Canadian and Australian crops increased: Grain market daily

Tuesday, 5 December 2023

Market commentary

- Global wheat prices rose yesterday after the USDA confirmed private sales of 440 Kt of US wheat to China, the largest sale in recent years. Short covering by speculative traders in the Chicago wheat futures market also likely added to the rises; speculative traders have been short (anticipating price falls) in recent weeks. However, larger crop forecasts for Canada (more below) may have limited the gains.

- May-24 UK feed wheat futures rose £1.60/t to close at £196.65/t, while the Nov-24 contract gained £1.30/t to close at £208.10/t.

- Paris rapeseed futures shrugged off pressure in Chicago soyabean prices, to record small gains. May-24 Paris rapeseed futures gained €2.00/t to close at €447.00/t (approx. £383.50/t), while the Nov-24 contract gained €0.25/t to €451.50/t (approx. £387.50/t).

- The Chicago soyabean market fell due to forecasts of beneficial rain in Brazil.

Canadian and Australian crops increased

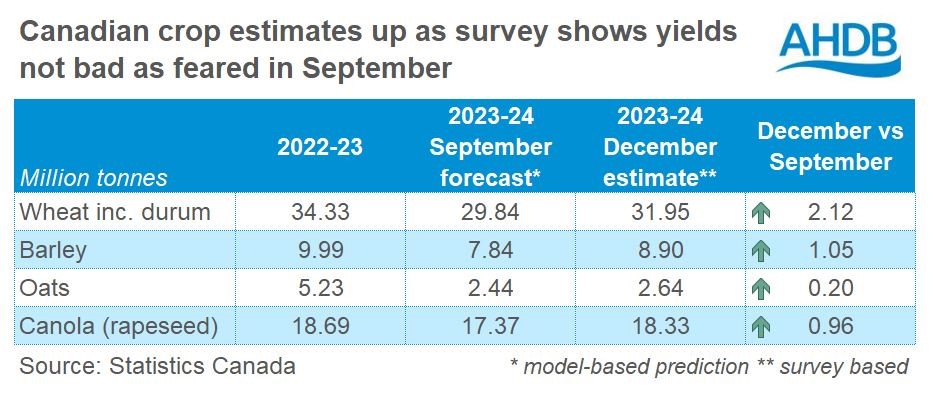

Updated official crop figures confirm that the 2023/24 Canadian wheat, barley, oat and canola (rapeseed) crops are all larger than previously forecast (Statistics Canada). Except for oats, updated Australian government estimates also point to larger 2023/24 crops than predicted in September too.

The two countries are key top exporters. Last month the USDA predicted that together Canada and Australia will account for 20% of global wheat trade in 2023/24, 28% of barley, 69% of rapeseed and 85% of oat trade.

It’s still important to note that crops in both countries are still considerably smaller than last year, with yields reduced by dry weather during the growing season. However, for Canada it seems that the impacts haven’t been as severe as feared back in September.

Meanwhile for Australia, it has been a mixed spring. Improvements in southern cropping regions are expected to more than offset downgrades in northern cropping regions. Production is down from September in Queensland and Western Australia but up for New South Wales, Victoria and South Australia.

The official crop forecasts (except for Australian oats) are now larger than the USDA pegged last month. For oats, the Australian crop is now slightly below the USDA figure, but this is outweighed by the increase to the Canadian forecast. So, the latest forecasts are likely to add to global availability this season compared to previous expectations and could weigh on, or limit rises in, global prices.

UK wheat prices are currently positioned to restrict exports and potentially attract imports in some areas of the country, with rapeseed prices also attracting imports. As a result, if the larger crop estimates for Canada and Australia do pressure global prices, this is likely to filter through to UK prices.

The caveat is that the Australia harvest is still ongoing, and so weather over the coming weeks will be important for final yields, but perhaps more importantly final quality. Although the harvest has progressed rapidly amid dry weather in Western Australia, in eastern areas rain in recent weeks has caused delays and likely impacted quality. The country is currently experiencing drier weather, which is forecast to continue in northern cropping areas, but rain is set to return later in the week for Southern Australia and Victoria. The Australian government usually releases its final crop estimates for the season in early March.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.