EU pig prices: supply and demand dance a fine line

Wednesday, 28 August 2024

Key points

- EU grade S reference prices have eased in the latest week

- Prices have been relatively stable for the last 5 months

- EU pig meat production up 3% year on year, but demand remains subdued

- Uncertainty has crept into the European market leading to more volatility

Prices

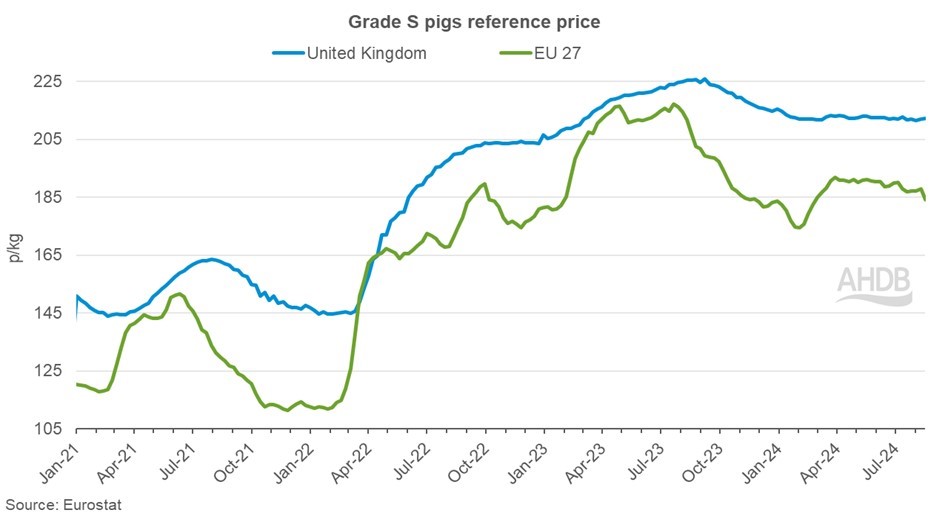

Although European reference prices generally see more volatility than the UK, there has been minimal movement for several months. Average prices are behind those from last year by around 23p but remain historically elevated.

In the latest week (w/e 18 Aug) the EU27 average for grade S pigs stood at 184.25p/kg, a decline of 3.5p week on week, however, it is worth noting that the Netherlands have not declared a price this week. Despite weekly price fluctuations, EU grade S prices have only moved by 2p since the start of the year (w/e 7 Jan).

The price differential between the UK and EU has been between 21p and 26p over the last five months. However, in the latest week the gap has widened to 28p, the largest gap seen since the end of February.

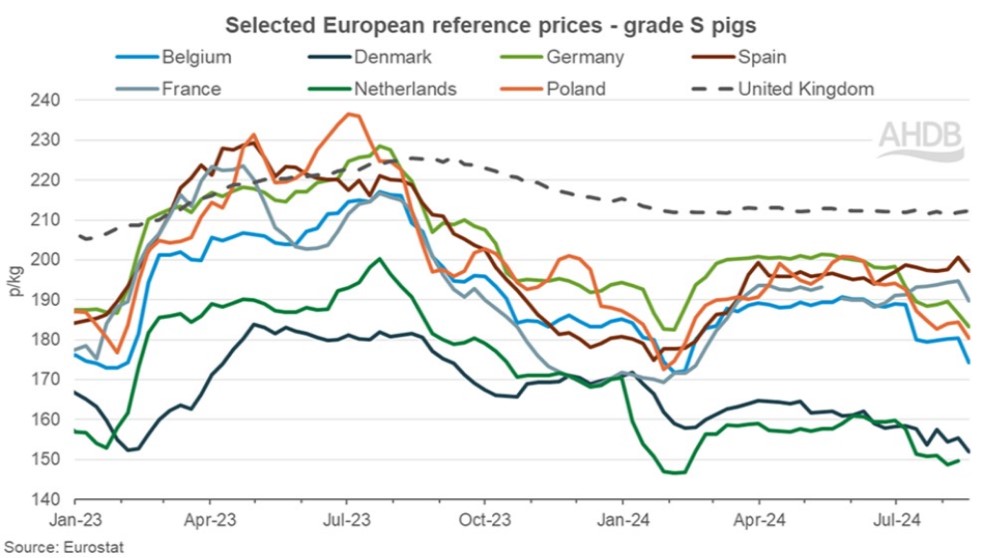

Looking at the key producing nations, all witnessed price declines in the latest week, between 3.3p/kg (Germany, Spain, Denmark) and 6.1p/kg (Belgium). Most countries have been trending downwards since the start of July, with the exception of Spain and France where gains have balanced with losses.

Where next?

It is likely that some downwards pressure could be felt within the European market in the coming weeks and months as the balance of supply and demand dances a fine line.

Pig meat production in the EU27 has been improving compared to the previous year, with production up 3% during the period Jan - May at 8.95 million tonnes. This production growth has been driven by increased slaughter (+1%) and heavier carcase weights.

Demand on the other hand has continued to be subdued as consumers, both domestically and internationally, continue to hold their purse strings tight. Due to increased competition on global markets, the EU has lost out on some export demand. Meanwhile, domestic consumption has been impacted by the wet weather, particularly in northern regions, with BBQ season reported as disappointing.

Uncertainty has crept into the European market in recent months. The announcement by China to launch an anti-dumping probe on imported product from the EU has caused some upset and caution within key exporters. Exchange rates have also seen additional volatility following political elections and changes in economic policy and interest rates. It is likely these concerns will continue to rumble on for the rest of the year.

Alongside these challenges is the spread of ASF. Germany has reported several new outbreaks this summer, closer to their western border. If the disease continues to spread west there could be significant issues with trade, especially if an outbreak occurs in Spain, the largest exporter.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.