Domestic rapeseed outlook - 2019/20 and 2020/21: Grain Market Daily

Friday, 9 October 2020

Market commentary

- Global wheat market closed down yesterday, UK wheat futures (Nov-20) were down £1.00/t to close at £182.90/t. Meanwhile, Paris milling wheat futures (Dec-20) closed at €199.00/t down, €1.50/t on Wednesday’s close.

- Chicago soyabeans futures (Nov-20) closed yesterday at $385.77, down $0.37/t. Although down yesterday, recent price support has been from large US export sales booked in successive weeks.

- There has also been support has for crude oil prices this week, with Brent crude oil (nearby) closing yesterday at $43.34/barrel, up 10.4% from last Friday’s close.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Domestic outlook for rapeseed 2020/21

Ahead of our Grain Market Outlook webinar next week (click here to register), we’re looking at the factors affecting the outlook for grains and oilseeds. On Tuesday we looked at the global oilseeds situation and this article focuses on the domestic outlook for rapeseed.

Looking back on a tough growing season

The growing season for harvest 2020 was extremely tough for many. Mounting pest pressure, one of the wettest autumns on record and an extremely dry spring has led to UK oilseed rape (OSR) production to be the lowest since 2004.

Although Cabbage Stem Flea Beetle (CSFB) started off as a regional issue in the South-East, there have been occurrences arising further north. Extensive pest damage and the wet winter led to many growers ripping out their OSR crops, reducing the national area, as our Planting and Variety Survey highlighted in July. Many that left the crop in situ, put minimal inputs into the crop, keen to avoid further financial loss. This was another factor that impacted the lower yields recorded this season.

The worst production of OSR since 2001?

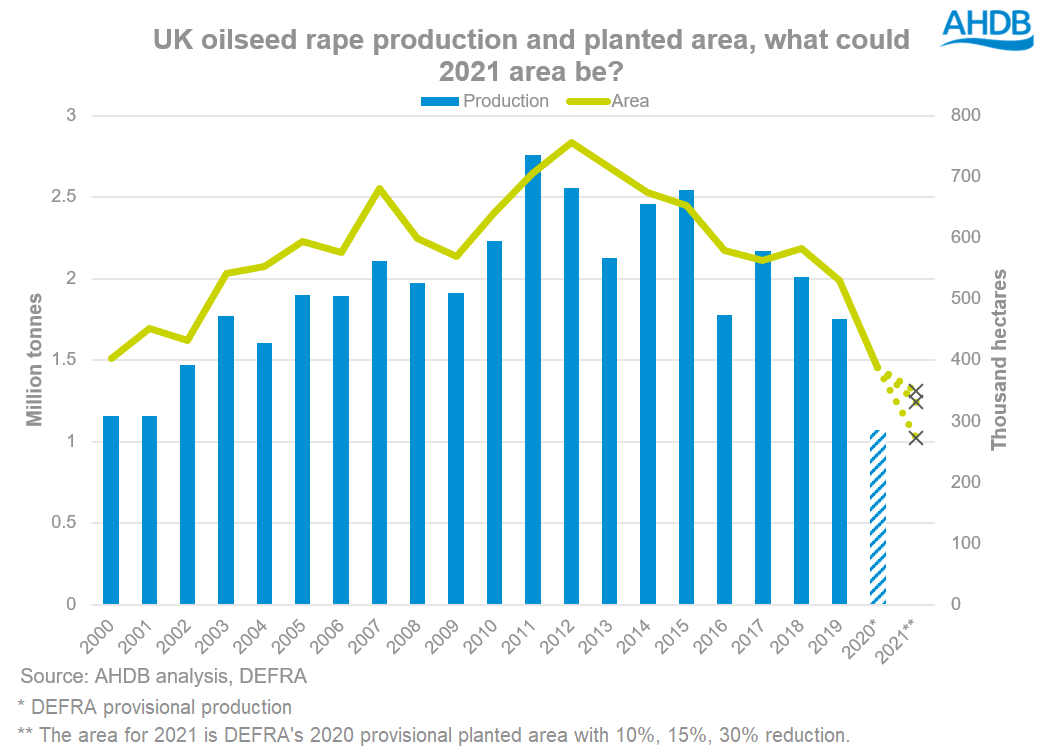

The provisional DEFRA figures, released on Wednesday, show the area for 2020 harvest at 388Kha, down 27% on last year. With yields significantly down on the year at 2.8t/ha, the provisional release estimates production at 1.07Mt.

