EU pork market: production gains but weaker exports pressure prices

Wednesday, 11 September 2024

Key points:

- EU pig meat production has grown compared to 2023

- Higher slaughter numbers and carcase weights have helped production in key producing countries

- Chile now stands as the second largest supplier of EU pig meat import volume

- EU offal exports to China have grown year on year despite over all pig meat exports falling

- EU S grade prices pressured downwards

Production

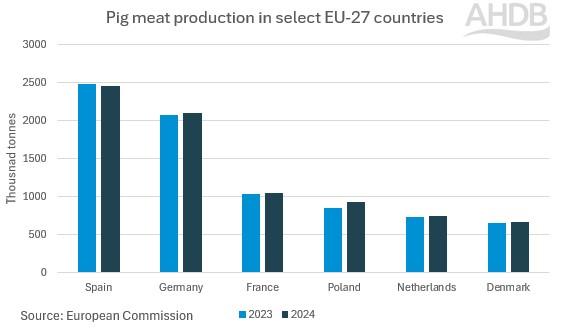

Pig meat production in the EU-27 has seen some resurgence in growth in the first six months of the year compared to 2023. Across the continent, we have seen production total 10.5m tonnes in the first half of 2024, growth of 164,000 tonnes (2%) from 2023. This growth has been driven by production gain across most EU nations. Poland saw the largest increase up 80,000 tonnes to sit at 934,000 tonnes so far this year. Germany, the second largest producer in the EU, made production gains of nearly 19,000 tonnes to reach just under 2.1m tonnes up to June, while Danish production grew 2% to 673,000 tonnes. However, Spain (the largest producer in the EU) saw a decline of just over 27,000 tonnes to 2.46m tonnes in 2024 so far.

Pig meat production in select EU-27 countries

Source: European Commission

On the whole, gains in production over the past year have been driven by increased slaughter numbers. Slaughter in the EU-27 bloc grew by 122,000 head up to June 2024, to sit at just under 110m head. Polish pig kill increased by 634,000 head (7%) to total 9.7m head so far in 2024, with Germany recording minor growth of 46,000 head to 21.9m head. Although production gains were seen in Denmark, pig kill recorded a fall of 248,000 head (3%) to 7.2m head, which would suggest heavier carcase weights have been the driving force of production. However Spanish slaughter numbers recorded the largest yearly decline, of 460,000 head to 26.2m head.

Trade

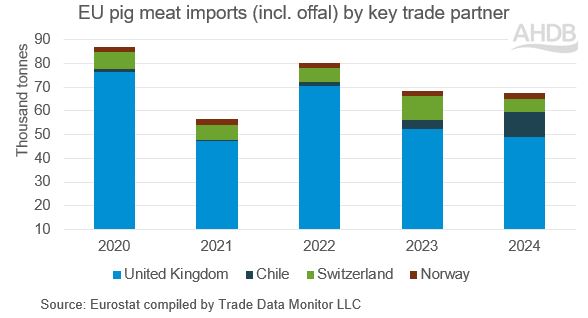

EU imports of pig meat (including offal) have fallen by 3,500 tonnes to 69,900 tonnes in the first six months of the year compared to 2023. The UK remains the largest volume provider to the EU, shipping 48,900 tonnes a market share of 70%. This is a decline of 3,500 tonnes from 2023.

Chile now stands as the second largest import provider to the EU. Pig meat volumes imported from Chile have grown substantially in the past two years, totalling 10,500 tonnes in 2024 so far. This is growth of 6,700 tonnes compared to the same period in 2023, when import volumes were lower in the first few months of the year. The ratification of the EU-Chile advanced framework agreement in 2022 allows more access for Chilean pork into the EU market, without full liberalisation on sensitive agricultural goods.

Swiss pig meat shipments to the EU have fallen 4,400 tonnes year on year to 5,800 tonnes with the market share falling from 14% in the first six months of 2023 to 8% in 2024.

