Market Report - 04 January 2022

Tuesday, 4 January 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

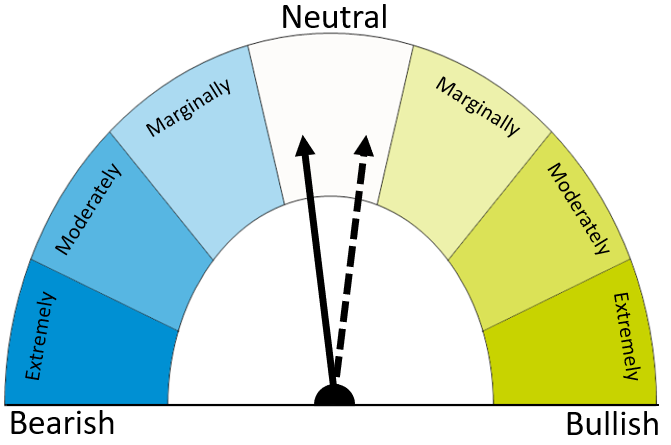

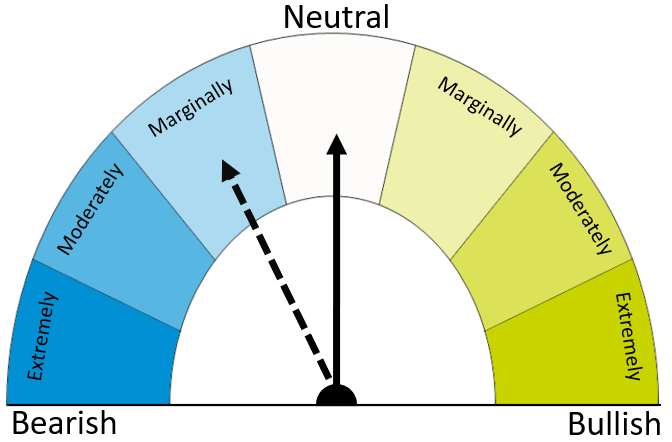

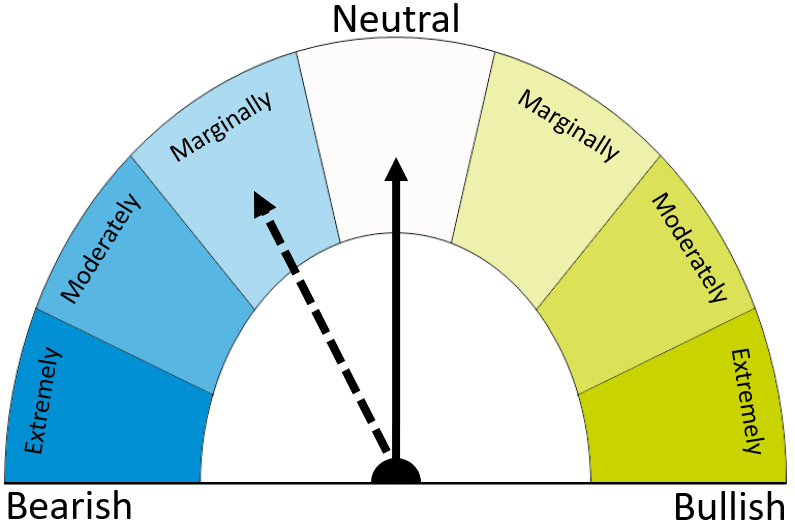

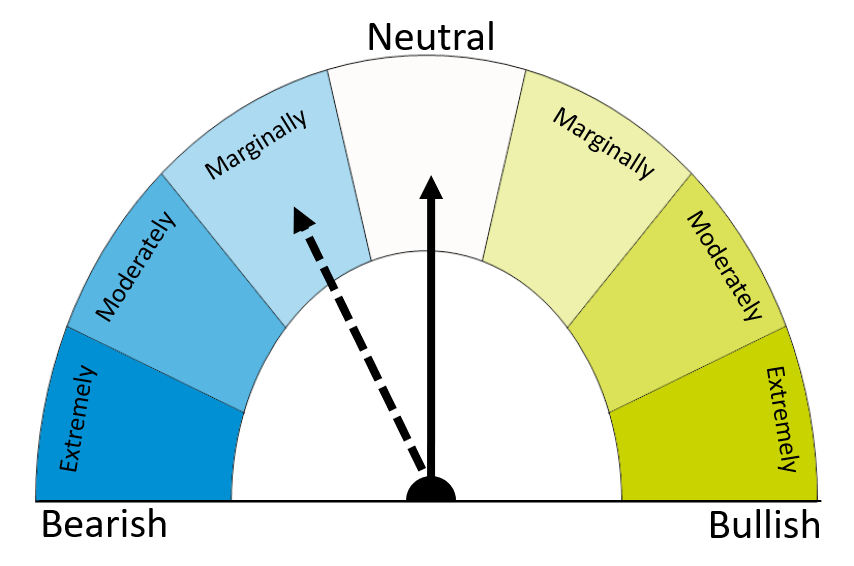

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Tight global supply and demand keep prices elevated, despite southern hemisphere harvest progress. Wheat gained some support from maize, as South American weather concerns continue.

South American weather concerns continue to support maize markets as large harvests are crucial to global supplies. Substantial cuts to forecasts may alter the longer-term price outlook. Weather will remain a key watch point.

Barley prices continue to follow wheat and maize, as global barley supplies remain tight. Omicron, and government restrictions, remain a watch point for malting barley demand.

