Crude oil prices could weigh on oilseeds: Grain market daily

Friday, 18 November 2022

Market commentary

- UK wheat futures (May-23) closed yesterday at £265.00/t, gaining £2.25/t on Wednesday’s close. The Nov-23 contract closed at £245.25/t, gaining £1.75/t over the same period. Despite the domestic market initially feeling pressure from the renewal of the Black Sea export corridor, it ended higher shadowing the gains in Paris wheat futures.

- Paris wheat futures gained in late trade on Thursday on discussion that China may have purchased additional French wheat, after the price dropped on the corridor extension.

- Further to that, after the price drop yesterday morning, Pakistan issued a new international tender to purchase import 500Kt of wheat.

- Paris rapeseed futures (May-23) closed at €599.25/t down €17.00/t on Wednesday’s close – this followed the downward trend of the oilseed complex – read more information about this below.

Crude oil prices could weigh on oilseeds

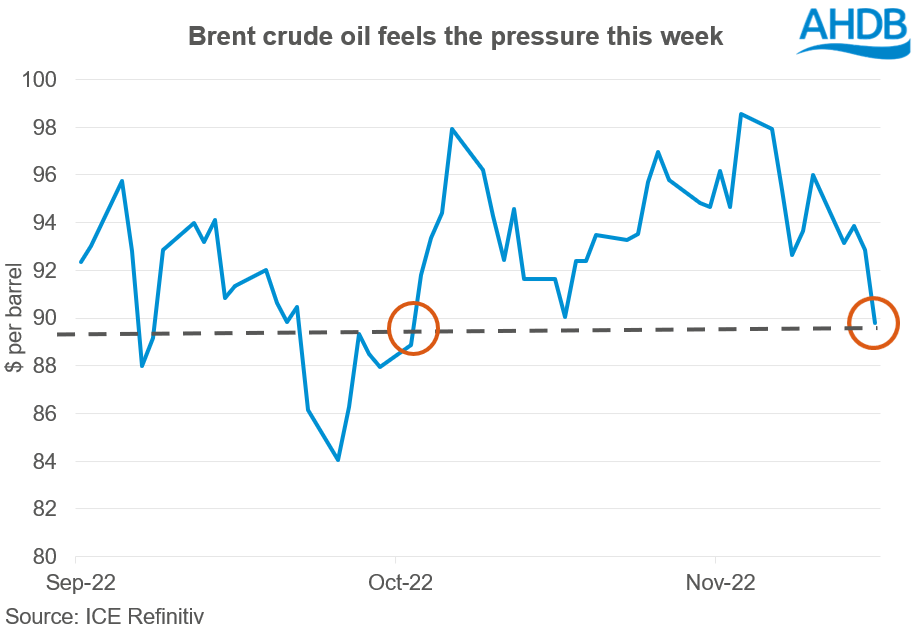

In addition to the renewal of the grain corridor from today, for another 120 days, falling crude oil prices have also pressured vegetable oil and oilseed prices this week. Brent crude oil closed at $89.78/barrel yesterday, this is down near 6.5% on last Friday’s close. This is also the lowest price since the start of October.

Crude oil is something that will have significant influence over ex-farm rapeseed prices, as global fuel mandates create global demand for vegetable oils as a blending feed stock. Over this same period Paris rapeseed futures (May-23) have dropped €35.25/t to close yesterday at €599.25/t.

Why the pressure on crude oil?

Crude oil has seen significant pressure this week on concerns of weakening demand in China. This is due to worries about potential lockdowns to curb surges in COVID-19 cases, with cases hitting the highest level since April. Further to that, pressuring crude oil are worries that further interest rate rises by the US Federal Reserve could drive the US economy into recession.

These pressuring factors seem to have overshadowed news from the EU, that they will be banning imports of Russian crude oil on 05 December 2022 and OPEC+ agreeing to further production cuts at the start of October which sent crude oil prices exponentially higher.

What does this mean?

Although lower crude oil could mean farmers see a lower fuel price into producing crops longer term, it will also weigh on the vegetable oil and oilseed complex. As mentioned above, Paris rapeseed has taken a hit this week.

Further to that, based on yesterday’s close, Malaysian palm oil futures (Feb-22) are down 10.2% and Chicago soyabean oil futures (May-23) are down near 5% on the week. This is filtering into Chicago soyabean prices (May-23) which are down 2.1% over the same period.

Pressure on crude oil could reduce demand for vegetable oil, which will inherently feed into prices. Currently the demand for soya oil as a feed stock in the US is very high from high diesel prices. If lower global fuel prices materialise, the demand for soya oil may lose out, and this could weigh on the oilseed market further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.