Could energy prices reduce milling wheat supplies? Grain market daily

Thursday, 7 October 2021

Market commentary

- Nov-21 UK feed wheat futures closed yesterday at £202.50/t, back up to the contract high seen on Friday and Monday.

- Paris rapeseed futures have continued to soar. The Nov-21 contract closed yesterday at €671.25/t, yet another contract high.

- Support comes from oil markets as most key contracts continued to rise yesterday.

- Indian wheat exports could quadruple compared to 2020 (4.2-4.4Mt vs 1.1Mt in 2020/21). This comes as global wheat and freight prices rise, making India a competitive origin for Asian markets.

- Next Tuesday we will be hosting our annual Grain Market Outlook conference. To watch a livestream of our event, sign-up here.

Could energy prices reduce milling wheat supplies?

In February, we speculated as to whether fertiliser prices could get to £300/tonne again, based on Chicago maize prices and demand for fertiliser, given their historic relationship. In July, they did just that.

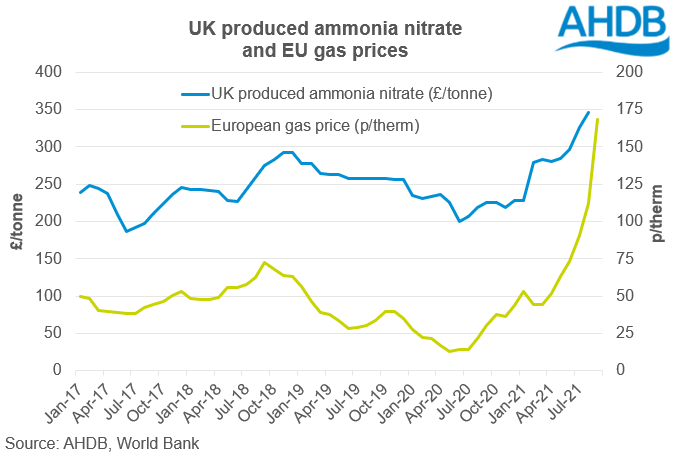

Ammonia nitrate (AN) fertiliser prices are driven not only by demand of course, but also by supply, which itself is influenced by the cost of production. These costs have increased dramatically as the price of natural gas, the main feedstock, has soared. So much so that production was halted at two of the UK’s main sites.

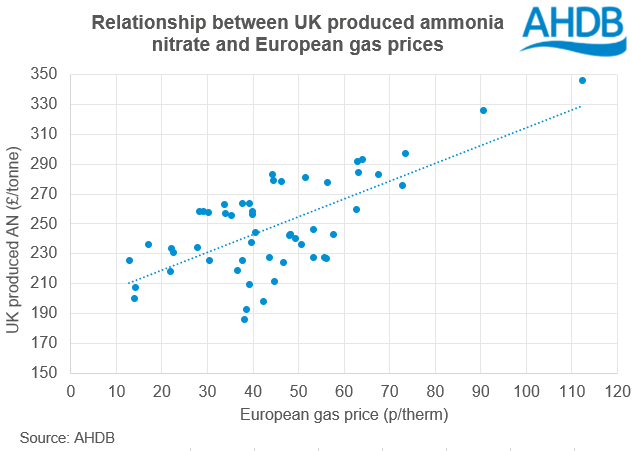

Unsurprisingly, there is a positive relationship between the price of UK produced AN, and gas prices in Europe. The latter have rallied extremely sharply in a fundamentally tight European market situation, with uncomfortably little gas in store ahead of winter. More Russian gas supplies may yet come to market, but until then, it has been up to the demand-side, to try to balance. This happens first by fuel switching in the electricity generation sector, but then by demand destruction, including in fertiliser production itself.

Based on gas prices in the month, a substantial increase in September recorded AN prices can be expected, with more to come. A very rough estimate based on the relationship with gas alone would imply a price in excess of £400/tonne, and that’s without supply interruptions. Demand plays a part too, and AN prices were already outpacing wheat price gains. At the end of last week, offers had been heard in the region of £600/tonne.

How might this effect the 2022 milling wheat area?

Fertiliser application is particularly important for those seeking to reach milling grade on wheat. And some farmers have already expressed concerns about potential yields. This could have implications for the UK wheat balance in the coming season.

AN prices may reach levels where even the decision to apply, if the intention is to seek a milling wheat price premium over feed wheat, is not a straightforward one. We will publish analysis over winter to help inform decision making on fertiliser applications.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.