This does not come as to much of a shock, as the area was similar to our Planting and Variety Survey and yield is within the range highlighted in the AHDB Harvest Progress reports.

With such low production, we have gone from being self-sufficient and pricing at export, to pricing to attract imports within the last 5 years.

Many growers seem to be turning away from OSR as a break crop within their rotation, which will impact the planted area going forward. However, this differs regionally and areas within the North of England and Scotland are relatively unchanged from last year as CSFB pressure is near non-existent.

The production economic still stack up, pest issues excepting. Our gross margins work pegged OSR in second place, up seven places from last year and just behind winter wheat.

That said, there is a belief across the industry that the harvest 2021 area is to be back on 2020. There’s a wide range of views but a general consensus that it is least 10% below Defra’s 2020 area figure. Should this transpire, we could be looking at an initial planted area of less than 350Kha. AHDB will be running our Early Bird Survey again this autumn to offer more insight.

In general, drilling conditions for OSR have been good. However, there is still a long way to go with CSFB larval pressure into the New Year unknown, combined with the threat of other pest damage.

Domestic demand for rapeseed

The UK’s domestic demand for rapeseed is around 1.8-2.0Mt of rapeseed per year, with the majority of this being crushed for edible oil and meal used in animal feed.

This marketing year, with a smaller production and subdued demand from Covid-19, we could expect demand to decrease marginally. Because of Covid-19, less oil will be required on the continent for bio-diesel blending mandates and reduced demand from hospitality as restrictions continue. However, while bio-diesel requirements did fall in the early days of lockdown, levels have since largely recovered (although not to pre-pandemic levels), and have arguably fared better than demand for ethanol based biofuels.

An increase in rapeseed imports

Because of the production deficit, imports of rapeseed into the UK are expected to increase for this marketing year. So, where could this supply come from?

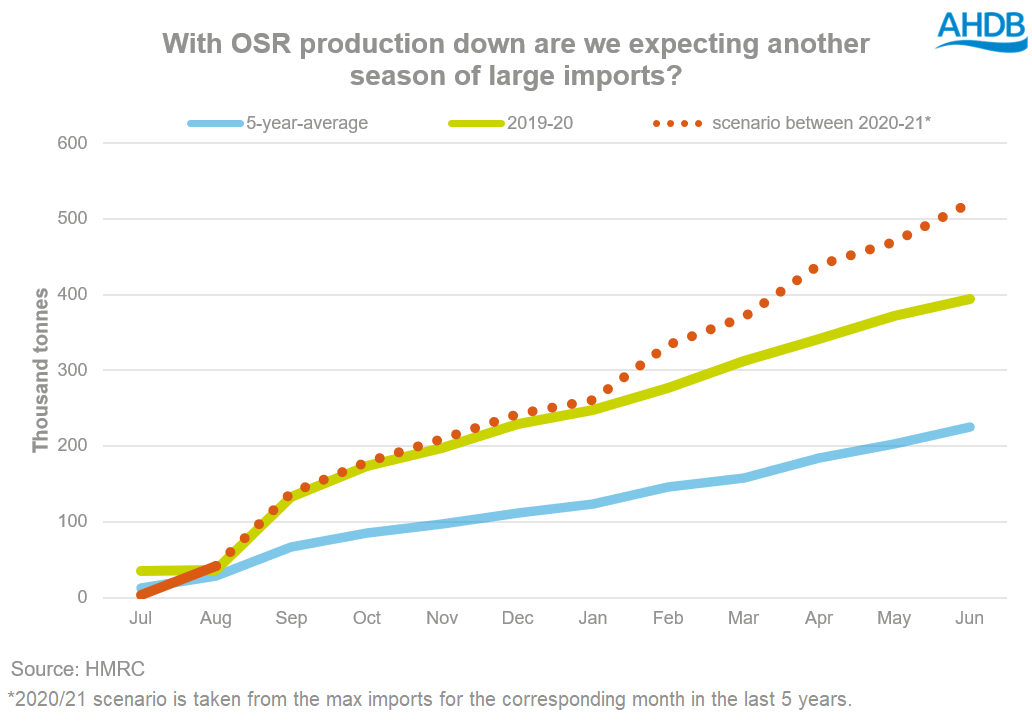

Over the last few years as domestic production has reduced, imports have increased. On a 5-year-average imports of rapeseed are c.225Kt. However, in the deficit last season (2019/20) imports extended to just under 395Kt.

