European oilseed prices consolidate: Grain market daily

Friday, 1 March 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £163.00/t, down £2.00/t on Wednesday’s close. New crop futures (Nov-24) closed at £181.50/t, down £0.80/t over the same period.

- Global grain markets ended mixed yesterday with nearby Chicago futures gaining from technical trading and short covering. Competitive Black Sea supplies continue to weigh on the broader grain complex.

- Paris rapeseed futures (May-24) closed yesterday at €412.00/t, down €3.00/t on Wednesday’s close. New crop futures (Nov-24) closed at €419.25/t, down €2.25/t over the same period. Rapeseed declined following pressure in Chicago soyabean futures, which were down due to lower demand for US soyabeans as South American supplies come to the market.

European oilseed prices consolidate

Since the start of 2024 there has been a significant amount of pressure on oilseed prices as anxieties over South American weather eased and soyabean harvests commenced. The forecast record supplies from the continent have come into focus.

Rapeseed prices over this period have been pressured with the oilseed complex, but pressure hasn’t been as strong as soyabeans and has started to slow.

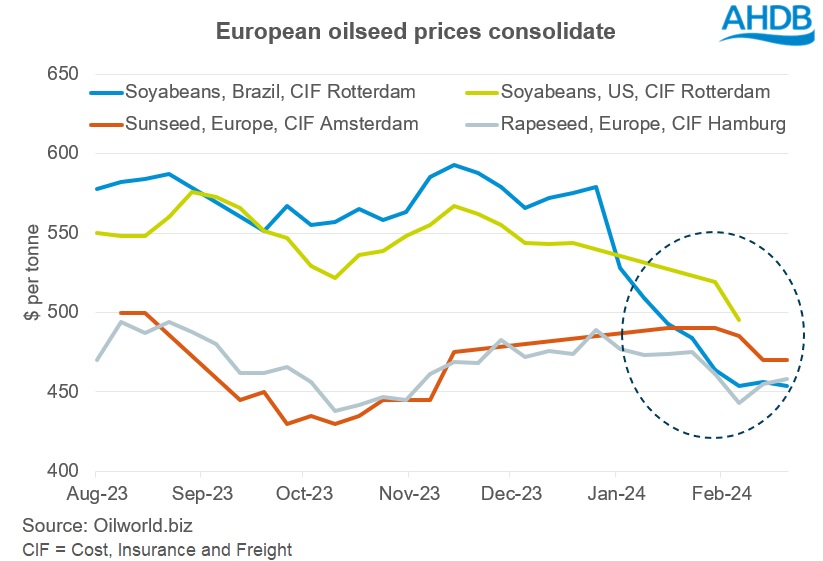

For context, the graph below displays oilseed prices in Western Europe from different origins. As soyabean harvests have commenced in Brazil, there has been a significant amount of pressure on spot soyabean prices. In just two months Brazilian soyabean prices into Europe have come down to trading near rapeseed prices.

These large South American supplies are seriously weighing on the oilseed market and have caused a huge consolidation in physical pricing of oilseeds.

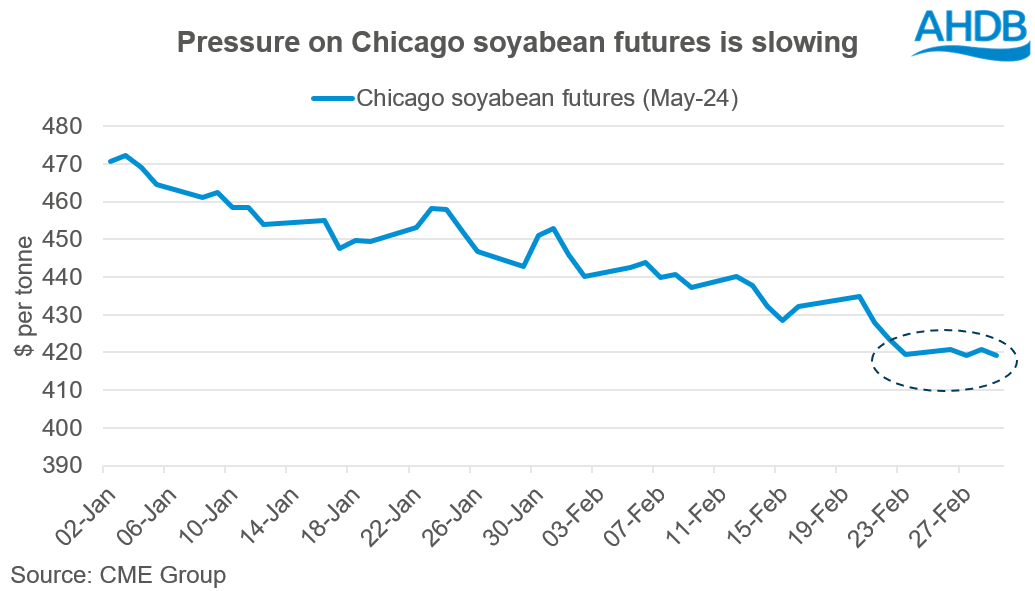

However, has this bearish news of South American supplies run its course? Since the start of 2024 Chicago soyabean futures (May-24) have been pressured every single week. This week though, prices have largely tracked sideways with the contract closing at $419.11/t yesterday, only marginally down from last Friday’s close ($419.48/t).

South American supplies and lacklustre demand for US soyabeans are expected to keep the market pressured, or at least keep a lid on prices. For there to be any significant support for rapeseed, or oilseed prices in general there needs to be a weather event on the Canadian Prairies or in the US Midwest.

A week today (08 March) the next USDA World Agricultural Supply and Demand Estimates will be released, which might provide market direction. But, ultimately the revisions, such as potential downward revisions to Brazilian soyabeans could possibly be priced into the market already.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.