Developing dairy regions expected to drive production over the next decade

Thursday, 23 July 2020

By Felicity Rusk

The OECD and FAO have published their latest report on the World Agricultural Outlook for 2020-2029.

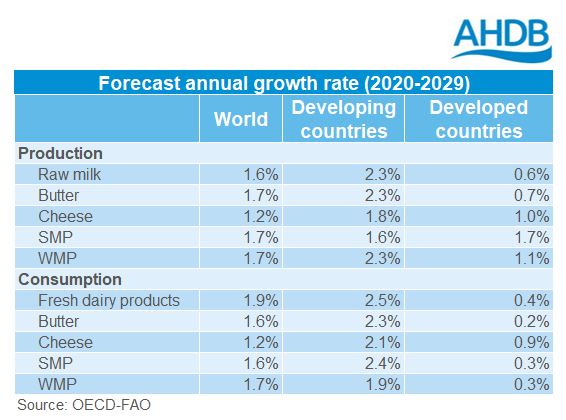

Over the next decade (2020-2029), global milk production is expected to rise by 1.6% per annum. This growth is expected to come from a combination of a larger milking herd (0.8%/annum) and continuous improvements in yields (0.7% annum).

In particular, emerging nations in the global dairy market are predicted to contribute the most to this production growth. India and Pakistan alone account for almost a third of the anticipated growth over the next ten years. Meanwhile, growth in more established dairy producers, such as the EU and US, is expected to be more muted due to environmental restrictions and limited growth in domestic demand.

Production of the key dairy commodities is also expected to increase. Butter, SMP and WMP production is projected to rise by around 1.6% per annum. However, the growth in cheese production is likely to be more muted, due to a slower increase in consumption in more developed markets.

Consumption of dairy products is forecast to grow by 1.2-1.9% per year over the next decade. The majority of this growth is expected to come to from developing nations, as dairy consumption is positively correlated with higher levels of urbanisation and household income.

While consumption shows positive growth in developed countries, it is at a much slower rate. Consumption of fresh dairy has been stable or declining in these regions, although there has been a notable shift towards higher use of dairy fat.

What are the key risks to the forecast?

One of the major risks to the forecast is the longer-term behavioural changes in consumer purchasing due to COVID-19. The foodservice sector is a key channel for dairy and the near shutdown of this sector will have affected consumption levels. If these measures remain in place over a prolonged period there could be longer lasting changes in consumer purchasing. Furthermore, the economic downturn will be a key factor affecting consumption levels, particularly of higher-valued products such as cheese and butter.

The increased pressure on dairy systems, particularly in developed nations, to continually move towards sustainable practices is going to be an important catalyst for changeover the next decade. We have already seen some nations, such as the Netherlands, put environmental legislation in place which has had knock-on effects on production.

Finally, future trade agreements could have important impacts on the movement of dairy goods. A key watch point will be Russia as the embargo on dairy products from major exporting regions is due to end this year. It will be interesting to see whether imports will return to pre-ban levels.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.