Could India return as a wheat importer in 2024/25? Grain market daily

Tuesday, 5 March 2024

Market commentary

- Global grain and oilseed prices gained yesterday following rises in the US markets. US prices were supported by short covering by speculative traders.

- UK feed wheat futures (May-24) closed at £163.50/t yesterday, up from Friday’s close by £1.95/t. New crop futures (Nov-24) were also up by £1.50/t over the same period, ending yesterday’s session at £181.10/t.

- Paris rapeseed futures (May-24) closed yesterday at €417.25/t, up €3.75/t on Friday’s close. New crop futures (Nov-24) were up marginally by €0.75/t over the same period, ending the session at €422.50/t.

- Adverse weather conditions in India could limit its wheat production, which could further reduce its stocks and in turn increase its reliance upon imports. This could add extra demand to the world market and support prices. However, Australia could soften any impact with a larger crop than earlier estimates would have suggested. Please see below for more information.

- China has increased its import budget to stockpile grain and edible oils, with the hopes of improving its food security.

Could India return as a wheat importer in 2024/25?

The possibility of India being an importer of wheat again in 2024/25 has more weight following recent adverse weather. Heavy rain and hailstorms have caused damage, including notable lodging, in some of the main producing areas, with the harvest due to start this month.

It’s uncertain how much production could be reduced. The Indian government currently forecasts the 2024/25 crop at 112.0 Mt, a new record and 1.3% up from 2023/24. But now some industry sources suggest the crop could be smaller than last year (LSEG).

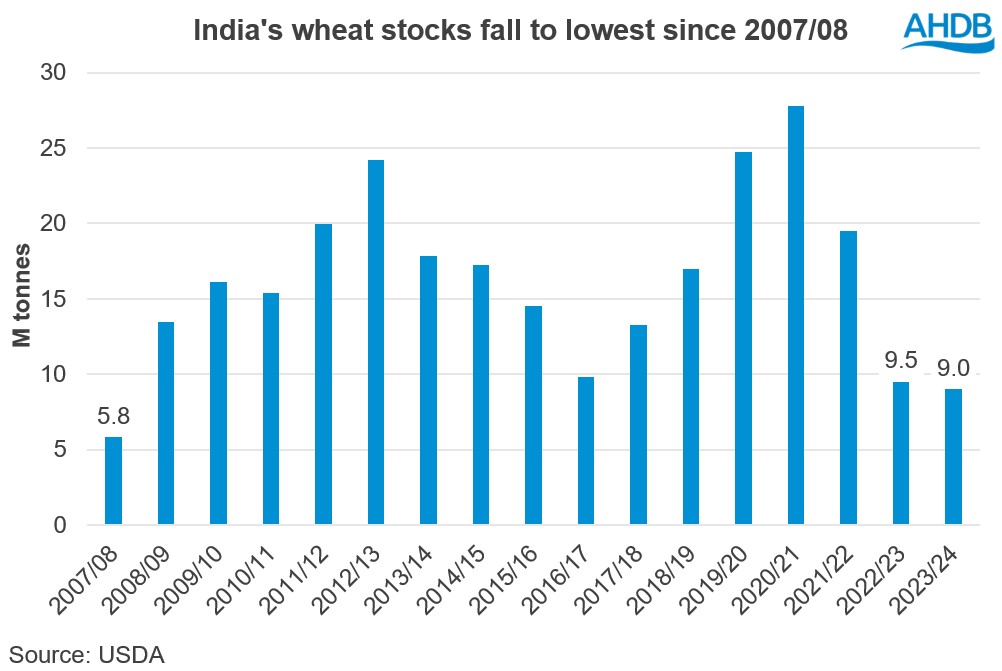

Indian stocks have fallen in recent years. India exported wheat during the price spike that followed Russia’s invasion of Ukraine and the El Niño weather event curbed the 2023 Indian crop. The USDA currently pegs Indian stocks at the end of 2023/24 at just 9.0 Mt, the lowest since 2007/08.

