Can the market sustain farmgate price increases?

Thursday, 23 December 2021

By Patty Clayton

In the past couple of months, there have been a flurry of milk price announcements, with many buyers raising farmgate prices by over 3ppl between November and January. But how much of the uplift can the market sustain?

After some weakness over the summer, market values for most dairy products have been steadily increasing since July, pushing up the equivalent market value for milk. Based on our milk market value indicator (MMV), changes in product values normally translate into higher farmgate milk prices around 3 months later.

August to October 2021

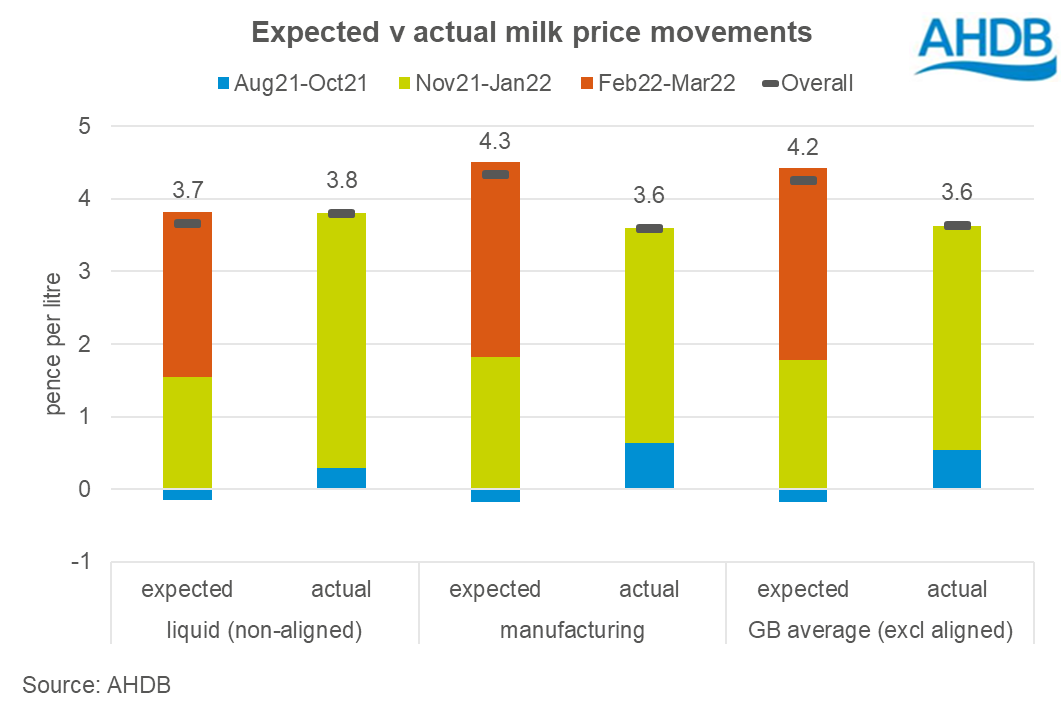

Slightly lower product pricing at the beginning of the summer (May through July) translated into a small drop in the MMV indicator of 0.3ppl, and an expected drop in the average GB milk price (excl. aligned) of 0.2ppl. In reality, there was a marginal increase in average milk prices over that period of 0.5ppl, due mostly to increased prices on manufacturing contracts.

November 2021 to January 2022

The strong recovery of dairy product markets since July generated a significant upturn in the equivalent market value for milk. Between August and October, the MMV indicator increased by 3.5ppl, which would suggest an increase of 1.8ppl on the average GB farmgate milk price over the subsequent 3-month period (Nov21-Jan22). When accounting for price announcements to date, actual changes have translated to an average increase of 3.1ppl between November and January.

February to March 2022

In November and December the wholesale market prices have risen strongly. The MMV indicator has increased by a further 5.2ppl, which would normally equate to a 2.6ppl increase in average GB farmgate milk prices in February and March. The chart below includes these market movements in the expected figures, but does not include any actual farmgate price announcements for February and March.

AHDB

AHDB

Overall

Based on historic relationships between market returns and farmgate milk prices, it appears that around 1.6ppl of the 3.6ppl average uplift seen between August and January has come from the market.

A further 2.6ppl might have been expected in February and March, following the rises in wholesale markets in November and December. However, that assumes a 3-month delay between market movements and farmgate price changes. It is likely that processors have pushed through price increases faster than normal on the back of strong market returns in November and December in a bid to help boost milk production levels over the winter.

Subscribe to our Dairy Market Weekly newsletter and receive market updates in your inbox every Thursday

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.