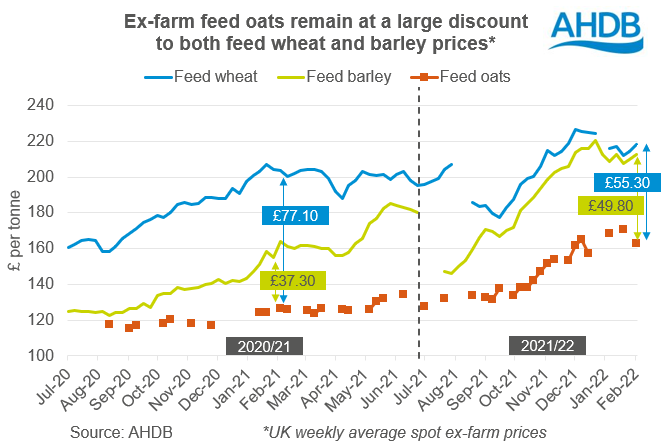

The large supply could be partly absorbed by higher animal feed demand. This is because ex-farm feed oat prices remain at a substantial discount to feed wheat and feed barley.

The price difference gives incentives to use oats in compound feed, plus for farmers to feed oats on the farm and sell their other grains. In the first half of the season (Jul-Dec), GB compounders used 65Kt of oats. This is an 83% increase from the first half of 2020/21 and the fastest pace on records back to 1992/93.

There is some uncertainty about oat milling demand. In the January balance sheets, AHDB forecast total human and industrial demand at 531Kt this season, unchanged from 2020/21, but back from 2019/20’s 553Kt. However, from July – December 2021, UK oat millers used 11% fewer oats than the same period in 2020.

Breakfast cereal buying eased back in 2021 after a bumper 2020. COVID restrictions eased and more people returned to eating out of their homes. Retailers also changed the promotions they offer (The Grocer).

Robust oat product exports may help to temper some of the changes in domestic consumption. But, if the current trends in millers’ usage continue, it could mean lower milling demand for the whole season.

Exports expected to speed up

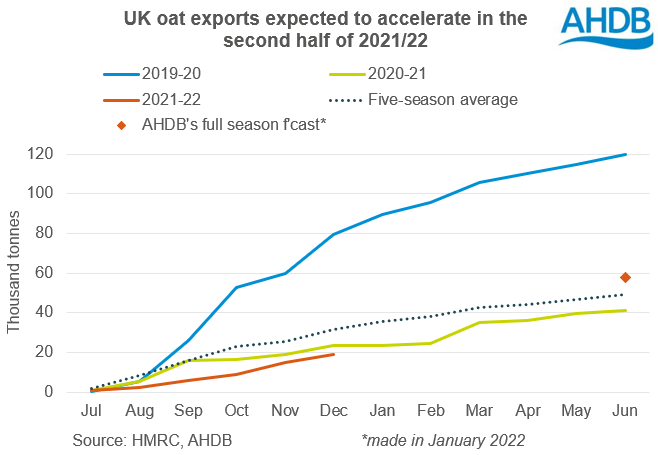

The balance between supply and UK demand is forecast at 306Kt, the highest in recent seasons due to the larger crop. This is despite factoring in more demand and means the export pace is key to minimising carryout stocks.

So far (Jul-Dec), the UK has exported 19.0Kt of oats (HMRC). This is 19% behind last season’s pace when exports totalled 41Kt. However, industry sources suggest UK oats are competitive in export markets, which are tighter supplied this season. As a result, the UK’s export pace is expected to speed up in the second half of the season – the question is how much.

The current (January) AHDB export forecast of 58Kt would still leave large carryout stocks. Stocks of that size would keep the pressure on open market oat prices into 2022/23. So, the export pace will need to be watched closely.

AHDB releases its next balance sheet forecasts on 24 March.

Oat area to slip back for 2022

The UK oat area could fall 6% to 187Kha for harvest 2022, according to AHDB’s Early Bird Survey. The survey uses plantings and planting intentions up to mid-November. The area forecast includes both winter and spring oats.

The year-on-year drop might be linked to prices, as ex-farm feed oat prices are far below other grains this season (see above). But, many milling oats are grown on contracts based on UK feed wheat futures and Nov-22 futures prices are currently very high. So, milling oat contract prices are likely to look attractive compared to recent years. If a contract can be secured, milling oats might continue to look attractive in the rotation. What’s more, fertiliser prices have remained high since the Early Bird Survey ran in November. As oats are relatively low input compared to other crops, could this limit the fall in the oat area in 2022?

Nonetheless, an area of 187Kha could still mean a 2022 crop of close to 1.0Mt if yields match the five-year average of 5.4t/ha. Unless 2021/22 exports reduce carryout stocks enough, another large crop could keep ex-farm feed oat prices under pressure compared to other grains in 2022/23.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.