Global grain markets

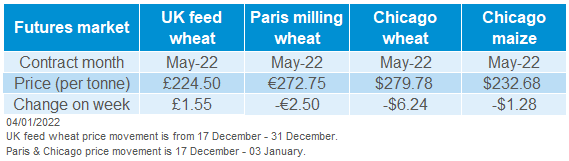

Global grain futures

Over the Christmas period Chicago maize prices saw some price movement, with small gains retraced in the past week. On 27 Dec, the May-22 contract reached $242.81/t. Though yesterday, the May-22 contract lost ground and closed at $232.68/t. This is down $1.57/t from the 31 Dec.

South American weather continues to be the key factor supporting maize and soyabean markets. Dry conditions before Christmas saw concerns grow for yields and subsequently production in Brazil and Argentina. Rains arrived last week in Brazil and Argentina, pressuring prices, although also caused floods in some areas of Brazil. The forecast ahead looks mixed. South Brazil continues to look dry but slightly cooler. Argentina is due small amounts of rain but is expected to stay relatively dry according to Refinitiv. According to the Commodity Weather Group, moisture deficits in Argentina could cover over half of maize and soyabean crops by next week (Refinitiv).

Based on growing South American weather concerns, in the week ending 28 December, Chicago maize managed money funds increased their long position by 3.0% from the previous week. Is this a signal that longer-term price sentiment may be more bullish than first expected? Changes to production forecasts are yet to be confirmed though.

Gains in maize markets may have been capped by smaller US exports. In the week ending 23 December, US maize exports totalled 921.4Kt (largest destinations being Mexico, China, and Japan). This is down 16% from the previous week and 9% below the previous 4-week average. In the week ending 30 December, preliminary data shows US maize exports to be down again (Refinitiv). The next US export sales report is due on Thurs (06 Jan).

Over the break, there was a lack of ‘new’ news for global wheat markets, though concerns of South American weather may have lent some support to wheat prices.

US winter wheat conditions have dipped over Christmas in some areas, according to the USDA National Agricultural Statistics Service. The top two wheat producing states, Kansas and Oklahoma, saw ‘good’ to ‘excellent’ conditions fall over December in a monthly update. This is perhaps not surprising considering the recent windstorm and moderate drought conditions. Something to watch going forward.

UK focus

Delivered cereals

UK feed wheat futures (May-22) closed on Friday (31 Dec) at £224.50/t. This is a gain of £1.55/t from the last Market Report (17 Dec close).

How does this translate into delivered prices? The next update to UK delivered prices is due on 7 January 2022.

Latest HMRC trade data indicates UK wheat import pace slowed (up to October). Season-to-date (July to October) imports are now down 19% from last season. Why is this important? Because UK availability continues to look tight.

The AHDB delivered cereals survey will recommence publication this Friday (07 January 2021).

Oilseeds

Rapeseed

Soyabeans

Short-term, the rapeseed market remains supported due to tight global supply and demand. Longer-term, soyabean sentiment could impact rapeseed price direction. Further to that, increased area for harvest-2022 could replenish global rapeseed stocks.

Marginally bearish outlook longer-term due to forecasted bumper crops. However, dry and hot weather (notably in Argentina) is expected, which could impact yields. If crop damage is realised, then this could change sentiment of the market.

Global oilseed markets

Global oilseed futures

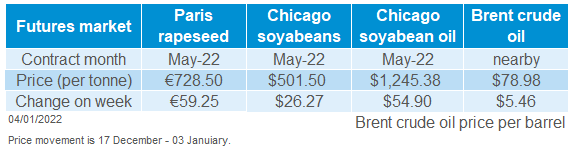

South American weather is becoming the core market focus, as harvest of these anticipated bumper crops near. From Thursday (23 Dec) to Monday (03 Jan) Chicago soyabean futures (May-22) gained 1.24%.

The market has been reactive to South American weather. Last Thursday (30 Dec) Chicago soyabean futures (May-22) were pressured and lost $10.84/t (2.14%) across the day. This was due to beneficial rains in the moisture deficit Southern Brazil growing belts.

However, forecasts of hot and dry weather across key growing regions supported the market yesterday. The May-22 contract gained 1.19% across the day from Fridays close. The dry weather is notably in Argentina, but it’s too early to tell if this will impact yields (Commodity Weather Group).

Capping large price gains, are slow US soyabean exports. Preliminary figures show that U.S. exporters shipped 1.19Mt of soyabeans (week ending: 30 Dec), down 32% from the prior four-week average and below analyst expectations which ranged from 1.4-1.9Mt (Refinitiv).

Malaysian palm oil futures (Mar-22) gained 3.41% yesterday. This is due to an expected seasonal reduction in output. However, recent floods in several states have added to concerns of reduced supply.

Palm prices are expected to stay strong in 2022. The Council of Palm Oil Producing Countries cites that production will remain constrained due to soaring fertiliser costs and labour shortages.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-22) closed Friday (31 Dec) at €711.75/t, gaining €10.50/t across the week (24 Dec – 31 Dec). However, the contract closed yesterday at an all-time high of €728.50/t.

The May-22 contract has gained €27.25/t over the Christmas period (24 Dec – 03 Jan). In this same period, sterling has strengthened by 0.89% against the Euro. Trading closed yesterday at £1 = €1.1928. This strengthening in sterling could limit large gains on our domestic delivered market in comparison to the continental market.

The AHDB delivered oilseeds survey will recommence publication this Friday (07 January 2021).

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.