EU Commission forecasts strong pork export growth in 2020

Tuesday, 14 July 2020

By Felicity Rusk

The EU Commission has recently published the summer edition of its short-term outlook for agricultural markets. This is an outlook for the EU-27 and so excludes the UK.

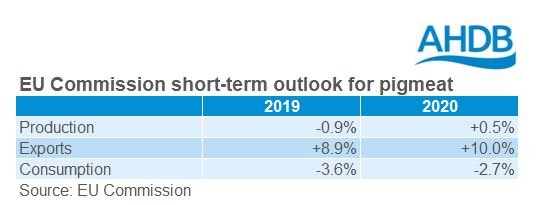

The Commission believes that EU pig meat production will show slight growth in 2020, in the region of 0.5%. This rise in production is expected to be supported by strong prices encouraging expansion and the return of domestic demand, particularly within the foodservice sector. Furthermore, prospects of strong export demand, predominantly to China, remains a key driver of the European market. EU consumption of pig meat is expected to fall below 30kg per capita in 2020, due to reduced consumption during quarantine periods, particularly for the foodservice sector.

The production growth is a slight downwards reduction from their previous forecast (+0.7%), which is likely a reflection of disruption to both processing and exports caused by COVID-19 this year. Additionally, producers may well be more cautious about expansion plans due to the pandemic.

Nevertheless, there are still risks to this forecast. The spread of African Swine Fever (ASF) remains an ongoing threat to the European pig herd. The assumptions made regarding the return of demand in the foodservice sector are also arguably on the optimistic side. A second-wave of coronavirus in either Europe or China would cause further disruption to the market.

EU pig meat exports are expected to continue showing strong growth this year, supported by robust demand from China. Coronavirus has only slowed down the Chinese attempts at herd-rebuilding after ASF decimated the nation’s herd and so production is expected to fall by up to 20% this year. As such, the protein deficit from the nation is larger than originally anticipated which should support import demand from the nation.

EU pig meat exports have already benefitted from this strong Chinese demand, recording a 150% increase in the first four months of the year. However, compared with the end of last year, China has also been increasing supplies from the US, Brazil and Canada, increasing their market share at the detriment of the EU. Looking ahead, this will be a key watchpoint, particularly as the US moves to capture more of the Chinese market.

Recently, global meat exports to China have also faced disruption due to coronavirus outbreaks amongst staff in processing plants. Some plants have suspended shipments to China because of this, with the Netherlands particularly affected. It remains unclear how and when this situation will be resolved. If prolonged, it could ultimately challenge the EU commission’s positive export outlook.

This challenge is also currently combined with unresolved disruption to slaughter in Germany. Together, this means pig prices are not particularly favourable at the moment. The expectation of strong prices could be challenged if these, or similar difficulties, are ongoing in the coming months.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.