South American supplies in focus: Grain market daily

Wednesday, 28 February 2024

Market commentary

- UK feed wheat futures (May-24) closed at £166.40/t yesterday, up £1.25/t from Monday’s close. The Nov-24 contract gained £1.60/t over the same period, ending yesterday’s session at £184.10/t.

- Domestic wheat futures followed EU and US wheat markets up yesterday. Low prices seem to have led to a slight uptick in global demand as Jordan have put out another tender today for 120 Kt of wheat, though it’s likely that competitive Black Sea supplies will limit any major price movement on the back of this.

- Paris rapeseed futures (May-24) gained €7.50/t yesterday, closing at €415.00/t. New crop futures (Nov-24) were up €5.75/t over the same period, ending the session at €420.50/t.

- Paris rapeseed futures followed the US soyabeans market up yesterday. A reduced forecast of Brazil’s harvest progression led to some support in prices, though expectations of ample global supplies limited gains. Read more on this below.

South American supplies in focus

As has been well reported, a key focus in both grain and oilseed markets at the moment is South American weather and what we can expect from the soyabean and maize crops this season. So, what are the current expectations and what will be the watchpoints moving forward?

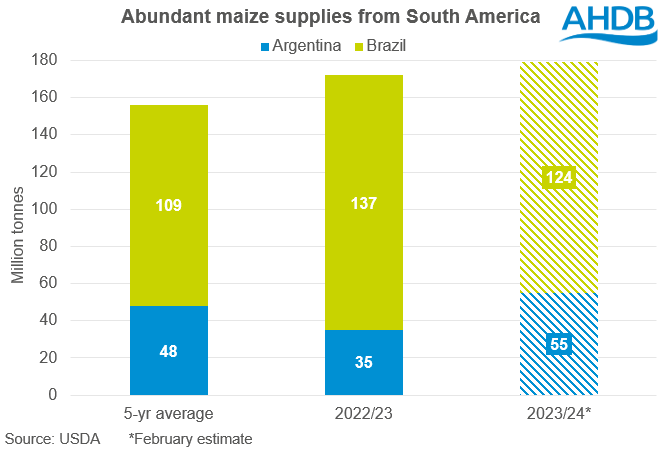

Maize

Following last season’s extreme drought in Argentina, the country’s maize crop in 2023/24 is forecast to rise considerably. In the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE), Argentinian production of maize this season was pegged at 55 Mt, up 57% on the year and up 15% on the five-year average. The Buenos Aires Grain Exchange has the figure even higher, at 56.5 Mt, up 66% on its 34 Mt estimate for 2022/23. As at 21 February, 28% of the maize crop was rated in good/excellent condition, compared to just 9% a year earlier, with another update due out tomorrow. However, dryness is still a concern in parts of Argentina, with yields of later-planted maize likely impacted.

In Brazil, the USDA are forecasting maize production this season at 124 Mt, down 9% on the year, though up 14% on the five-year average. Estimates are variable though, with Conab estimating Brazil’s total maize production at c.114 Mt, down 14% on the year. These estimates were made at the beginning of the month, and the rapid pace of Safrinha maize plantings as well as overall adequate weather could see revisions in upcoming estimates. According to AgRural, Brazil’s centre-south plantings reached 73% complete last Thursday, ahead of 59% a week prior.

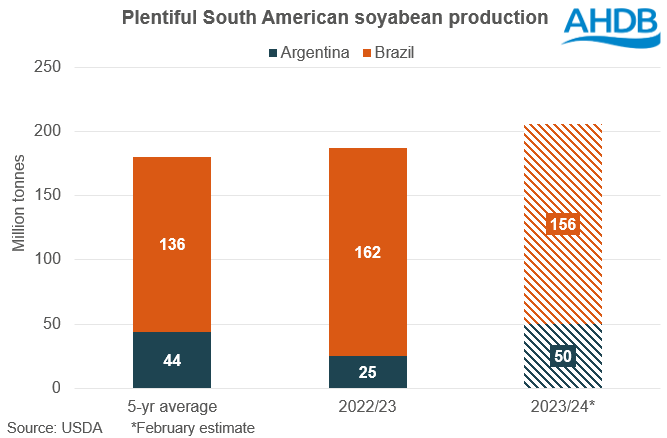

Soyabeans

Much like maize, soyabean production in Argentina is expected to see a yearly increase due to last season’s poor crop. The USDA currently estimates production to reach 50 Mt, double last year’s figure and up 14% on the five-year average. The Buenos Aires Grain Exchange expects production to reach 52.5 Mt this season, up from its estimate of 21 Mt in the last marketing year. In Argentina, 20% of the late-planted soyabeans are setting pods, meaning the crop is sensitive to moisture and temperature stresses. Yields of early-planted soyabeans are expected to have been impacted by the previously hot and dry conditions, though if weather is favourable going forward, later-planted soyabeans are expected to be higher.

In Brazil, according to the USDA, soyabean production is forecast to decline by 4% on the year to 156 Mt. If realised, this would be up 15% on the five-year average. Conab currently pegs production at c.150 Mt, down 3% on the year. However, on Monday, AgRural pegged the crop at 148 Mt, with yield losses recorded in key producing areas with harvest now underway. AgRural said that, as of last Thursday, soyabean harvest in Brazil had reached 40% of the planted area, ahead of 33% at the same point last year. More information of yields will likely impact upcoming revisions of the soyabean production estimates.

What does this mean for domestic prices?

According to AHDB’s latest weekly market report, the longer-term outlook for domestic rapeseed and grain prices is mildly bearish. This forecast is largely due to expectations of heavy supplies from South America coming onto the global markets and weighing on oilseed and feed grain prices. Even given the variability in estimates, and the impact that weather could still have, it is unlikely that revisions will be that extreme at this point in the season that we will not have abundant supplies. However, if we do have periods of hot and dry weather in key agricultural regions of Argentina and Brazil, we could see some short-term rallies over the coming weeks, which is something to watch out for.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.