Currently high tariffs limit India’s imports. After the 2023 harvest there was talk that India could cut these tariffs to allow more wheat imports due to falling stock levels. But the government has so far held off. India is due to go to the polls in April or May, and a decision on cutting tariffs seems unlikely before the election in case it results in higher global prices (S&P Global). Higher import demand from India would mean more demand into the global market, which in turn could push up prices.

But larger Australian crops expected

In the most recent seasons when India imported larger volumes, Australia and Ukraine were key suppliers. As shipping through the Red Sea is currently difficult, this could hamper Black Sea grain supplies to India and puts more focus on Australia as a likely supplier to India.

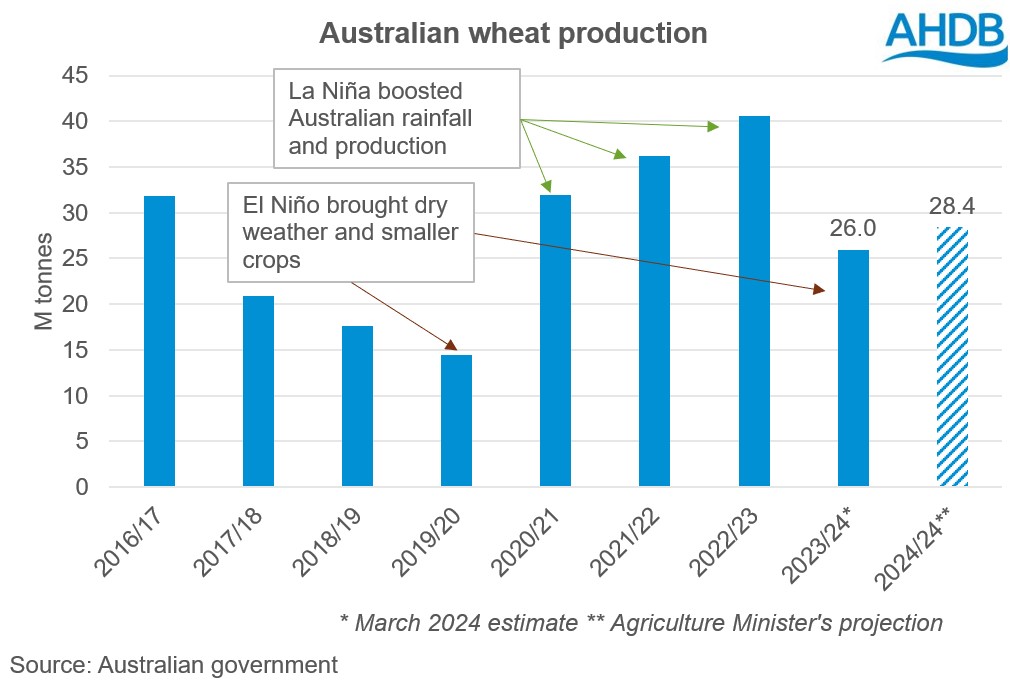

While the El Niño weather event in 2023 has undoubtedly reduced production in Australia, revised estimates out this morning show a bigger crop than was previously predicted. Rain over its summer months supported Australian wheat production. As a result, and with harvesting now wrapped up, the Australian government increased its estimate of the 2023/24 crop by 0.5 Mt to 26.0 Mt today.

There are also early suggestions of a rebound in production in 2024/25 as a La Niña weather event is predicted to return later this year. La Niña usually brings higher than average rainfall across Australia and from 2020 to 2022 resulted in bumper crops. Farmers in most parts of Australia plant winter wheat from April through June, with September and October the key months for yield forming. Australia’s Agriculture Minister projects production could rebound to 28.4 Mt in 2024/25.

Larger Australian production could soften, or even offset, the impact if India does return to the global market as an importer. The level of Australian exports and the timing of any cut to Indian import tariffs will be important as to the impact of Indian imports.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.