Could lower diesel prices offer some relief for farm margins? Grain market daily

Friday, 1 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £174.65/t yesterday, down £2.30/t from Wednesday’s close. The May-26 contract fell £1.85/t over the same period, ending the session at £186.65/t

- Domestic wheat futures followed global grain markets lower, weighed down by strong global supply prospects. Chicago wheat and Paris milling wheat futures (Dec-25) fell by 0.3% and 1.3%, respectively. Adding to the bearish sentiment, SovEcon raised its forecast for Russian wheat exports in the 2025/26 season to 43.3 Mt, up from 42.9 Mt previously

- Nov-25 Paris rapeseed futures closed yesterday at €477.50/t, down €5.25/t on the day, while the May-26 contract dropped by €6.25/t to €483.50/t

- The decline in European rapeseed futures followed a drop in US soyabean markets, which hit their lowest level since early April. This was driven by an improved US weather outlook and sluggish demand from China (LSEG)

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could lower diesel prices offer some relief for farm margins?

Overhead costs typically account for up to two-thirds of total arable crop production costs in the UK, making them a key factor influencing farm profitability, alongside crop yields.

One part of these overheads is energy, particularly fuel, which has contributed to the increase in cost of production over recent years. So, what is the current outlook?

Energy market overview

Recent analysis shows that UK natural gas prices have eased slightly but remain relatively high due to ongoing supply constraints and firm import demand.

Crude oil prices have also softened, following a recent spike linked to tensions in the Middle East.

Since mid-June, nearby Brent crude futures have fallen by 5.1%, closing at $72.53/barrel yesterday, still above the year-to-date average of $70.52/barrel (from January).

According to the US Energy Information Administration’s short-term outlook (June 2025), Brent crude prices are forecast to decline gradually through the rest of the year, averaging around $66.00/barrel in the fourth quarter, as global supply continues to outpace demand.

So, what’s the impact on red diesel?

Red diesel, which is made from crude oil, typically follows global crude price trends. However, local factors such as exchange rates, tax policy and domestic supply conditions can also influence pricing.

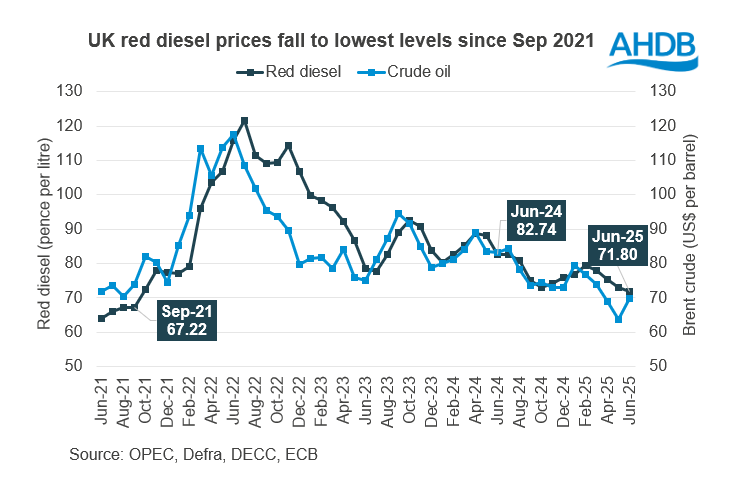

In June 2025, the average red diesel price stood at 71.80 pence per litre (ppl), down from 82.74 ppl in June 2024, the lowest level recorded since September 2021, before the surge in post-pandemic demand.

This marks a seasonal decline of 10.96 ppl over the 2024/25 period (Jul-Jun), based on average prices in July 2024 and June 2025.

With the 2025 harvest now well underway, attention is shifting to cost control again, particularly against a backdrop of unsettled weather.

Recent rainfall has led to delays in harvesting, meaning some farms may face higher-than-expected fuel bills. This comes despite lower red diesel prices, as wetter crops are likely to require more drying, adding to on-farm energy costs.

Looking ahead

With continued volatility in global energy markets and the autumn drilling period fast approaching, forward planning remains key to managing production costs.

Growers are encouraged to monitor input usage closely and make full use of available tools such as AHDB’s Farmbench and Harvest Toolkit to help manage margins and support informed decisions making throughout the remainder of harvest and into the next cropping season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.