EU pig meat imports (inc. offal) by key trade partner

Source: Eurostat via Trade Data Monitor LLC

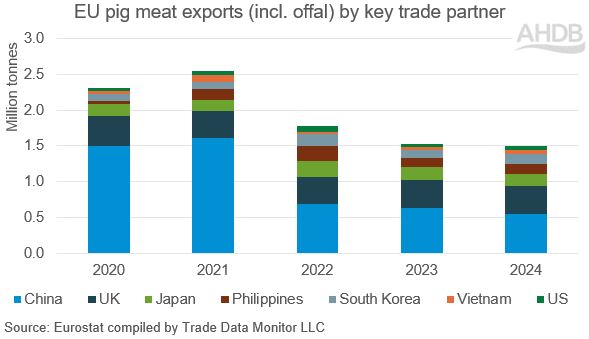

EU pig meat export volumes have totalled 1.93m tonnes so far in 2024, a 4% (84,600 tonnes) fall from the previous year, despite increased production Movements have been mixed across key shipping destinations with China and Japan driving most of the year-on-year decline, meanwhile the US and other southeast Asian countries have recorded volume growth.

EU pig meat exports(inc. offal) by key trade partner

Source: Eurostat via Trade Data Monitor LLC

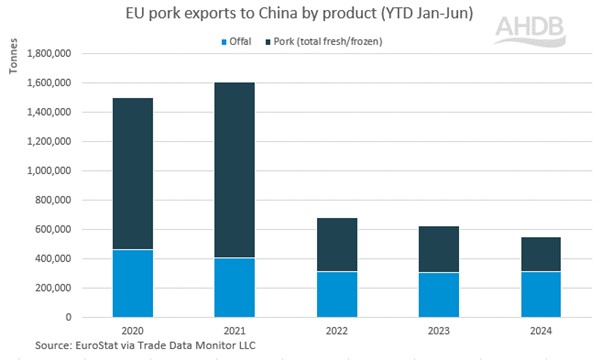

China remains the largest destination for EU pork exports, commanding a market share of 29%, with volumes totalling 550,000 tonnes, a fall of 80,500 tonnes (13%) from last year. However, within this total volume, offal sits 10,000 tonnes higher year on year, at 316,000 tonnes. EU exports to China have struggled similarly to the UK, with an increase in market competition from Brazil, the US and Canada, combined with a struggling Chinese economy leading consumers to seek more affordable cuts.

EU pork exports to China by product (YTD Jan-Jun)

Source: Eurostat via Trade Data Monitor LLC

Prices

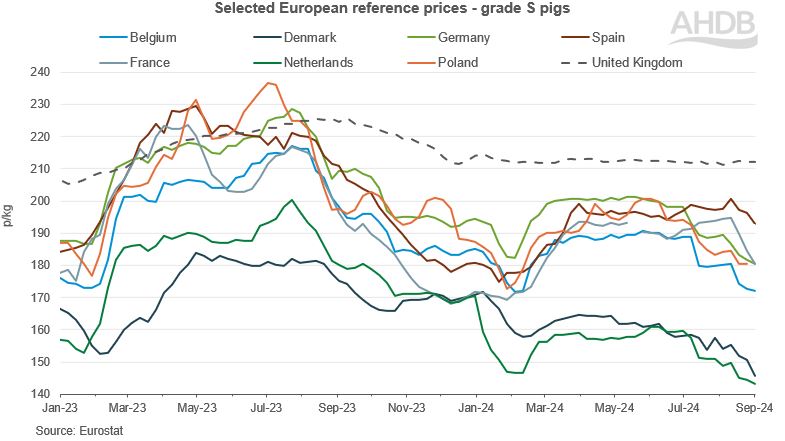

Given the increase in overall EU production, alongside tepid domestic and international demand, prices have shifted lower as supplies outweigh demand. The EU S grade pig price saw another weekly decline to 179.49p/kg for the week ending 01 September, a fall of 2.7p from the previous week. This marks the third week in a row of declining prices, which has followed a period of stability. All key producing countries reported a decline, with the largest decline of over 5p coming from Denmark, bearing in mind that Poland did not record a price. With this, the differential between the EU and UK pricings has increased to nearly 33p/kg, the biggest difference since February.

Selected European reference prices - Grade S pigs

Source: Eurostat

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.