EU export concerns cap market gains: Grain market daily

Friday, 8 December 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £196.30/t, down £0.70/t from Wednesday’s close. New crop futures (Nov-24) saw the same fall as the May-24 contract yesterday, closing at £207.75/t.

- Despite US market strength yesterday, both European and domestic wheat futures closed lower yesterday. Read more about this below.

- Paris rapeseed futures (May-24) found some support yesterday, gaining €5.00/t yesterday to close at €443.00/t. Nov-24 futures gained €4.50/t over the same period, closing at €449.75/t.

- Rapeseed futures found strength with Chicago soyabean futures (May-24) yesterday, gaining 1%.

- Yesterday, crop agency Conab cut their Brazilian soyabean output forecast for 2023/24 to 160.18 Mt, back from 162.42 Mt last month due to planting delays. Though this crop is still forecast a record.

EU export concerns cap market gains

Yesterday, European and domestic markets saw slight pressure overall, despite strength across US wheat markets. As reported in yesterday’s analysis, strong Chinese wheat buying following a rain-impacted Chinese harvest, has been pushing prices higher for US markets. On Wednesday, this filtered through into domestic markets. However, yesterday European markets ended the day flat, with Paris milling wheat (May-24) falling €0.50/t, to close at €236.00/t, leading to small pressure also seen across domestic markets.

Why was this? Well, a rise in the value of the euro played into concerns of EU export competitiveness, as well as a lack of fresh sales of French wheat to China as US origin picked up demand. Though 75 Kt of German wheat has already or is set to sail for Morrocco in the coming days.

On top of this, Black Sea wheat competitiveness continues, despite concerns of difficult weather in the Black Sea region having seen some impact to shipping. On Tuesday, Egypt purchased 180 Kt of wheat, made up of 120 Kt of Russian origin and 60 Kt of Ukrainian. On Thursday, Egypt booked 420Kt of Russian wheat for shipment in January too.

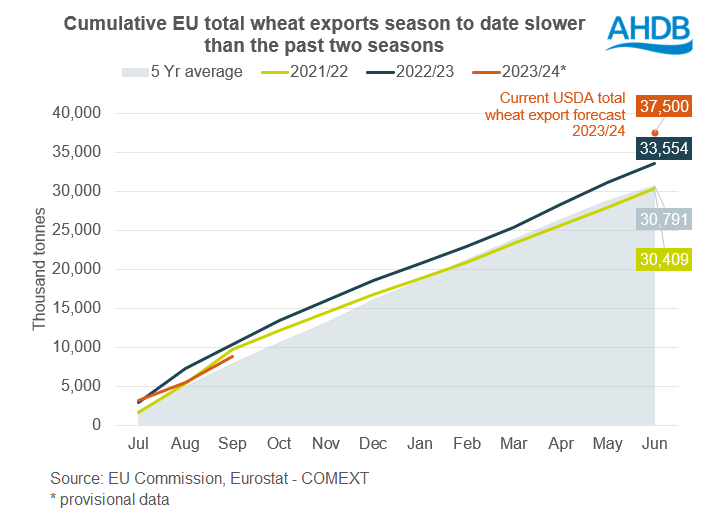

This all comes in the context where we can see EU export pace has been slow compared to the past two years. Looking to EU Commission Eurostat data, July to September, 8.76 Mt of soft wheat was exported from the EU. This was 15% behind the same period in 2022/23, and 8% behind the same period in 2021/22. However, remained 13% above the previous 5-year average. When including durum wheat, total wheat exported July to September lagged last season and the season before by 15% and 9% respectively.

Using the EU customs surveillance data, to bring data up to 03 December, the EU had exported 12.52 Mt of common wheat season to date, behind last year and the year before by 18% and 11% respectively.

The latest USDA World Agricultural Supply and Demand Estimates (WASDE) are due this evening at 5pm, could we see the current official EU total wheat export forecast of 37.50 Mt revised? This total is above last year’s export number of 35.08 Mt and the pace for the season remainder would need to pick up significantly through the season remainder. It is likely China looks to continue to import, though who will pick up this demand?

Other areas to watch out for in the latest WASDE include US wheat and soyabean closing stocks, Chinese import forecasts as well as South American maize and soyabean crop forecasts for this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.