Analysing HMRC data, if we were to take maximum monthly import for each month (Aug-Jun) over the last 5 seasons, plus Jul-20 imports, this adds up to 520Kt. In this year of large deficit, that may not be an unrealistic import figure for 2020/21.

Based on 5-year-average, most (c.80%) of UK’s import are from the EU, with additional imports from large rapeseed exporters, such as Ukraine and Australia.

Priority of the UK’s domestic use of rapeseed will be for meal and edible vegetable oil for domestic use. Surplus rape oil is usually exported to the continent to be blended into biodiesel but as the UK’s production reduces, the exportable rape oil market will too as the priority will be to supply the domestic edible market.

Do small supplies mean inflated OSR prices?

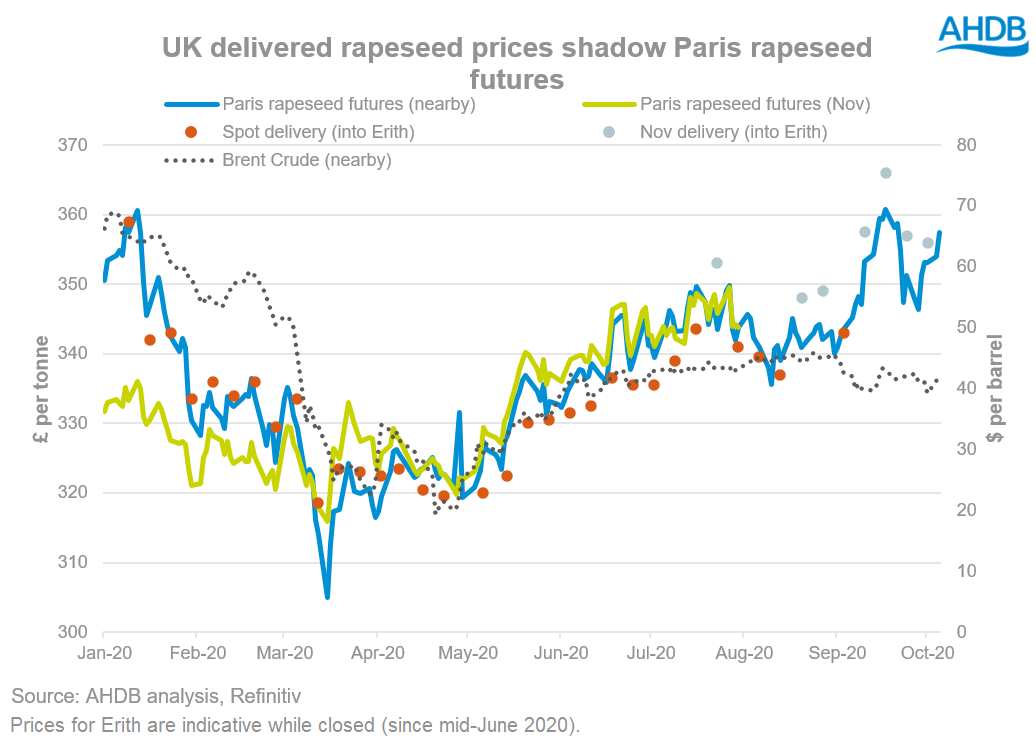

Although we are in a large rapeseed deficit, this does not mean supported prices throughout this marketing year. Our domestic rapeseed price is driven by the Paris rapeseed futures contract. Global supply and demand, not only in rapeseed but other oilseeds too, will drive these prices.

We discussed in our global oilseed overview how there are many parameters dictating prices this season. But further to that, what will have influence on our domestic prices will be the currency relationship between sterling and the euro.

Conclusions

Despite such a low production, what can we expect from OSR over the next 12 months:

- Demand for rapemeal in UK to remain, providing it stays price competitive to soyameal.

- Imports to increase to supply a feed and edible oil market. Rape oil exports to the continent will fall as large amounts of surplus rape oil will reduce.

- Despite the significant deficit that the UK is entering, this does not mean prices are going to be supported all season. Supply and demand within the global oilseed complex will dictate price direction.

- A likely lower area planted for 2021 harvest as growers turn away from OSR.

- Crop that have established well are reported to be looking the best for a few years. However, the spring will show the extent of pest damage.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.