December dairy market review

Thursday, 6 January 2022

By Patty Clayton

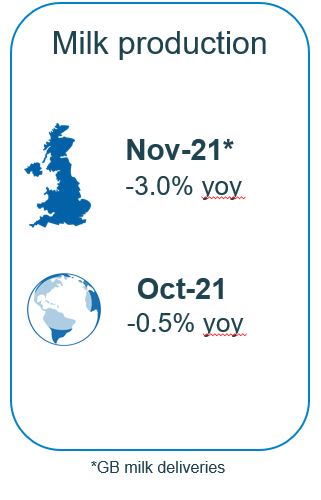

Milk production

GB milk deliveries were stuck in neutral through November, with volumes down 3.0% on year earlier levels. After a record year in 2020, Nov-21 production was the lowest of the past five years. The reduction in yields through the autumn period has led to a downward revision in our production forecast, which is now predicting a season total of 12.52bn litres for 2021/22, 1.2% lower than 2020/21.

Average GB daily deliveries in the period 1-18 December were running 3.7% below previous year levels, and 2.1% below forecasted figures.

Global milk delivieries saw a year on year drop in October of 0.5%, equivalent to a drop of 4.1m litres of milk per day. Production fell in October in all the key regions except Argentina and the US. New Zealand and Australia production have been negatively impacted by weather conditions. Through the peak period (Aug-Oct), NZ were down 4.0% year on year, while Australia’s production was down 2.8%.

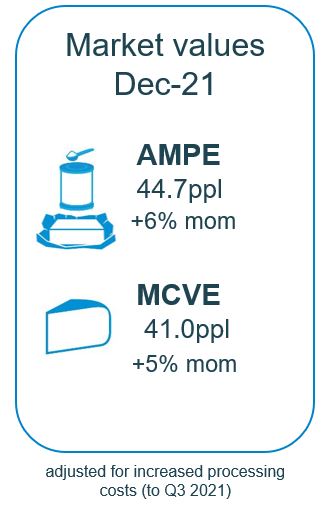

Wholesale markets

The typical dip in wholesale pricing which accompanies the holiday period did not materialise as anticipated in UK markets this December. Tight milk supplies continued to support product prices, and high spot milk prices meant a lesser share of milk went into manufactured products. A rally in demand was reported by some traders as buyers holding out for lower prices realised they may not come, which further lifted prices.

Both AMPE and MCVE moved higher in December, up 6% and 5% respectively on the month. This includes an adjustment for the higher energy costs faced by processors.

Farmgate prices

Market-related farmgate prices rallied strongly in December in response to the jump in market returns through the final quarter of 2021. While there is normally a 3-month lag between a change in market values and milk prices, many dairy companies have raised prices by over 3ppl between November and January, of which around half appears to be directly related to higher market returns. It may be that processors have pushed through price increases faster than normal in a bid to boost production over the winter months.

Input costs of the three ‘Fs’ – feed, fuel and fertiliser, continue to move upwards. There was some easing of fuel prices on global markets in November, but these have not yet translated into price reductions on the domestic market. Fertiliser prices moved up again in November, and are now more than double year-earlier prices. Feed prices remain high, with few signs of any respite, which has likely impacted on milk yields in the past few months.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.